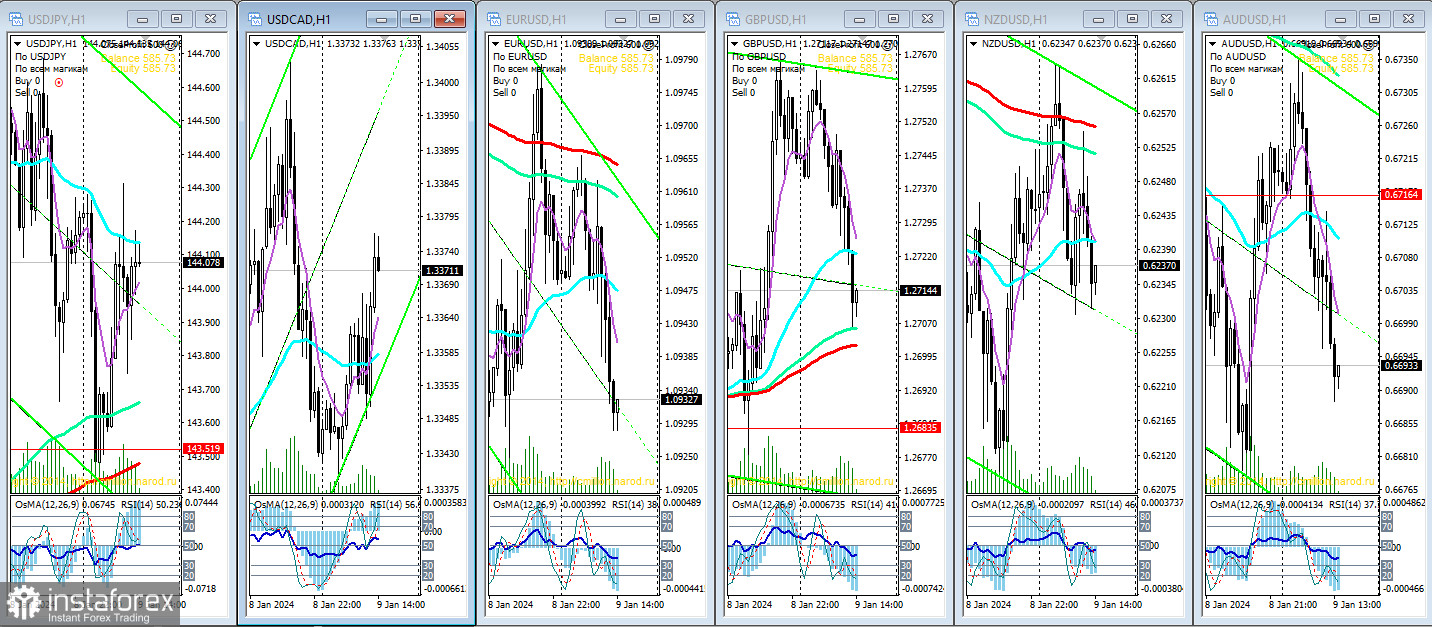

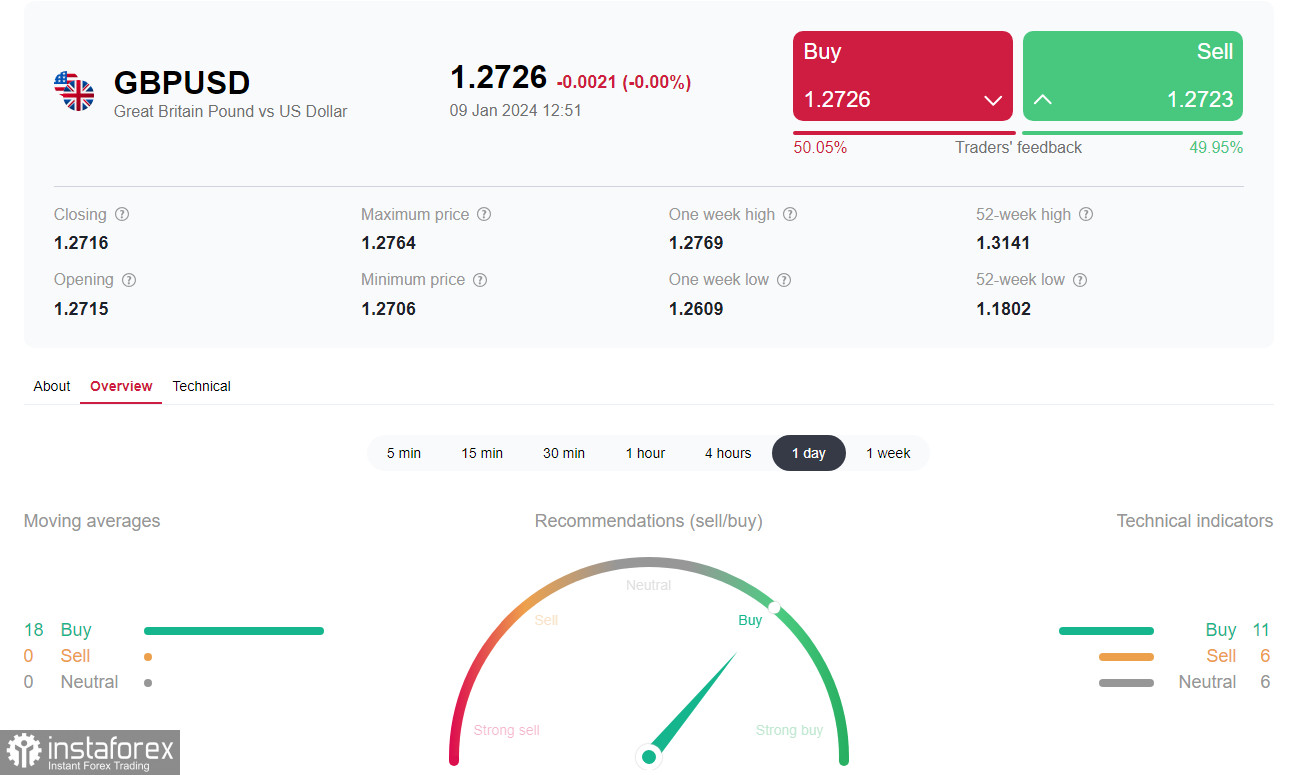

If we conduct a brief analysis of the six major U.S. dollar currency pairs, it is evident that the GBP/USD pair is "lagging" in its decline compared to other currency pairs. At the same time, the pound maintains a bullish impulse.

There could be several reasons for this, including expectations of actions from the Bank of England to contain the still high inflation, comparatively much higher than in other major world economies.

According to data presented on December 20th by the UK's Office for National Statistics, the consumer price index in November decreased by -0.2% (against 0% in October and a forecast of a +0.1% increase) and slowed down in the annual indicator to +3.9% (against +4.6% the previous month and a forecast of +4.4%). The core CPI also adjusted, to 0% in monthly terms and +5.1% annually against +0.1% and 5.7%, respectively, in October.

The pound weakened sharply after this publication but then corrected upwards again. Despite the fact that inflation is slowing down faster than expected by the Bank of England, as the data shows, it is still significantly higher than the target level of 2%, which maintains the possibility of the Bank of England keeping the interest rate at high levels for a longer time.

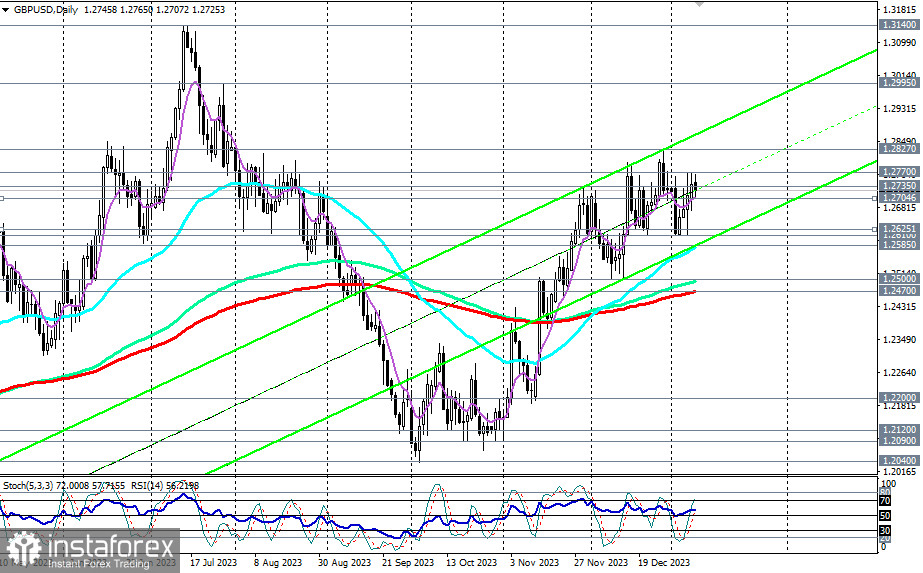

Before the New Year holidays, the GBP/USD pair reached its highest level in five months near the mark of 1.2827, but then fell by 220 points.

In the first week of the new year, the pound received new support from published higher data on business activity in the UK, as well as lending statistics (consumer lending volume added +2.005 billion pounds in November instead of the forecasted +1.4 billion pounds).

At the beginning of this week, the GBP/USD pair was able to rise to a local 7-day high of 1.2770.

In the absence of important publications, market participants regarding the pound will be watching two events of the week – the speech of the Bank of England head Andrew Bailey in Parliament on Wednesday (starting at 15:15 GMT) and the publication of data on British GDP (expected to grow in November by +0.2% and +0.1% annually) and industrial production (forecasted to increase by +0.3% after -0.8% in the previous month) on Friday (at 07:00 GMT).

Bailey is likely to take a cautious position and confirm that further actions of the Bank of England will depend on incoming macro data.

Volatility in the GBP/USD pair this week will also sharply increase on Thursday, when at 13:30 (GMT), weekly data on the dynamics of unemployment benefit claims and fresh data on inflation in the USA will be presented.

The forecast expects an acceleration of the Consumer Price Index (CPI) in December to +0.2% and +3.2% (on an annual basis) from +0.1% and +3.1%, respectively, the previous month. Thus, inflation in the U.S. remains almost twice as high as the Federal Reserve's target level.

If the data are confirmed or turn out to be stronger than forecasted values, this could significantly weaken expectations regarding the start of the Federal Reserve's monetary policy easing program and support the dollar.

In this case, a fall in the GBP/USD pair is also likely. In an alternative scenario, it is logical to expect a breakout of the local resistance at 1.2770 and a resumption of GBP/USD growth.

And for today and tomorrow, the economic calendar is practically empty. This means that news drivers are absent, and the major currency pairs will most likely continue to trade within ranges close to their current levels.