Despite fairly significant economic reports and statements from Federal Reserve officials, the euro remained relatively stable. It certainly didn't stand still, but the extremely low level of volatility is somewhat surprising. Eurozone retail sales fell 0.3% in November, which is the sharpest decline in retail volume since August. And yet, the euro rose after this report. Then came the statements from Dallas Federal Reserve President Lorie Logan as she said the central bank shouldn't rule out another rate hike due to the recent easing in financial conditions. Her remarks may have also weighed on the euro.

It seems that the retail sales data went largely unnoticed because the market moved in a different direction after its release. This may be due to a sudden surge in demand for European bonds, causing their yields to drop significantly. For instance, the yield on ten-year bonds plummeted from 3.182% to 2.850%. This is a significant change that cannot be solely attributed to expectations of monetary easing. It is likely a result of a sudden frenzy in the market. Subsequently, the remarks of the Federal Reserve officials calmed the market, and quotes gradually returned to the levels they were at before the issuance of debt securities.

The only thing we can highlight for today is the eurozone unemployment rate, which is expected to rise from 6.5% to 6.6%. This may exert pressure on the euro, although not significant. The market is currently ignoring economic reports, especially since the US inflation data is scheduled for release on Thursday, and investors are not willing to take risks ahead of such significant data.

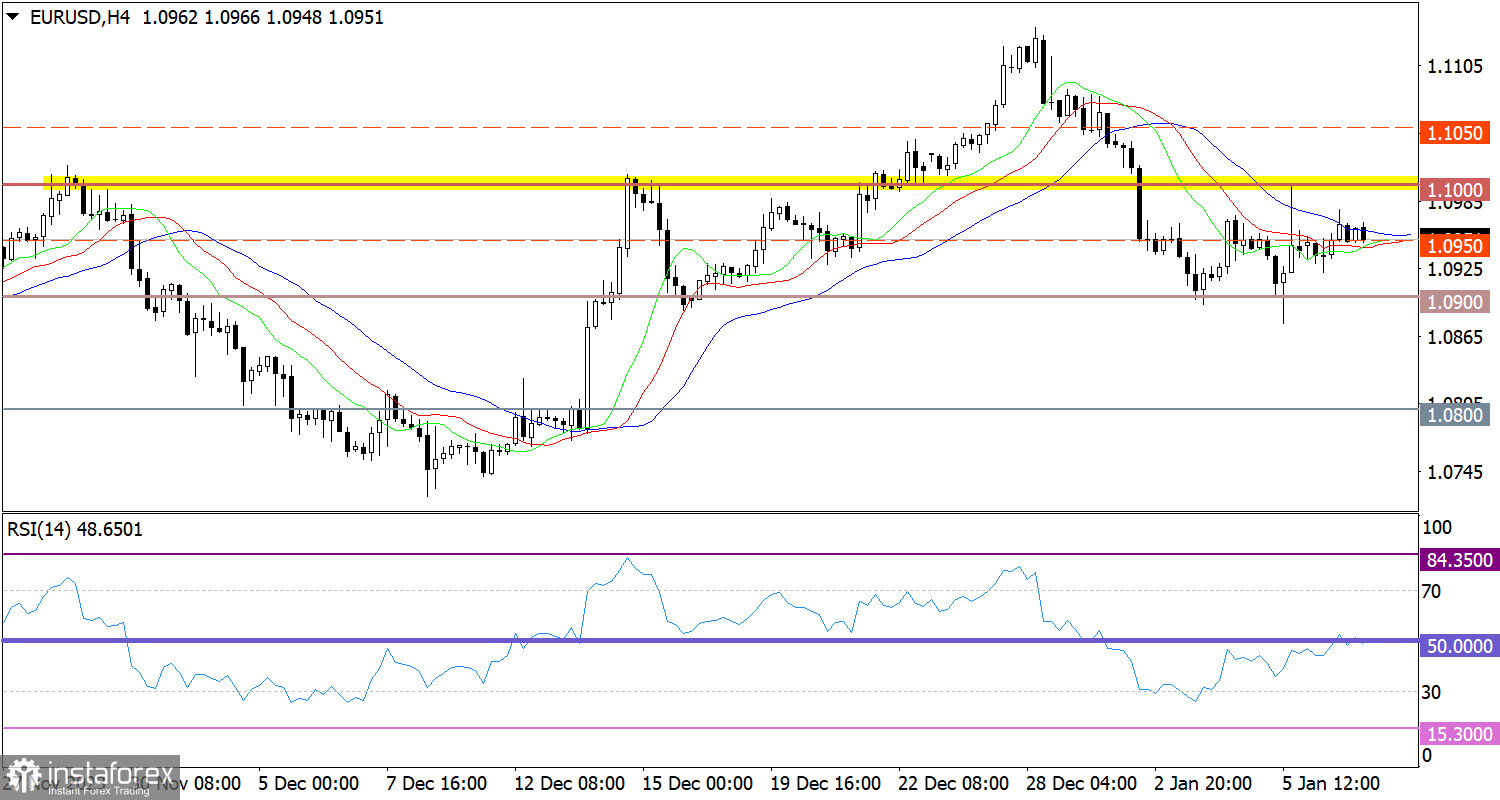

The EUR/USD pair has been generally stagnant since last Thursday, forming doji candlesticks on the daily chart. This indicates a typical consolidation phase, which could potentially lead to the process of building up trade forces.

On the four-hour chart, the RSI has been moving along the 50 middle line, confirming the consolidation stage.

On the same time frame, the Alligator's MAs are intersecting each other, corresponding to a consolidation stage.

Outlook

A prolonged period of consolidation will eventually lead to speculative price spikes. For this reason, the ongoing consolidation should be viewed as a catalyst for future price movements. The optimal tactic is to employ the breakout method, where local bursts of activity are considered.

The complex indicator analysis unveiled that in the intraday and short-term periods, technical indicators are pointing to a consolidation phase.