The GBP/USD currency pair showed a confident rise on Friday, ending the day positively. The British pound strengthened significantly, although there were no more reasons than for the euro's rise. Once again, macroeconomic statistics did not favor the British currency unequivocally and, if anything, were to the contrary. However, we saw the pound rise where it shouldn't have.

As a result, we can only say one thing: the market once again disregarded the positives from the United States and worked hard on the negatives. Nothing changes in the market's perception of macroeconomic statistics and the fundamental backdrop. Traders still desperately want to avoid buying the dollar or are guided by their considerations that have nothing to do with fundamentals and macroeconomics.

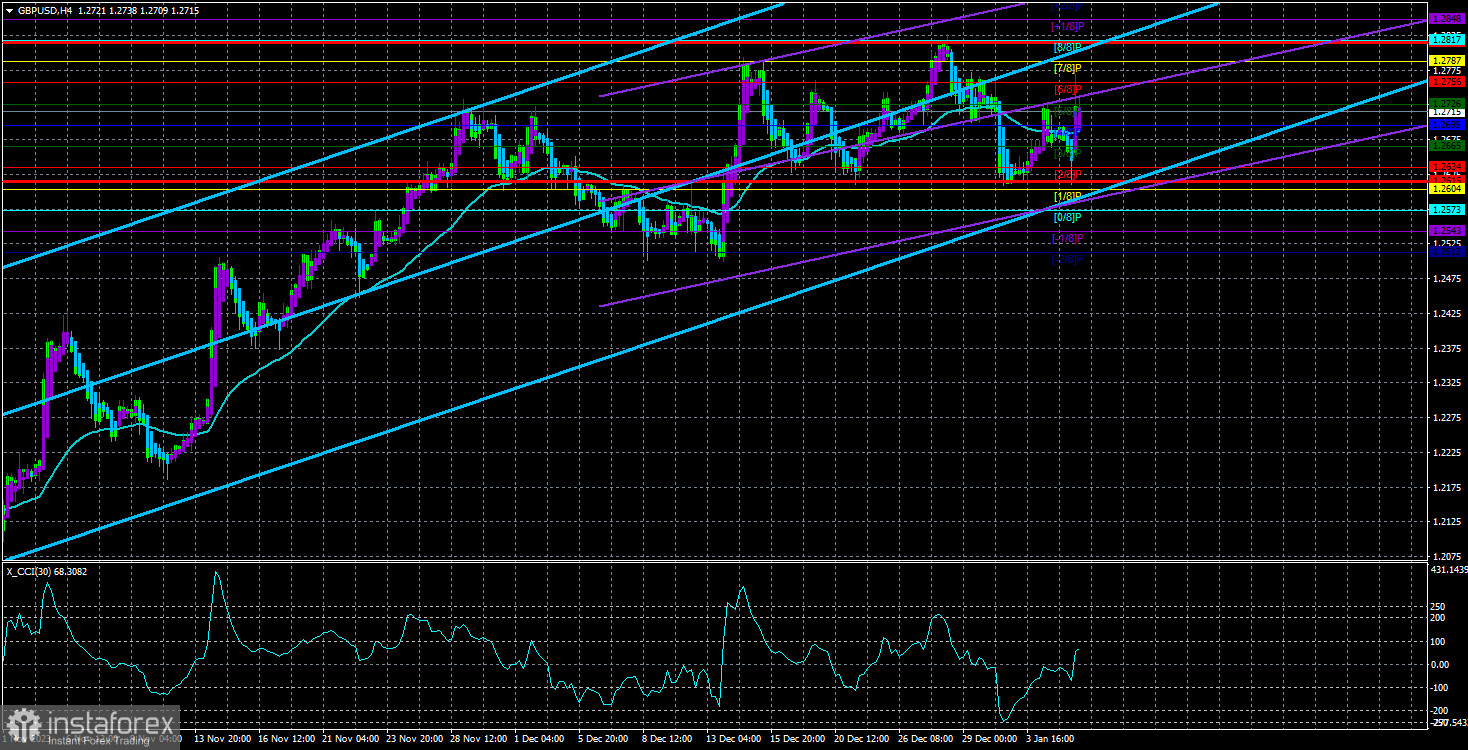

From a technical standpoint, on the 4-hour timeframe, a "head and shoulders" pattern is forming. The peak value was reached on December 28th, around 1.2817. The "left shoulder" formed on December 14th, near 1.2787. The price almost reached 1.2787 on Friday, but a slight discrepancy is possible. Thus, we will have a strong reversal model if the pattern truly forms.

Meanwhile, the market believes that the Fed will maintain its monetary policy easing throughout 2024, while the Bank of England will keep its "hawkish" stance for a long time. However, if we only had doubts about such a scenario previously, other analysts are starting to join us, doubting that the British regulator will refrain from lowering the key rate.

A high rate for the British economy means that each subsequent month could begin a protracted recession. Despite Andrew Bailey reassuring the markets about the absence of recession risks, it is clear to everyone that tight financial conditions do not promote economic growth. The UK economy has been stagnant for six consecutive quarters.

The Fed can easily afford to keep the rate at the current level for as long as necessary, but the Bank of England is unlikely to do the same. However, the Bank of England will be forced to keep the rate at its maximum until the very end, as inflation still exceeds the target value by twice. Thus, assuming that the Fed will start raising the rate much earlier and more frequently than the Bank of England in 2024 is wrong.

We do not see any reason for the British currency to continue rising. However, as before, we need technical sell signals to attempt to trade this fundamental hypothesis. It's worth noting that the market can trade completely independently of fundamentals and macroeconomics, so we need technical indicators to understand the market sentiment and follow the market itself.

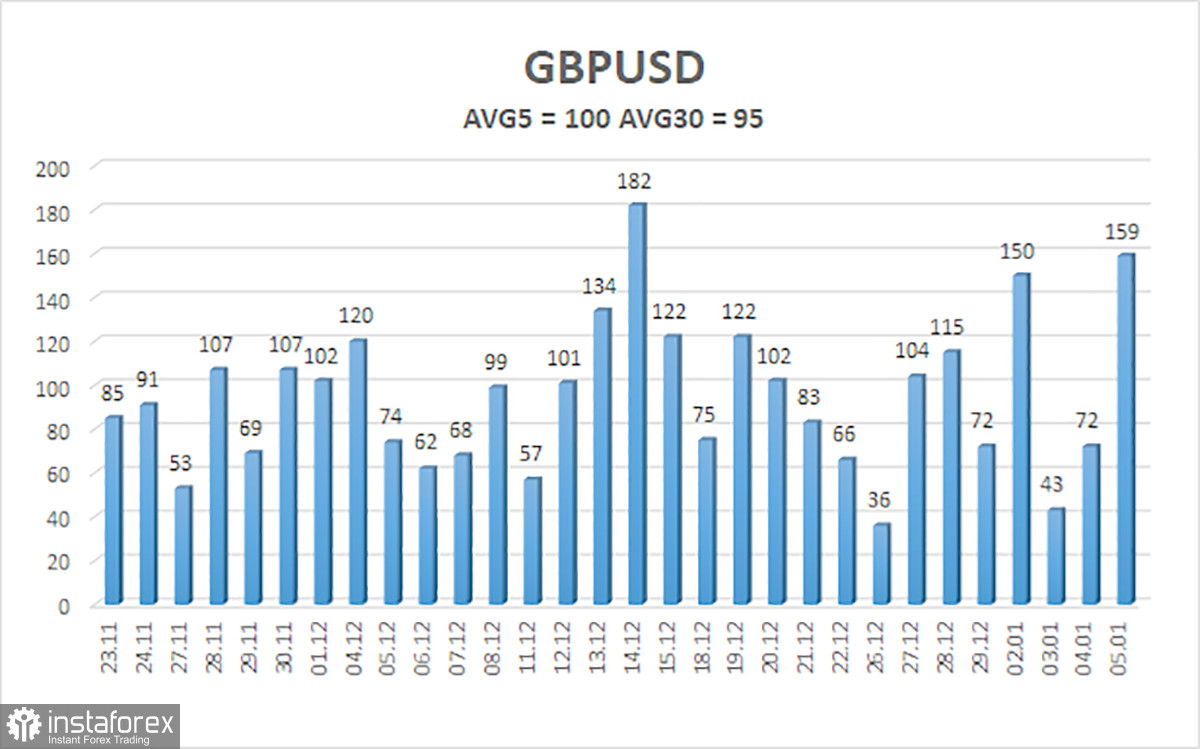

The average volatility of the GBP/USD pair over the past five trading days as of January 8th is 100 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, January 8th, we expect movement within the range limited by the levels of 1.2615 and 1.2815. A downward reversal of the Heiken Ashi indicator will indicate a new attempt to start a downward trend.

Nearest support levels:

S1 - 1.2695

S2 - 1.2665

S3 - 1.2634

Nearest resistance levels:

R1 - 1.2726

R2 - 1.2756

R3 - 1.2787

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates that a trend reversal in the opposite direction is approaching.