At the turn of 2023 and 2024, there was a lot of optimism regarding the British pound. The Bank of England is expected to make smaller repo rate cuts than the Federal Reserve and European Central Bank, as the UK economy begins to pick up and the growth in global risk appetite supports sterling as a pro-cyclical currency. Against this backdrop, Goldman Sachs' forecast of GBP/USD rising to 1.3 by the end of June seemed quite logical. Fidelity International even put out a figure of 1.4. However, something went wrong with the pound right from the start.

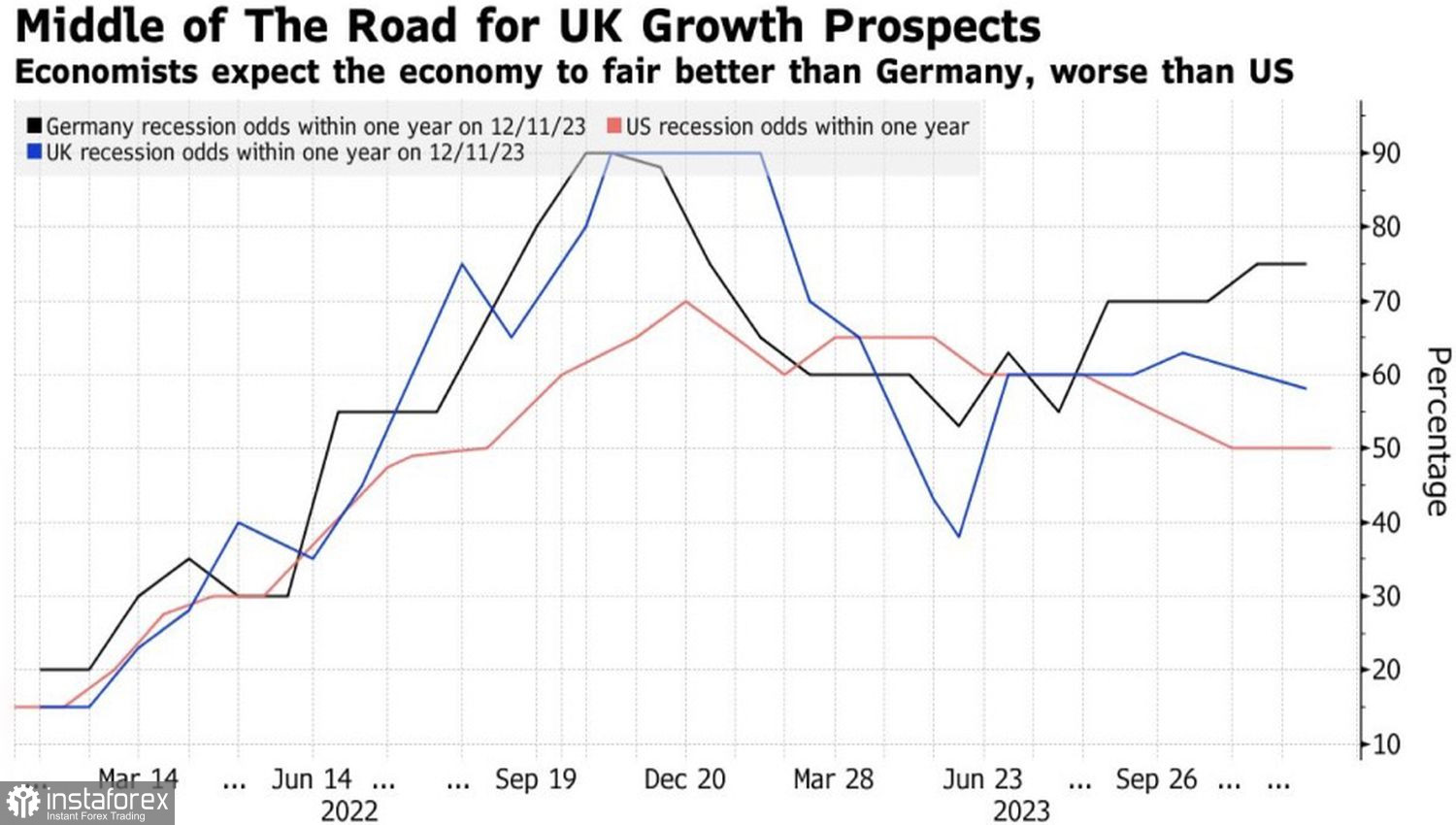

According to Prime Minister Rishi Sunak, the UK economy has outperformed skeptics and surpassed other countries, such as Germany. Bloomberg experts are lowering the chances of a recession despite a GDP contraction in October. The indicator is expected to show growth in November, thus offsetting the previous negative. Pleasant news is also expected from November's industrial production.

Dynamics of recession chances in the UK and Germany

Even if a downturn hits the UK in the fourth quarter, it will be insignificant. At its February meeting, the Bank of England is likely to raise economic growth forecasts and lower inflation estimates. Consumer prices are moving towards the 2% target faster than anticipated, prompting Andrew Bailey and his colleagues to abandon rhetoric about maintaining the repo rate at a high level for a long time.

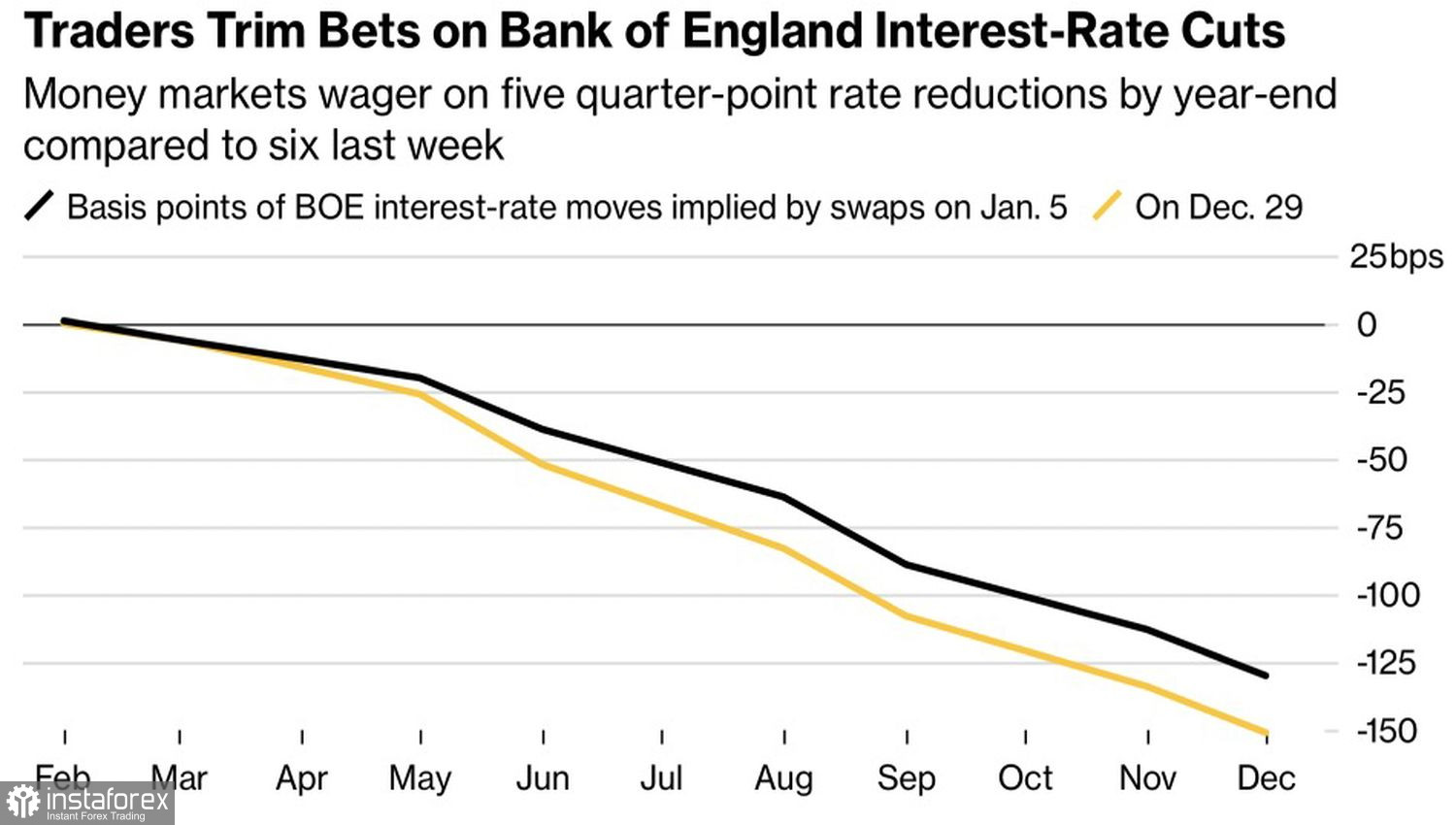

Meanwhile, the futures market expects its reduction by 125 basis points to 4%. This is less than the ECB's deposit rate cuts and the Federal Reserve's federal funds rate forecasted by derivatives. London's slower pace of monetary policy tightening compared to Frankfurt and Washington gives the pound an important advantage over the euro and the U.S. dollar.

Market expectations for the Bank of England rate

Nevertheless, sterling is not in a hurry to use its trump cards. The reason is the market's overestimation of the chances of the Federal Reserve's monetary policy weakening and increased demand for safe-haven assets amid heightened political risks in the U.S. and earthquakes in Japan. Congress will have to make tough decisions on budget spending to prevent government shutdowns and provide military aid to Ukraine. The presidential race is starting in the States. January promises to be difficult in terms of politics, and the dollar may take advantage of its reliability.

It must be acknowledged that in October-December, the market got ahead of itself, demanding six acts of monetary expansion from the Fed in 2024. Now, investors are revising their views, supporting the bears on GBP/USD. Moreover, data on U.S. employment strengthen the risks of accelerating not only the economy but also inflation in the U.S.

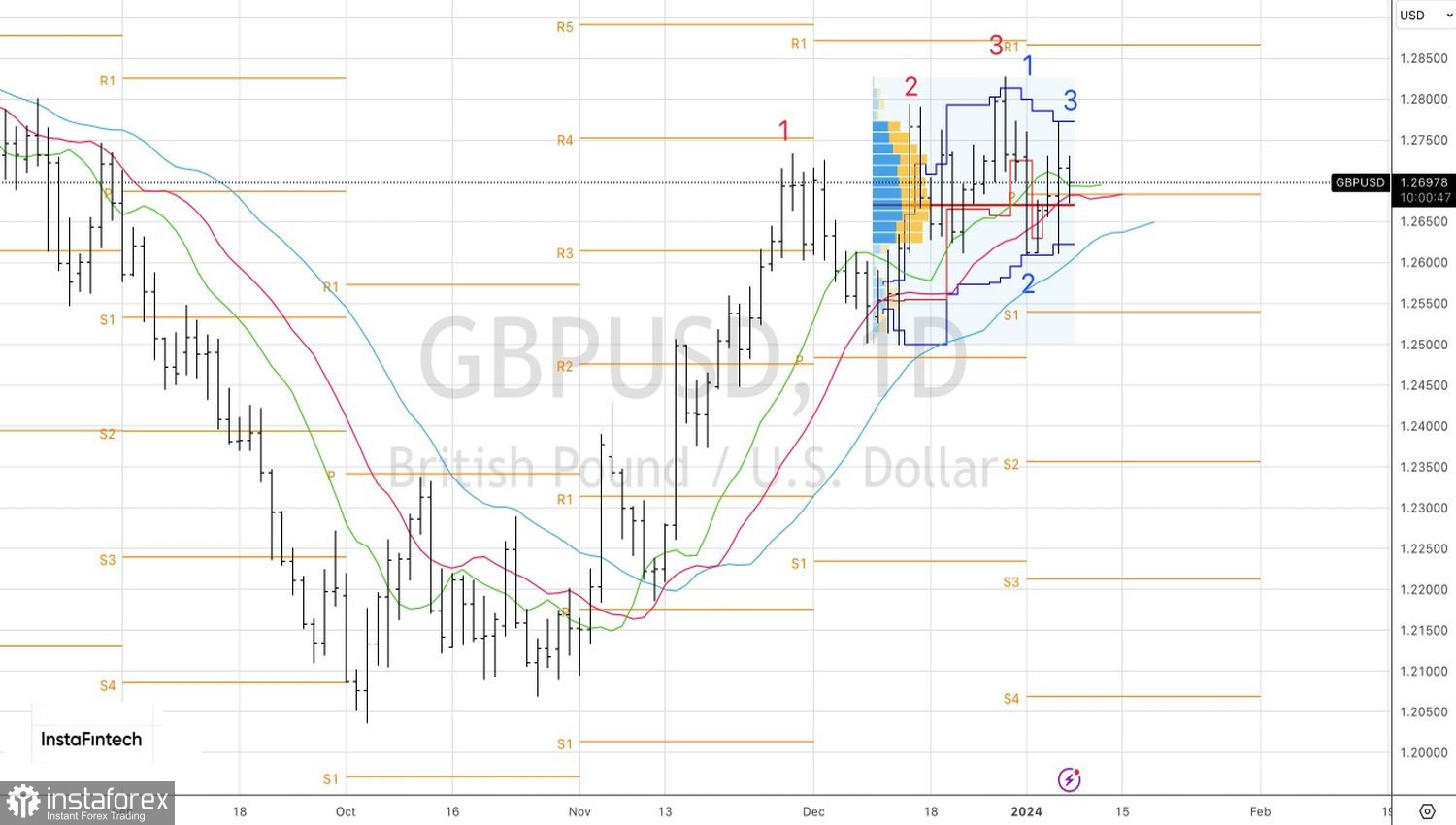

Technically, on the daily chart of GBP/USD, there is a combination of the Three Little Indians and 1-2-3 patterns, which increases the risks of a pullback to the upward trend. To sell the pair, it makes sense to use the break of support near the fair value of 1.2665.