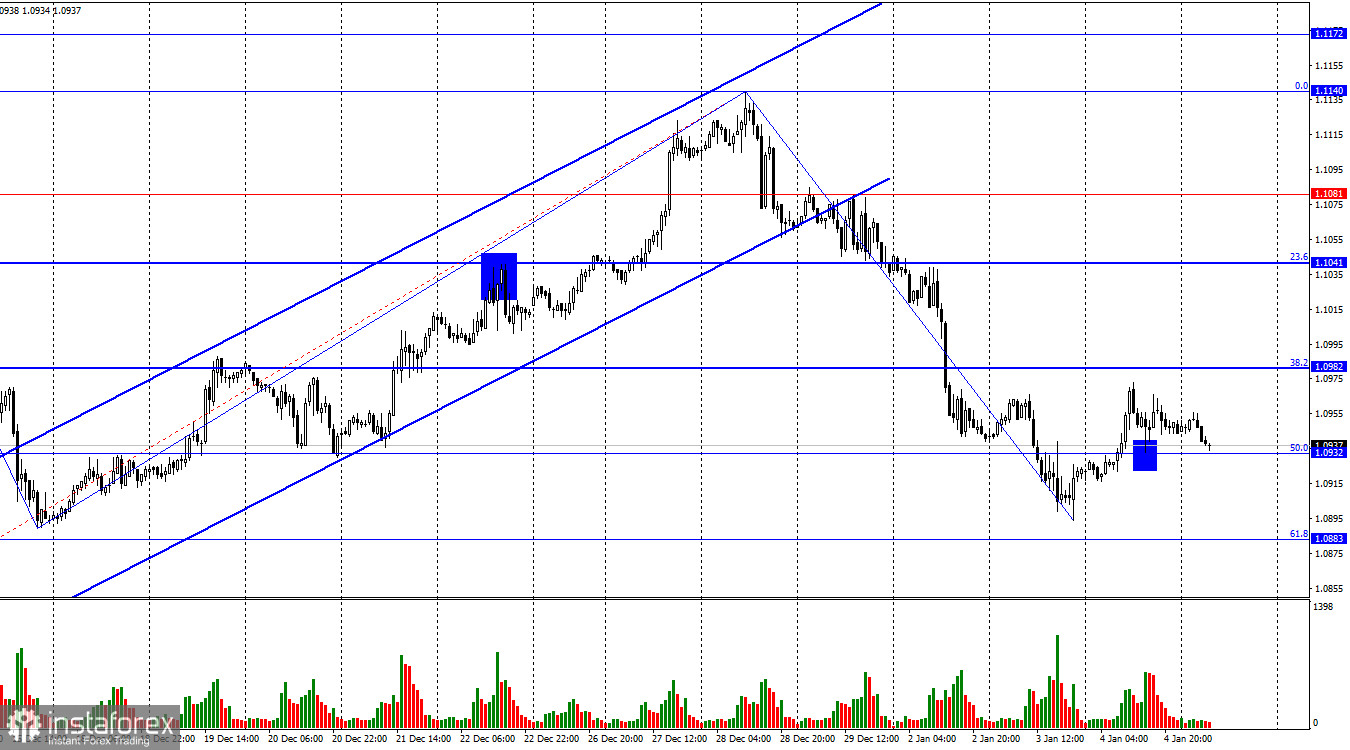

On Thursday, the EUR/USD pair secured itself above the corrective level of 50.0% (1.0932), which allows it to anticipate further growth towards the next corrective level at 38.2% (1.0982). Bulls couldn't reach this level yesterday, but today, a rebound from the level of 1.0932 will once again give hope for the rise of the European currency. If the pair maintains its course above 1.0932, it will work in favor of the US currency and a resumption of the decline towards the Fibonacci level of 61.8% (1.0883) and beyond.

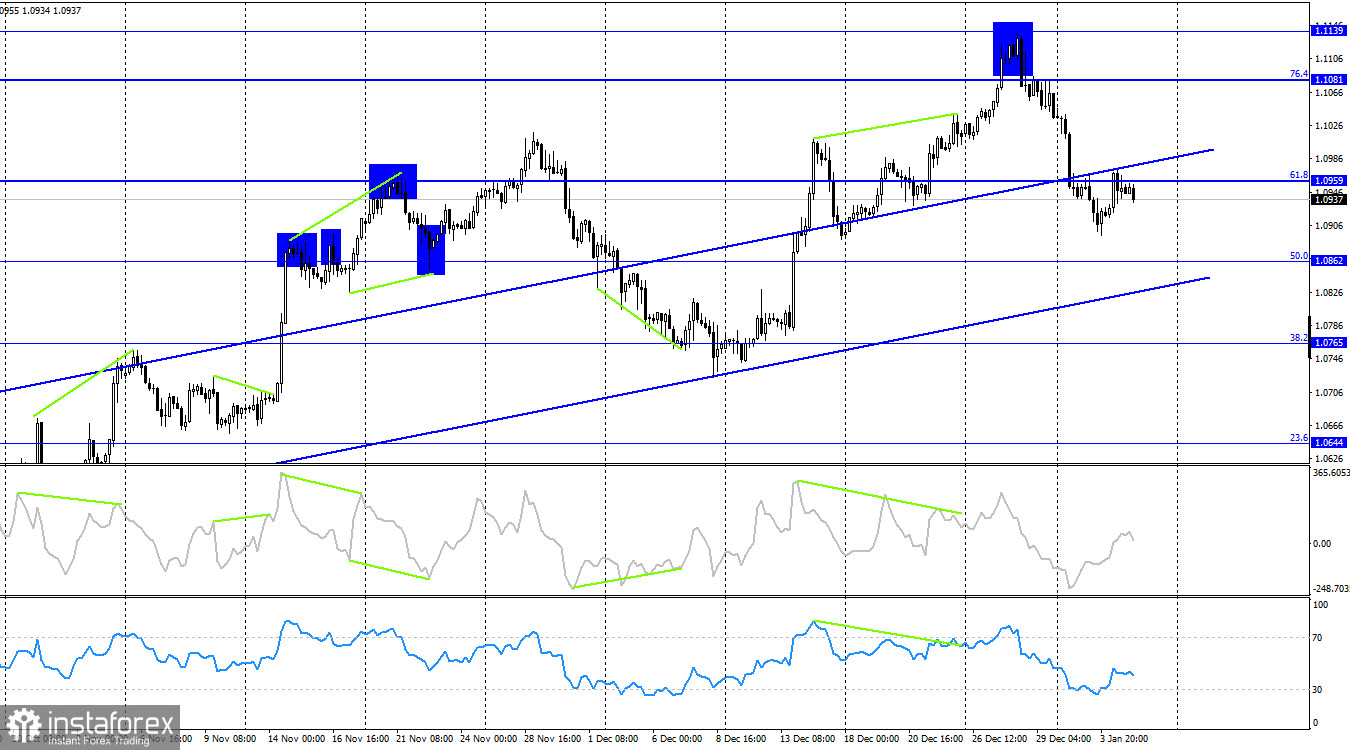

The wave situation is becoming more interesting. The latest downward wave has ended exactly where the previous wave ended (around the level of 1.0890). Thus, there has been no breach of the low from December 15th. Based on this, the waves continue to signal the persistence of the bullish trend. There are no signs of the end of this trend despite the pair's 250-pip drop. If the new upward wave turns out to be weak and does not break the peak from December 28th, traders will receive the first sign of the end of the bullish trend. However, before this happens, the pair may move up to 250 points and build a series of ascending waves.

The information background on Thursday was quite interesting. In the United States, data on initial and continuing jobless claims were released, as well as the ADP report, which showed the creation of 164,000 new jobs instead of the expected 115,000. However, the dollar needed to receive strong support from these data. Today, the reports will be stronger and more important. In the European Union, the inflation report for December will be the first to be released. According to experts, the Consumer Price Index is expected to accelerate to 3.0% y/y, which could support the bulls, as the ECB may postpone the first rate cut to the second half of 2024 in this case. Inflation may accelerate even more, exceeding 3%, which will further bolster buyers.

On the 4-hour chart, the pair has secured itself below the corrective level at 61.8% (1.0959), allowing for anticipation of further decline towards the next Fibonacci level at 50.0% (1.0862). However, this drop will not cancel the ascending trend corridor, which still characterizes traders' sentiment as "bullish." I will only expect a strong decline in the euro after it secures itself below the corridor. Until that moment, bulls can initiate a new attack at any time.

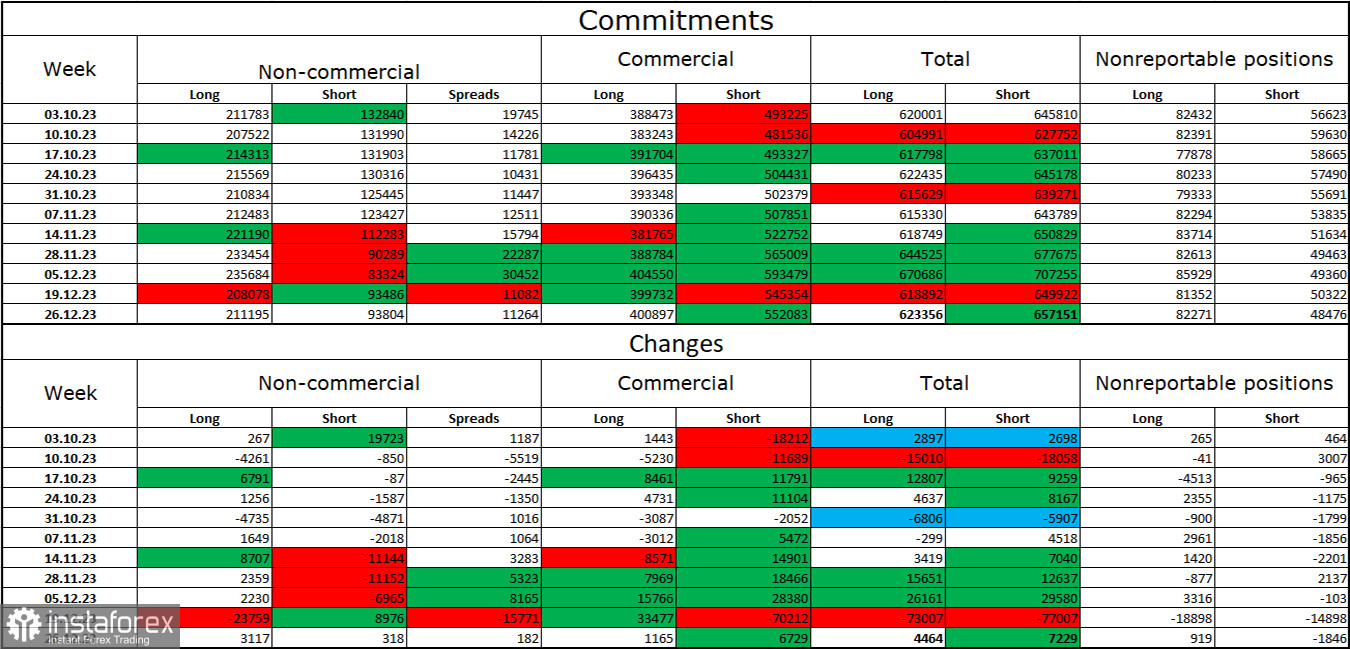

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 3,117 long contracts and 318 short contracts. The sentiment of major traders remains "bullish" but is weakening once again. The total number of long contracts concentrated in the hands of speculators is now 211,000, while short contracts amount to only 94,000. Despite the significant difference, the situation will shift toward the bears. Bulls have dominated the market for too long, and now they need strong news to sustain the bullish trend. I do not see such news at the moment. Professional traders may resume closing long positions soon. The current numbers allow for a resumption of the euro's decline in the coming months.

Economic Calendar for the US and the EU:

EU - Consumer Price Index (10:00 UTC).

US - Nonfarm Payrolls Change (13:30 UTC).

US - Unemployment Rate (13:30 UTC).

US - Average Hourly Earnings Change (13:30 UTC).

US - ISM Services Business Activity Index (15:00 UTC).

On January 5th, the economic calendar contains several interesting entries, with the highlight being the Nonfarm Payrolls report in the United States. Thus, the impact of the information background on traders' sentiment today can be significant.

Forecast for EUR/USD and Trader Recommendations:

Selling the pair is possible today if it secures itself below the level of 1.0932 on the hourly chart, with targets at 1.0883 and 1.0823. Buying opportunities can be considered if there is a rebound from the level of 1.0932 on the hourly chart, with targets at 1.0982 and 1.1041. Be cautious during the release of European and American reports.