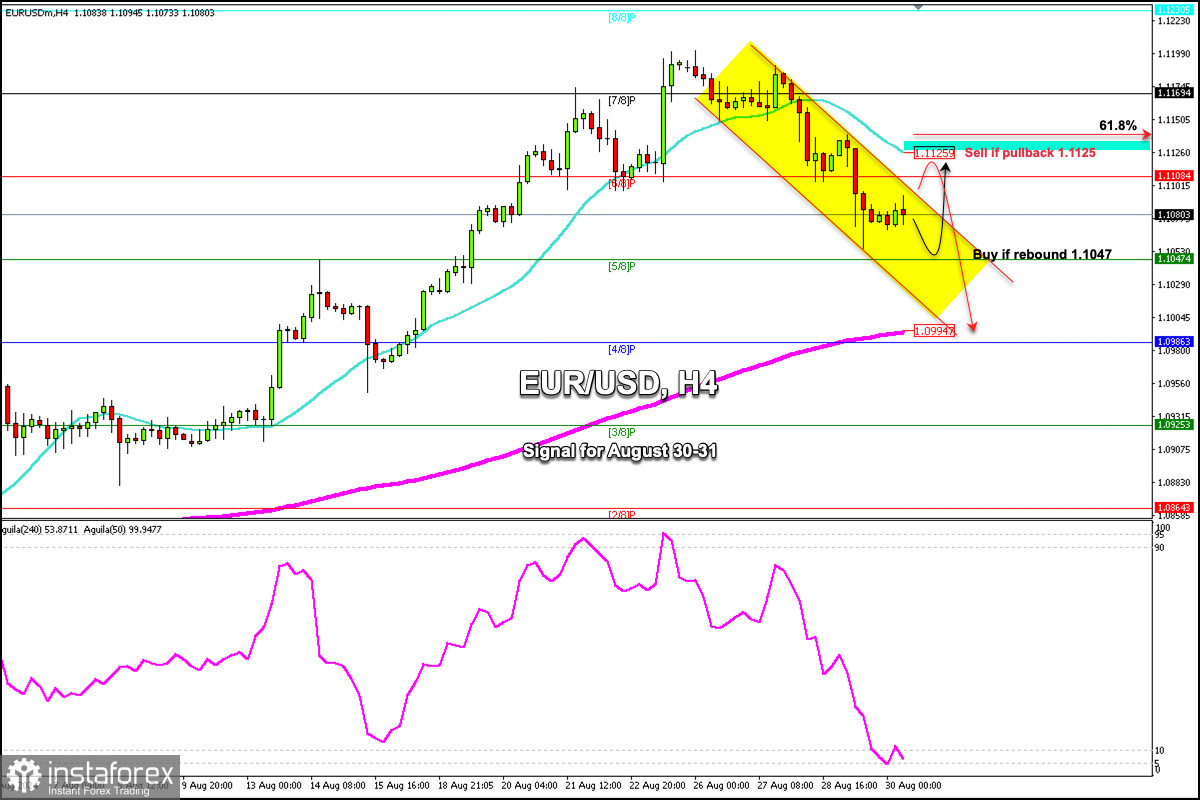

Early in the American session, the EUR/USD pair was trading around 1.1080 with a technical correction after reaching the high of 1.1201.

Currently, a bearish trend is observed in the euro. In case of a technical bounce at 5/8 Murray, the currency is likely to resume its bearish cycle and continue its fall until the psychological level of 1.1000. The euro was in technical correction for two days and is now consolidating around 1.1070.

In the American session, the US inflation data will be published, which could cause strong volatility. We must pay attention to this data to look for opportunities to continue selling in case the euro rebounds and reaches the 61.8% Fibonacci level at around 1.1143.

EUR/USD has an important support at 1.1047. This level could offer a technical bounce as the eagle indicator is showing oversold signals. In addition, a buying opportunity is likely to appear around 5/8 Murray.

Since August 26th, the euro has been trading in a bearish trend channel and it is likely that after a rebound the pair will try to reach the strong resistance of 1.1108, or 21 SMA at 1.1125. It could also finally reach 1.1143 (61.8%). Both levels could act as resistance for the euro and we could see these areas as an opportunity to sell.