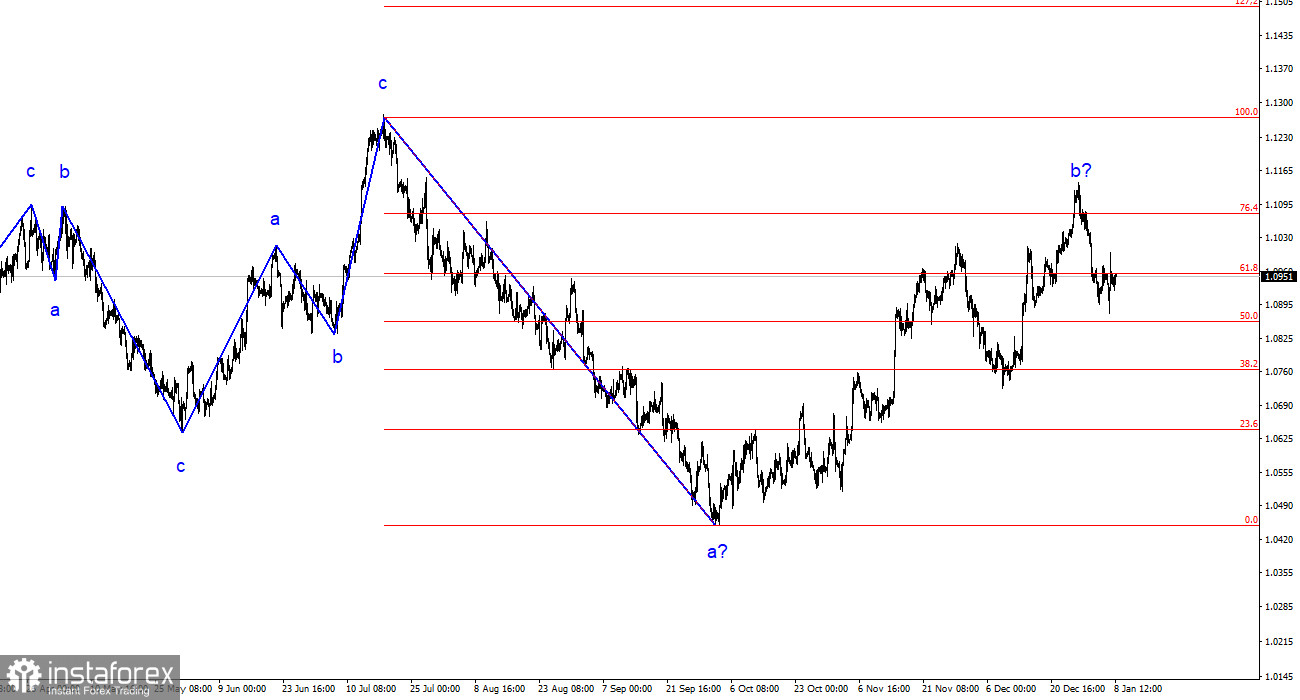

The wave analysis of the 4-hour chart for the euro/dollar pair has become more complex. Over the past year, we have only seen three-wave structures that constantly alternate with each other. The construction of another three-wave structure, a downtrend, is ongoing. The presumed wave 1 has been completed, but wave 2 or b has become more complex three or four times, and there are no guarantees that it won't become more complex again.

Although the news background cannot be considered "supportive of the European currency," the market consistently finds new reasons to increase demand for the pair. Such a situation is not normal. Even if the upward trend segment is resumed, its internal structure will become unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is indeed the case, wave c is currently being constructed, and the entire wave 2 or b may still be completed at any moment (or may have already been completed). The current pullback from the highs looks convincing, so we can expect a transition to wave 3 or c construction.

Retail sales in the Eurozone have decreased again.

The euro/dollar exchange rate increased by 15 basis points on Monday (when writing this review). There needs to be more to draw conclusions. More importantly, on Friday, there was an unsuccessful attempt to break through the 1.0880 level, corresponding to 61.8%, according to Fibonacci. This attempt stopped the current decline of the euro and does not allow us to confidently state the completion of the upward wave 2 or b.

On Monday, the news background was very weak, as it has been throughout the week. I can only mention inflation in America from the important reports, which will be released on Thursday. Today, there was a report on retail trade in the European Union in November, which declined by 0.3%. However, the market was already prepared for such a figure, so we saw that the demand for the euro remained the same.

I expect the construction of a descending wave 3 or c. With each passing day, there are more signals that the ECB will not transition to a soft policy until the summer of 2024, but at the same time, I see more and more signals that the Fed will also not transition to a soft policy before the summer. The market will be disappointed with the next report on American inflation, and the FOMC will not dare to make the first rate cut in the spring of 2024. The market has taken the first step towards constructing wave 3 or c, and now it needs to take the second one.

General Conclusions.

Based on the analysis, I conclude that constructing a descending wave set continues. The targets around the 1.0463 level have been ideally worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a correction wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive descending wave 3 or c with a significant decline in the pair. The unsuccessful attempt to break through the 1.1125 level, which corresponds to 23.6% according to Fibonacci, indicated the market's readiness for sales.

On the larger wave scale, we can see that the construction of corrective wave 2 or b is ongoing, which, in terms of length, is already more than 61.8% from the first wave, according to Fibonacci. As I have already mentioned, this is not critical, and the scenario of constructing wave 3 or c with a decline in the pair below the 4-figure level is still in force.