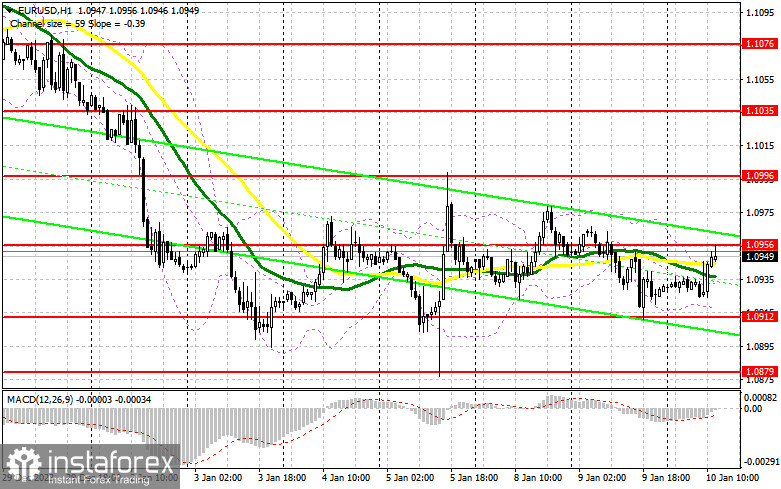

In my morning forecast, I drew attention to the level of 1.0956 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. Growth and the formation of a false breakout around 1.0956 occurred, but as you can see on the chart, the euro never experienced active downward movement. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

The absence of significant fundamental statistics suggested that the market would not show any dynamics in the first half of the day, as indeed happened. Unfortunately, the second half of the day may be equally calm and within a sideways range. The reason is the need for more important data, including data on the American economy. Changes in wholesale inventory levels are unlikely to be significant to currency traders. The speech of FOMC member John Williams may have some impact. If price pressure returns amid Williams' statements, I will only act after forming a false breakout around the nearest support at 1.0912. This will provide a suitable entry point and lead to an upward movement towards 1.0956, where we currently find ourselves. Only a breakout and a new top-down range will determine the development of a bullish scenario, giving a chance to buy with a target of 1.0996. The ultimate target will be at 1.1035, where I will take profits. In the case of EUR/USD declining and lack of activity at 1.0912 in the second half of the day, pressure on the pair will increase ahead of tomorrow's important inflation data in the US. In that case, I plan to enter the market only after forming a false breakout around the previous week's low at 1.0879. I will consider opening long positions on the rebound from 1.0834 with a target of a 30-35 point upward correction within the day.

To open short positions on EUR/USD, the following is required:

While trading below 1.0956, the chances of downward movement and the realization of the morning signal remain, but the longer the sellers hesitate, the lower these chances become. It would be good to see another false breakout formation around 1.0956, which would indicate the presence of sellers in the market and lead to a downward movement towards 1.0912. Only after a breakout and consolidation below this range, which could occur after statements by representatives of the Federal Reserve, as well as a bottom-up retest, do I expect to find another entry point into the market with a move to 1.0879. Protecting this level will be the last hope for buyers. The ultimate target will be the minimum at 1.0834, where I will take profits. In the event of EUR/USD rising in the second half of the day due to soft comments from Federal Reserve officials and the absence of bears at 1.0956, demand for EUR/USD will return, along with the prospects for an upward correction. In this case, I will postpone selling until testing the next resistance at 1.0996. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on the rebound from 1.1035 with a 30-35 point downward correction target.

Indicator Signals:

Moving Averages:

Trading occurs around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author determines the period and prices of moving averages on the H1 hourly chart and differs from the standard definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator at 1.0915 will act as support.

Indicator Descriptions:

• Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

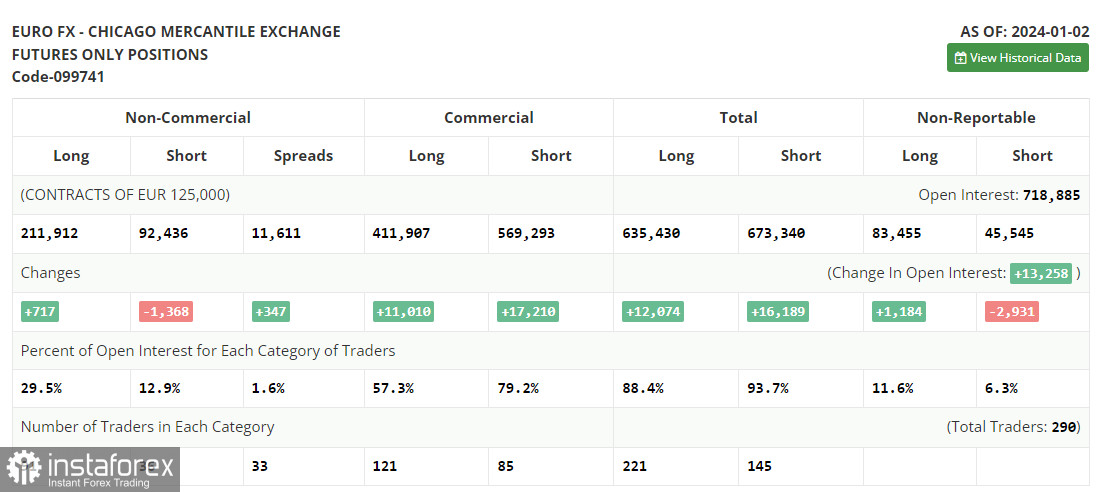

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.