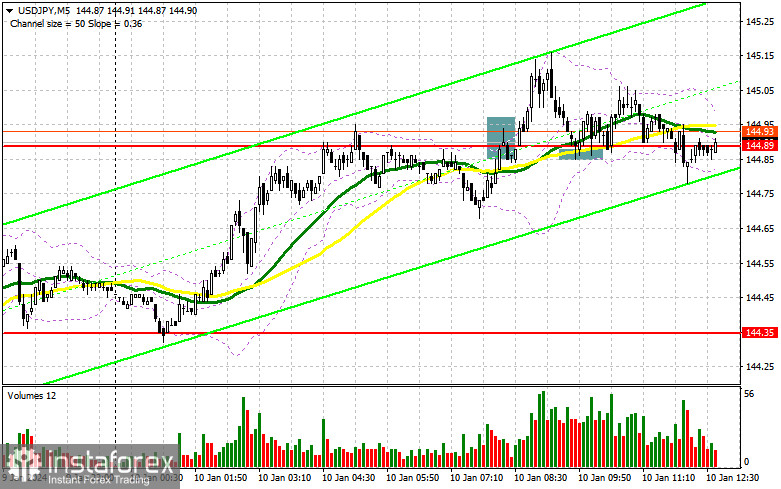

In my morning forecast, I focused on the level of 144.89 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The upward movement and the formation of a false breakout at this level led to a setup for selling, but the drop never occurred, resulting in loss fixation. After breaking through and retesting 144.89 from above to below, I found an entry point for buying the pair, but after a 25-point upward movement, the buying momentum faded. The technical picture was slightly adjusted in the second half of the day.

To open long positions on USD/JPY, the following is required:

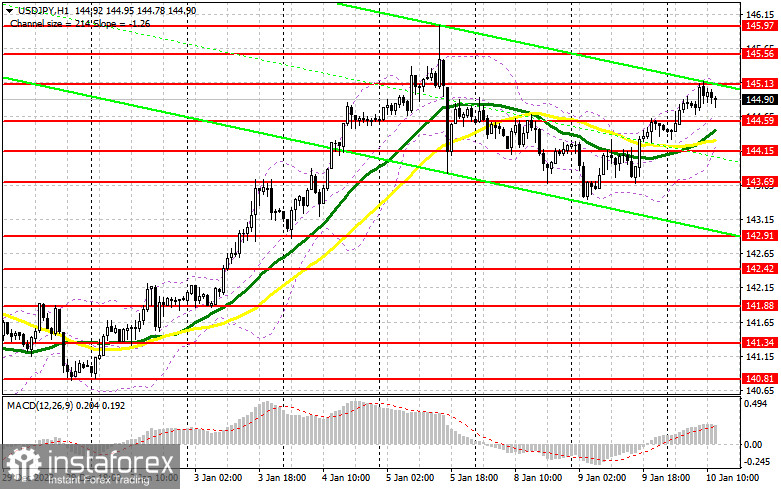

Ahead of us, we have a speech by a representative of the Federal Reserve, John Williams, who may support the positions of other committee members, which, in a way, will weaken the dollar's stance. However, considering the bullish trend we are observing and the problems recorded in the Japanese economy recently, it is unlikely that we can expect a significant decline in the pair in the second half of the day. But if Williams is not as dovish in his statements, the chance of the pair's continued rise will be much higher than a decline. I prefer to buy only after the formation of a false breakout at 144.59. New support formed at the end of the first half of the day, slightly below which the moving averages pass, playing in favor of the bulls. This can provide a suitable entry point for buying the dollar with a good potential return to the 145.13 area. In the face of tough central bank comments, a breakout and bottom-up retest of this range will lead to new purchases with the prospect of recovery to the 145.56 area. The ultimate target will be the 145.97 area, where I plan to take profits. In the scenario of the pair declining and the absence of buyer activity at 144.59, which is a rather contentious level, pressure on the dollar will return, leading to a larger downward movement. In this case, I will attempt to enter the market around 144.15, but only a false breakout there will provide a point for opening long positions. I plan to buy USD/JPY on the rebound only from the monthly minimum of 143.69 with the aim of a 30-35 point intraday correction.

To open short positions on USD/JPY, the following is required:

Sellers did everything they could in the first half of the day but failed to achieve a downward movement. Only Federal Reserve officials' very dovish tone can pressure the dollar. If this does not happen, the bears must assert themselves again around the daily maximum of 145.14. I prefer to act there only after forming a false breakout, similar to what I discussed earlier, even though it did not succeed in the first half of the day. Only this will confirm the presence of significant players in the market and provide a selling point capable of pushing USD/JPY towards 144.59. A breakout and bottom-up retest of this range will deal a more serious blow to buyer positions, leading to the removal of stop orders and opening the way to 144.15, where I expect significant buyer activity. A more distant target will be the 143.69 area, where I plan to take profits. In the scenario of USD/JPY rising and the absence of downward movement at 145.13 in the second half of the day, it's best to postpone selling until testing the next resistance at 145.56. If there is no downward movement, I will sell USD/JPY on the rebound immediately from 145.97, but only counting on a pair correction of 30-35 points within the day.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating a possible rise in the pair.

Note: The author determines the period and prices of moving averages on the H1 hourly chart and differs from the standard definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator at 144.15 will act as support.

Indicator Descriptions:

• Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

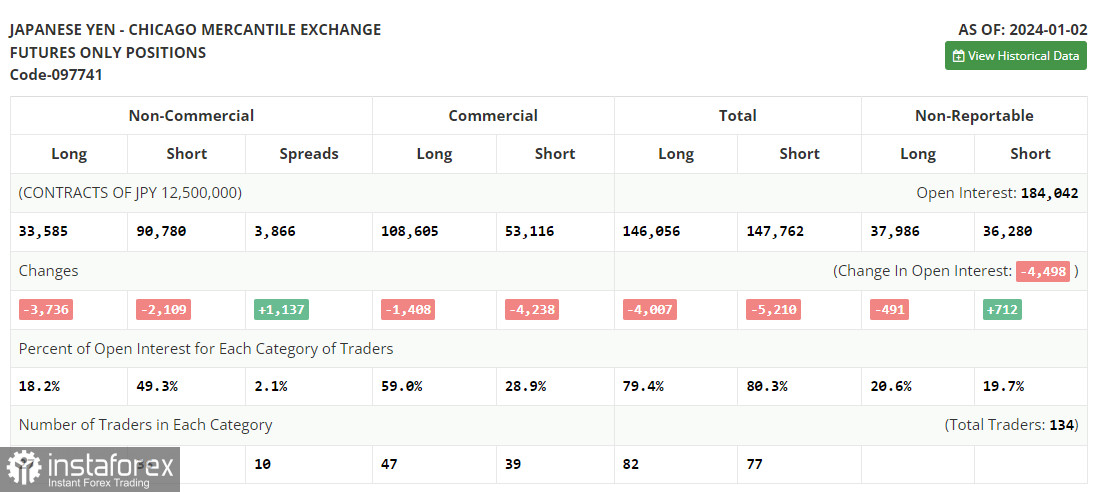

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.