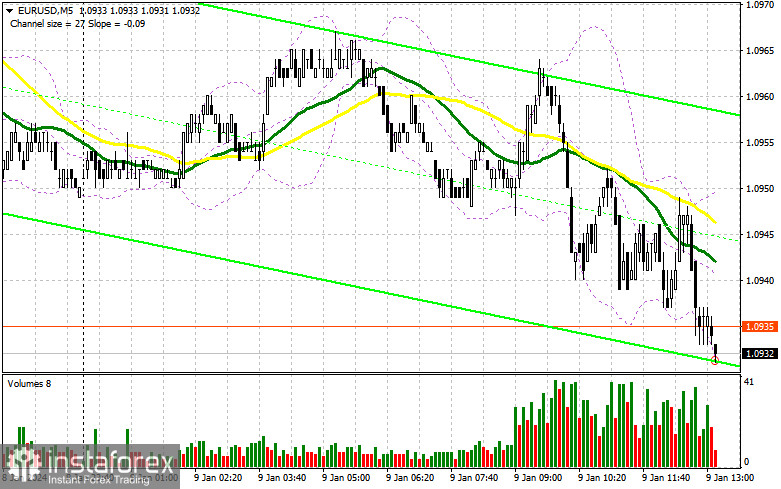

In my morning forecast, I mentioned the level of 1.0924 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline did occur, but we have yet to reach this area for a test due to the low market volatility. The lack of suitable entry points in the first half of the day also affected the technical picture, which I decided not to revise for the American session.

To open long positions on EUR/USD, it is required:

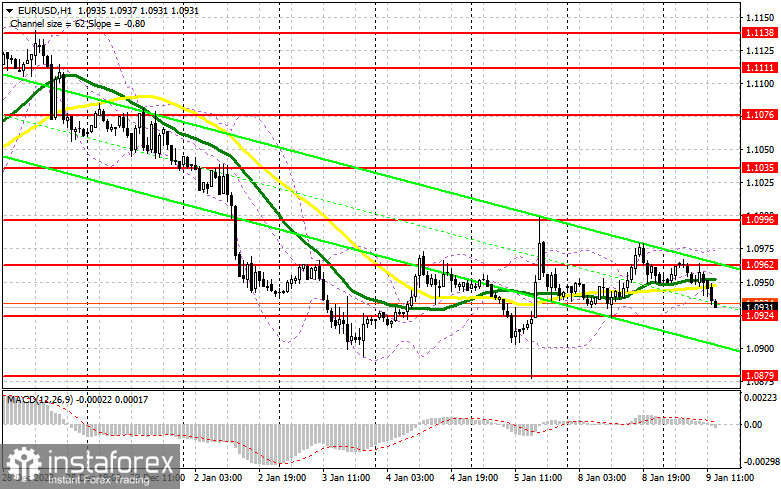

The released data from Germany once again disappointed. Industrial production there declined more than expected, which could explain the current decline in the euro. On the other hand, the unemployment rate data suggests that the European Central Bank may continue its tough policy since the labor market is not reacting much. This is more of a positive factor for the euro than a negative one. In the second half of the day, no such statistics could turn the market around, but there was a speech by FOMC member Michael S. Barr. Yesterday, his colleague was very dovish, leading to a dollar decline. In case of sustained downward pressure, I will act after forming a false breakout near the nearest support level at 1.0924. This will provide a suitable entry point and upward movement towards 1.0962. Only a breakthrough and an update from top to bottom of this range will determine the development of the bullish scenario, giving a chance to buy with a movement towards 1.0996. The ultimate target will be at 1.1035, where I will take profit. In the case of a decline in EUR/USD and the absence of activity at 1.0924 in the second half of the day, pressure on the pair will increase. In this case, I plan to enter the market only after the formation of a false breakout in the area of last week's low at 1.0879. I will open long positions only after a rebound from 1.0834 with the target of an upward correction within the day by 30-35 points.

To open short positions on EUR/USD, it is required:

Sellers took advantage of the moment, but it is still too early to say they have a strong advantage. In the case of an increase in the pair, only a tough tone from the FOMC representative can help protect the nearest resistance at 1.0962, where an unsuccessful consolidation will indicate the presence of sellers in the market, leading to a downward movement towards 1.0924. After a breakthrough and consolidation below this range and a reverse test from bottom to top, I expect to receive another selling signal with an exit at 1.0879. Protecting this level will be the last hope for buyers. The ultimate target will be at the minimum of 1.0834, where I will take profit. In case of an upward movement of EUR/USD in the second half of the day on the background of dovish comments from FOMC representatives similar to yesterday, as well as the absence of bears at 1.0962, demand for EUR/USD will return, along with the chances of building an upward correction. In this case, I will postpone selling until testing the next resistance level at 1.0996. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on the rebound from 1.1035 with the target of a downward correction by 30-35 points.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author determines the period and prices of moving averages on the H1 hourly chart and differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator at 1.0932 will act as support.

Indicator Descriptions:

- Moving Average (an indicator that determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (an indicator that determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence — Convergence/Divergence of Moving Averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

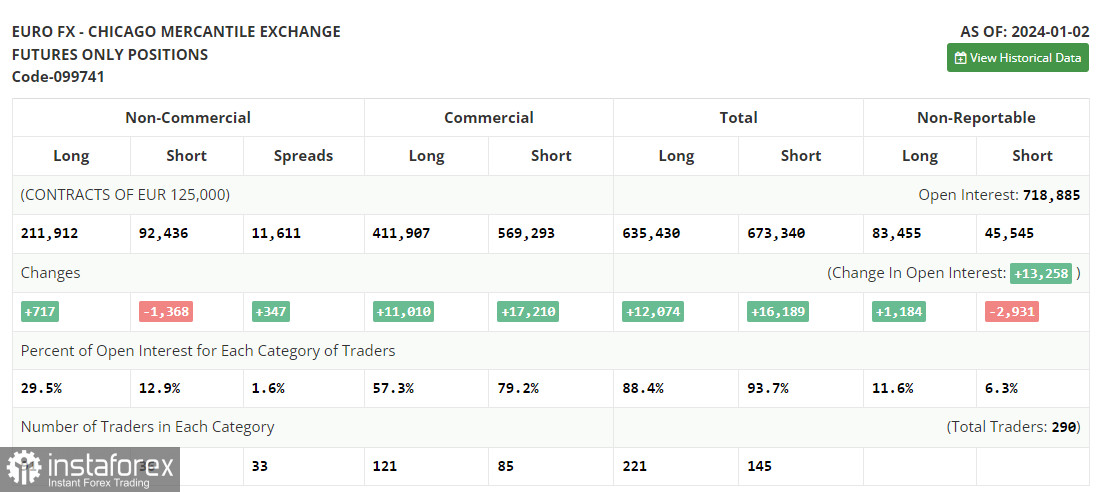

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long non-commercial positions.