Details of the Economic Calendar on January 8

Eurozone retail sales decreased by 0.3% in November compared to the previous month, matching analysts' forecasts.

In terms of the information flow, there were speeches by Federal Reserve representatives. One of them expressed the opinion about a possible increase in the refinancing rate in case of inflation growth in the USA, while another head of the Federal Reserve Bank, on the contrary, considers an early reduction of the key rate.

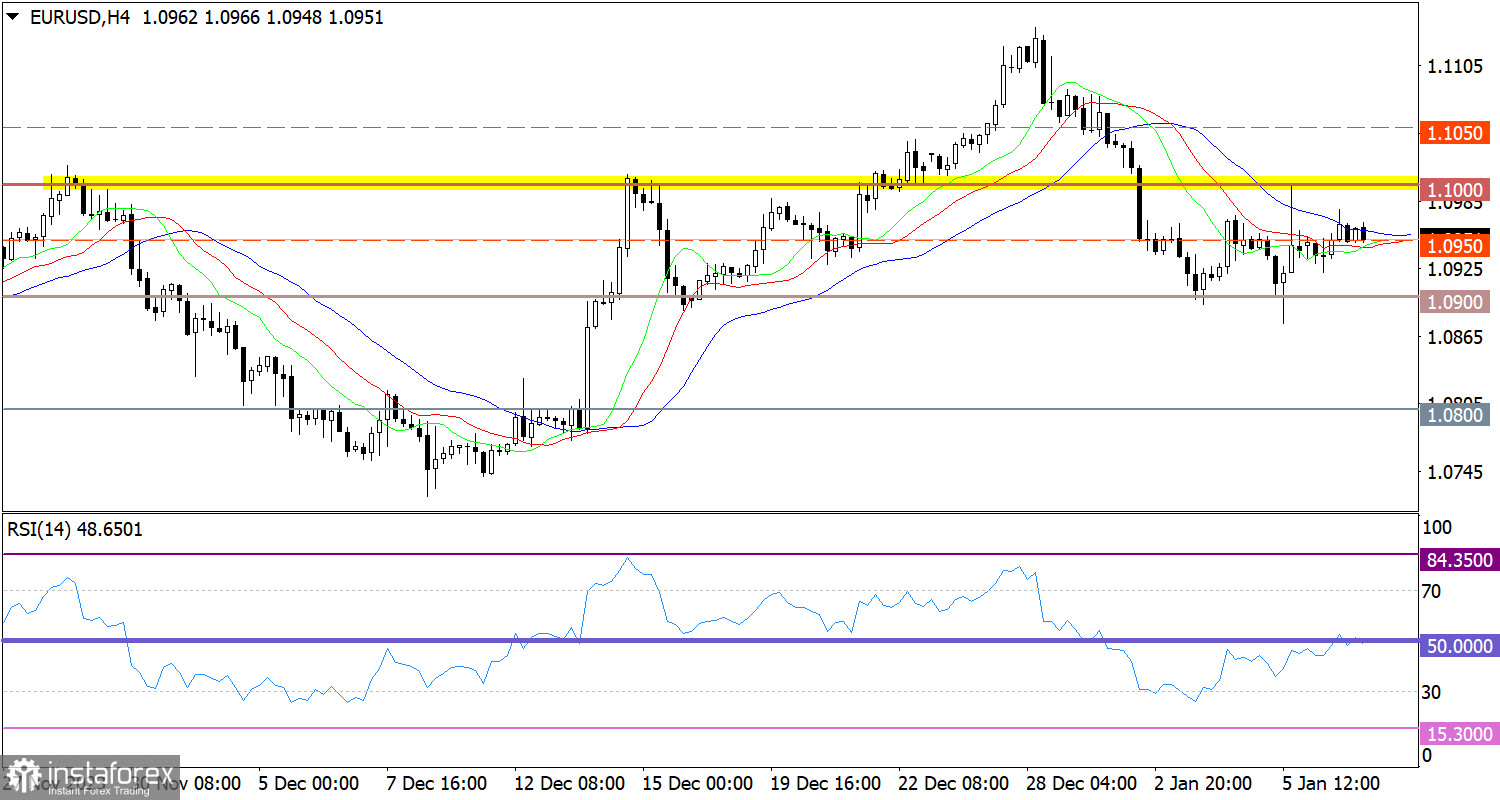

Analysis of Trading Charts from January 8

The EUR/USD currency pair has been relatively stable since last Friday, forming doji candles on the daily chart. This price action indicates a characteristic stagnation, which could lead to an accumulation of trading forces.

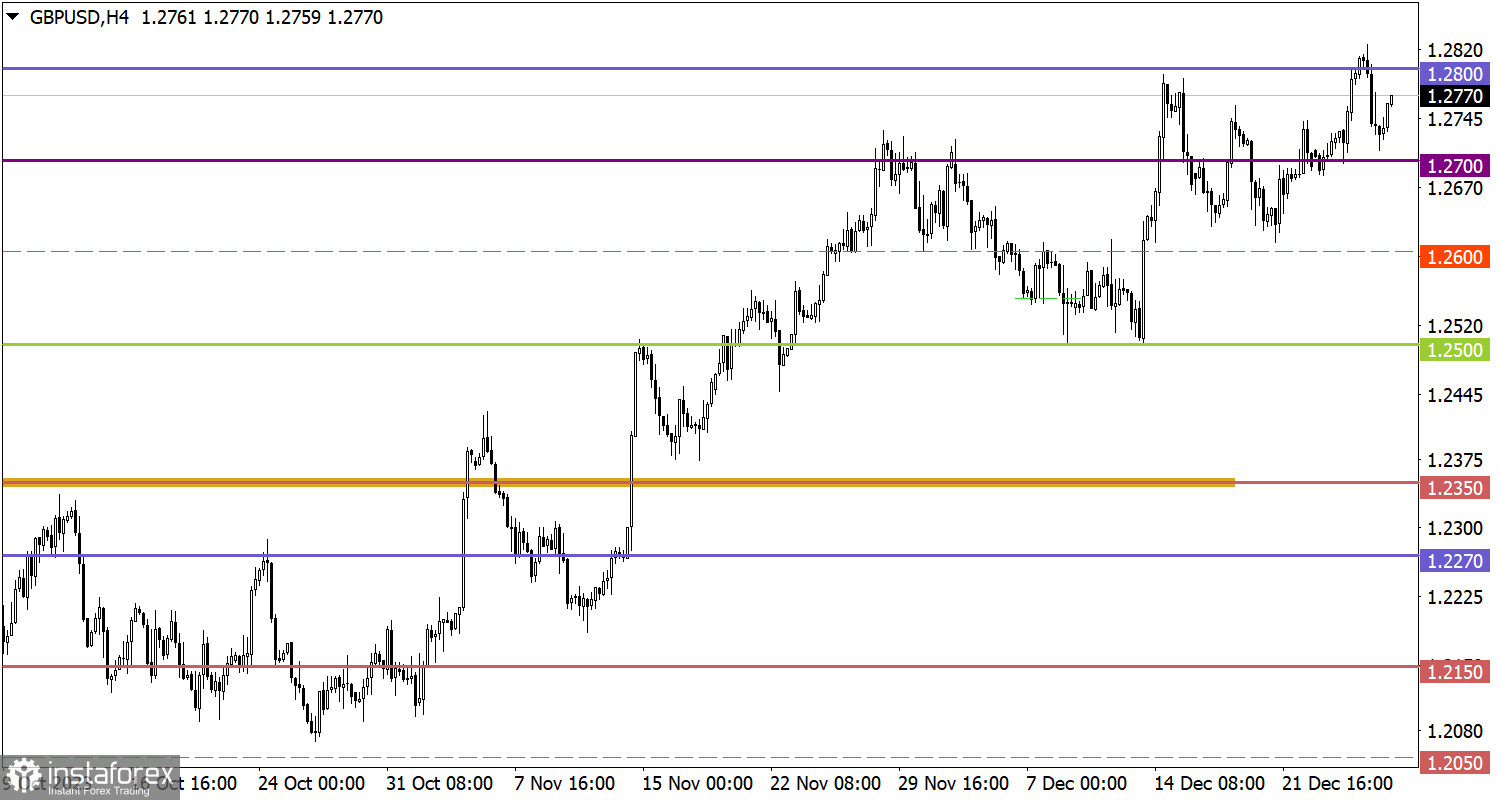

The GBP/USD currency pair shows an upward trend over several days. However, when examining the trading chart over several weeks, a characteristic flat is observed between the levels of 1.2600 and 1.2700.

Economic Calendar on January 9

Today, the main focus should be on the unemployment rate in the European Union, which is expected to rise from 6.5% to 6.6%. This could potentially lead to some weakening of the euro if the data matches the statistics.

EUR/USD Trading Plan for January 9

Prolonged stagnation at one level can eventually lead to speculative price jumps. For this reason, the current stagnation should be considered as a lever for subsequent price movements. The optimal approach is the method of outgoing impulse, which takes into account a local spike in activity.

GBP/USD Trading Plan for January 9

In this case, the upward cycle began from the lower boundary at 1.2600. It is possible that near the 1.2700 mark, there will be a reduction in the volume of long positions, which could lead to a slowdown in the upward cycle.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.