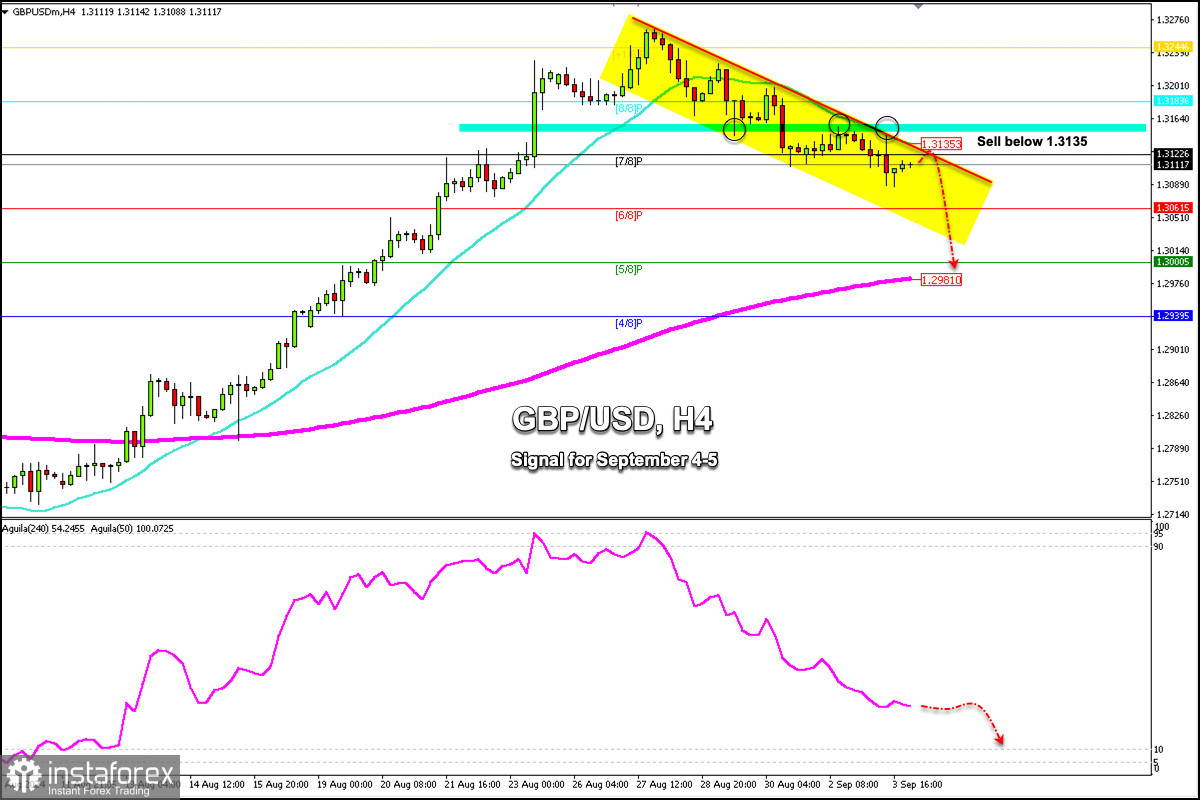

The British pound (GBP/USD) is trading around 1.3125 within the bearish trend channel forming since August 23, below the 21 SMA, and below the 7/8 Murray.

On the H4 chart, we observe that the British pound is under a technical correction. Yesterday during the American session, it tested the bearish trend channel and could not break it which caused a fall to the low of 1.3087.

However, we see a slight recovery, but this could trigger another bearish sequence only in case it fails to break above 1.3140. Then, it could resume its bearish cycle and reach the psychological level of 1.30.

The outlook for the British pound could change if it consolidates above 1.3140 (21 SMA) in the next few days. Then, we could see this as a signal to buy with targets at 8/8 Murray located at 1.3183 and finally at +1/8 Murray located at 1.3244.

If the British pound tries to break the bearish trend channel in the next few hours, it will find a rejection. This serves as a signal to sell. If this scenario occurs, we could sell during a bearish acceleration with targets at 6/8 Murray located at 1.3061 and finally at the 200 EMA located at 1.2981.