While the market is trying to understand where EUR/USD will go after the release of U.S. inflation data for December, the Federal Reserve is puzzling over the dynamics of consumer prices. The cost of goods has been falling for six consecutive months, ending in November, thanks to the recovery of supply chains. However, the prices of services, on the other hand, continue to rise. This creates huge uncertainty and complicates decision-making.

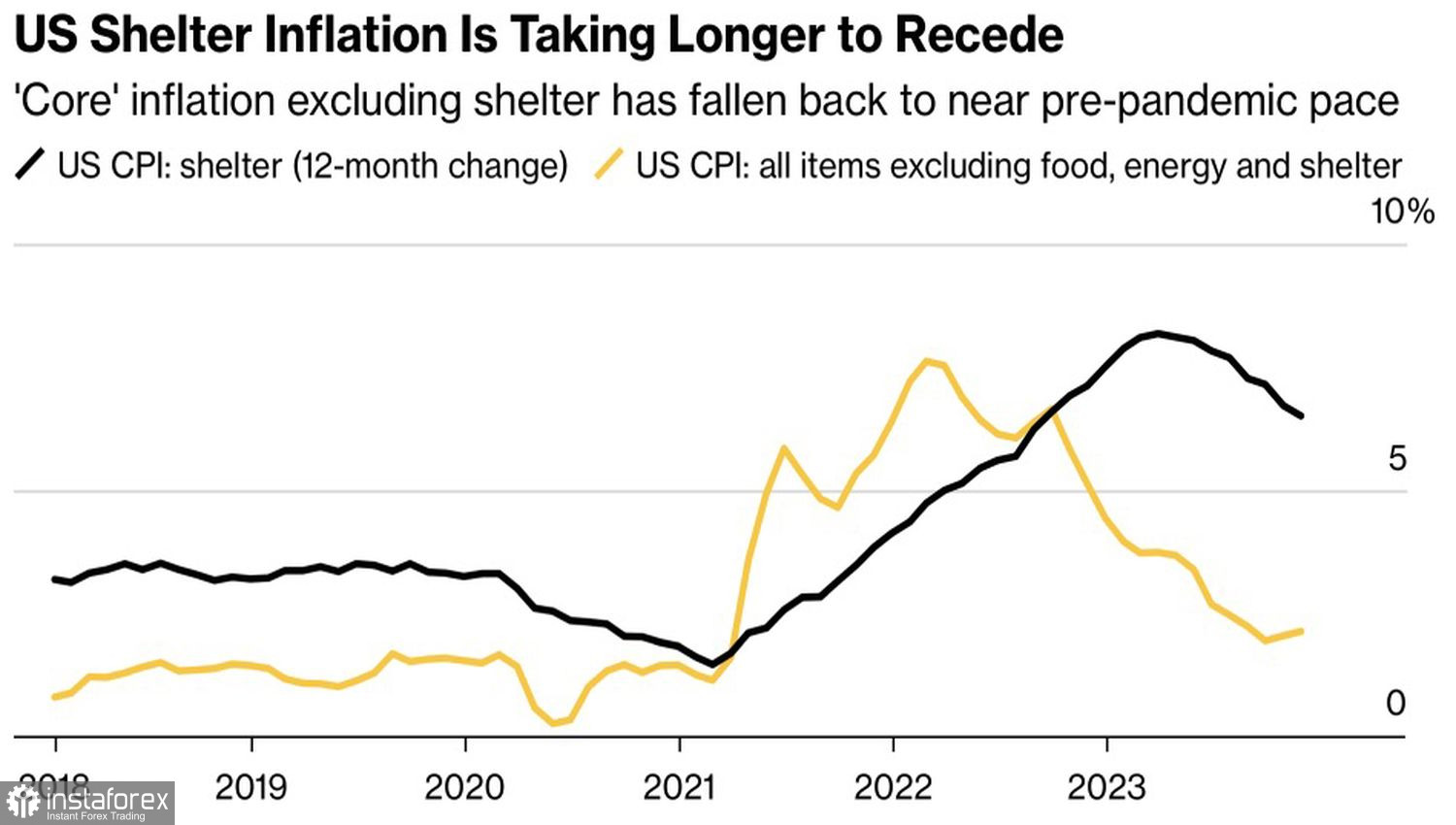

Dynamics of U.S. Inflation

The Federal Reserve has a dual mandate. The central bank must stabilize inflation near the 2% target while simultaneously supporting the labor market. Its dovish pivot in December, against the backdrop of the personal consumption expenditures index not reaching its target, means the Fed is now paying more attention to the economy than prices. Why is this? There is a belief that Jerome Powell and his colleagues want to support the current government in the 2024 U.S. presidential elections. Joe Biden is unlikely to like the idea of slowing down the U.S. economy. Stimulating it through easing monetary policy would allow the Democrats to win again.

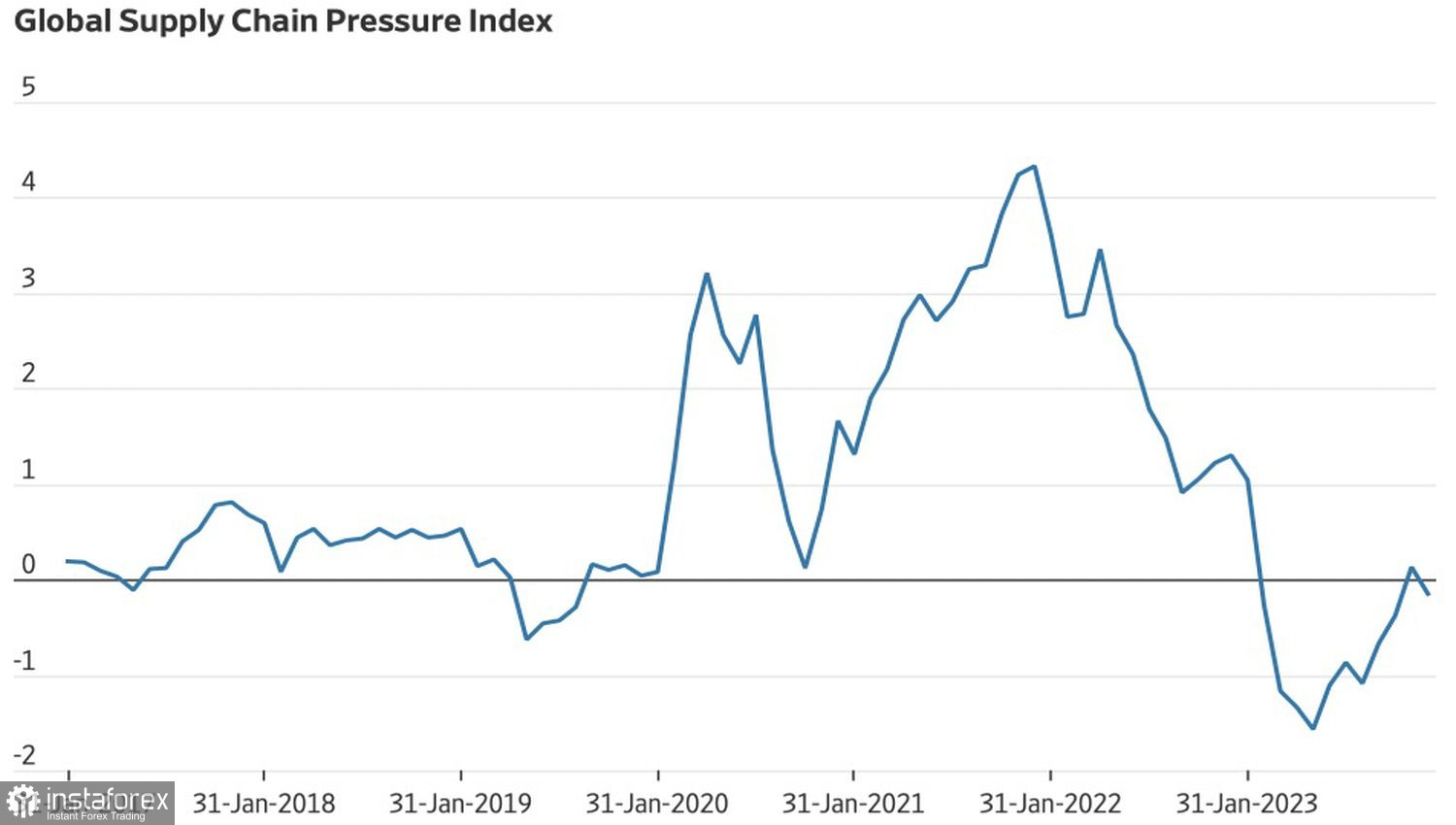

Perhaps the reasons for the Fed's dovish pivot should be sought in the synchronous dynamics of the index of pressure on global supply chains and inflation in the USA. After a sharp rise due to the pandemic and the armed conflict in Ukraine, the first indicator has been steadily declining and returned to pre-pandemic levels. Inflation follows the same trajectory. If so, then the federal funds rate should be gradually lowered to provide the U.S. economy with favorable conditions as before.

Dynamics of the Supply Chain Pressure Index

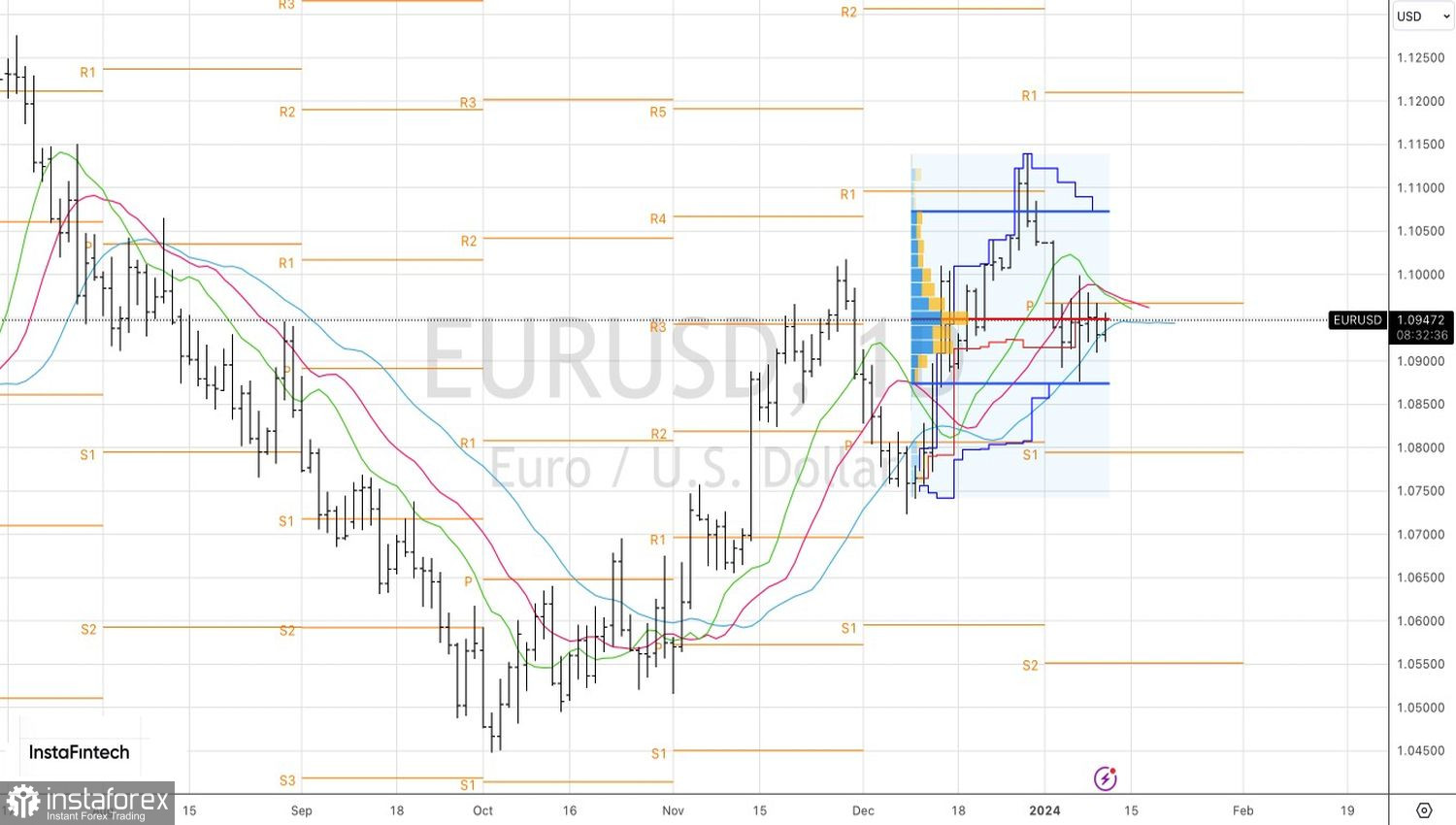

Wherever the truth lies, markets, after the Fed's dovish pivot, wanted more. In its forecasts, the central bank indicated three rate cuts in the federal funds in 2024, but investors saw six. The market clearly got ahead of itself in October-December and is now reversing. Investors are revising their views, allowing the U.S. dollar to mark its best start to the year since 2011. However, it is not a fact that its winning streak will continue.

TD Securities believes that after the tumultuous movements in 2023 on Forex, there will come a medium-term consolidation. The drop in the USD index could have been more serious in the fourth quarter, but investors did not hastily get rid of the U.S. currency. At the beginning of 2024, it corrected its positions. Danske Bank even claims that EUR/USD reached its peak at the end of December and will now decline. The bank advises its clients to sell euros against the U.S. dollar on the rise.

In reality, it is better not to rush anywhere until the release of the U.S. inflation data for December.

Technically, on the daily chart of EUR/USD, the bears' attempt to play an inside bar did not yield results. If the market does not go where it is expected, it is more likely to go in the opposite direction. Isn't this principle a reason for a breakout in the main currency pair at resistance at 1.098?