The currency market still revolves around interest rates. I've previously mentioned the potential rate cut by the Federal Reserve, and in this article, we will talk about the Bank of England. Judging by the pound's current exchange rate, the market doesn't really believe that the BoE will lower interest rates in 2024. Of course, this is not the case, and the market understands that sooner or later, rates will be lowered in the UK. However, I said: "judging by the current exchange rate." And I said that because the market is in no hurry to lower the demand for the pound. Why? Simply because it considers the prospect of monetary easing in the UK to be a distant one, unlike the Federal Reserve.

However, I don't agree with this assessment. And I'm not the only one. For instance, Goldman Sachs has stated that they expect the first BoE rate cut in May. Recall that the FOMC expects the first easing in March, one meeting earlier. In my opinion, the difference is not too great for the demand for the pound sterling to remain high or rise even further. Goldman Sachs believes that the BoE will trim rates at each meeting, starting in May 2024, until it reaches 3% in May 2025. This implies that this year it will be lowered five times by 25 basis points each. Remember that Fed Chair Jerome Powell and his colleagues talked about three rate cuts this year...

Deutsche Bank believes that the BoE's rate will be reduced to 4% by the end of 2024, which also implies five rounds of rate cuts. Both Banks note progress in fighting high inflation and cite it as the key reason for the impracticality of maintaining the rate at its peak. Also, take note that other major banks and analytical companies have similar forecasts. The biggest difference lies in the timing of the start of the easing cycle – some believe that the process will start in June and not May, which is one meeting later.

In one way or another, the Fed and the BoE may cut their rates by the same number of basis points in 2024. Under certain scenarios, the BoE may even outpace the Fed, despite its lower rate. In my opinion, all of this provides a basis for the pound's decline, which is fully supported by the current wave analysis.

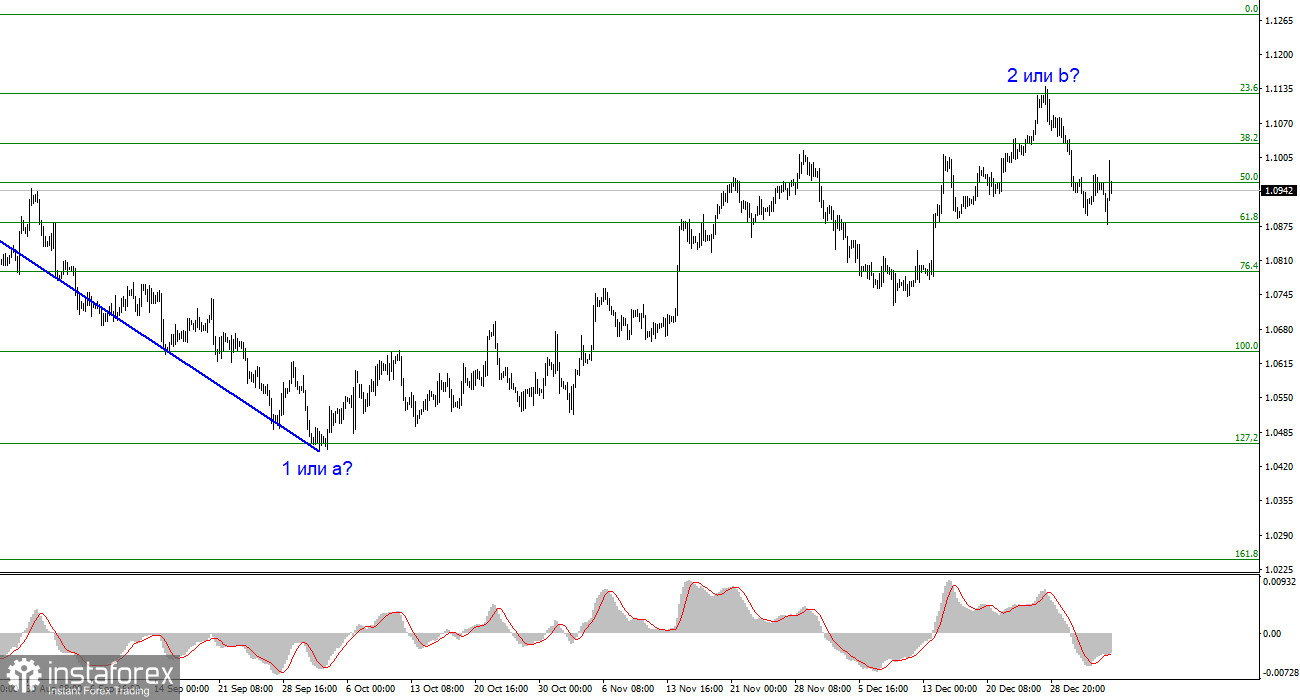

Based on the analysis, I conclude that a bearish wave pattern is being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break the 1.1125 level, which corresponds to 23.6% Fibonacci, indicates the market is prepared to sell.

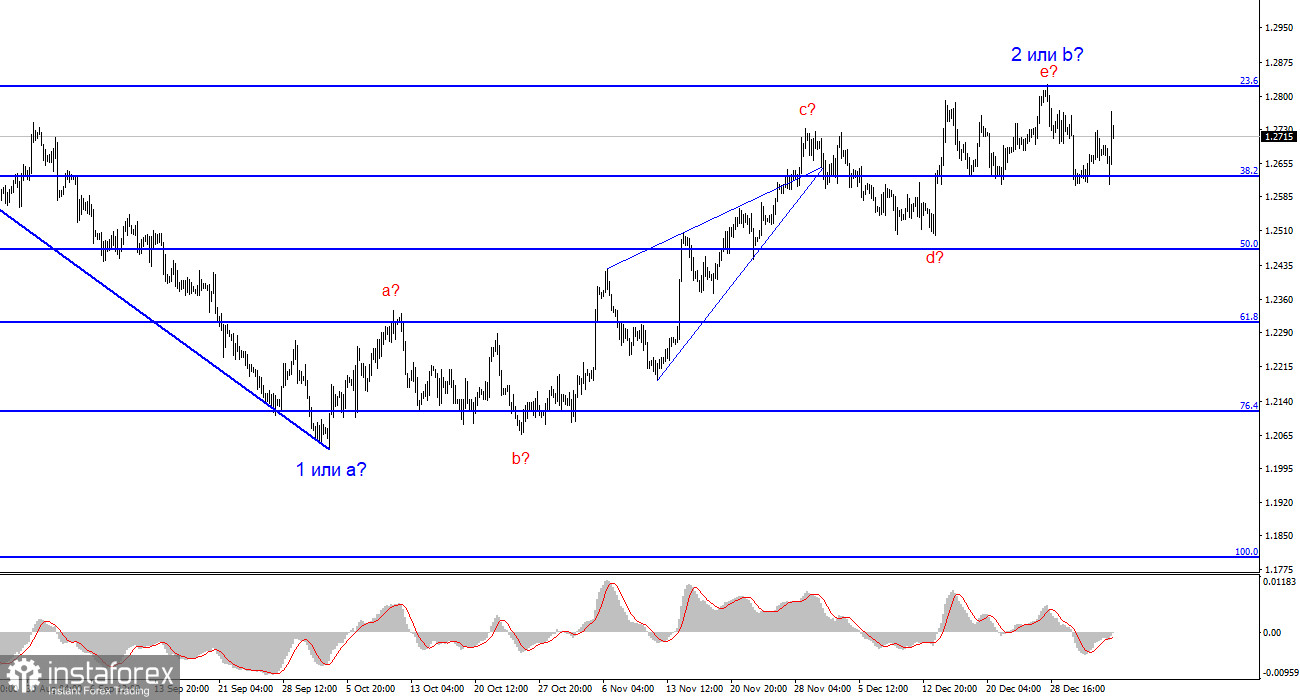

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. In fact, we are already seeing some signs of it coming to an end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.