The US dollar continues to face pressure in the currency market. As I mentioned earlier, the market is convinced the FOMC's next move will be to trim rates in March, ignoring statements from several Federal Reserve members. In the new year, Raphael Bostic, Michelle Bowman, Thomas Barkin, and Lorie Logan have already made relevant statements. Let's discuss Logan's recent statement.

Lorie Logan, President of the Federal Reserve Bank of Dallas, said in a speech that the central bank may need to resume raising its short-term policy rate to keep a recent decline in long-term bond yields from rekindling inflation. In her opinion, easing financial conditions too quickly may push demand. And rising demand will cause prices to increase again, as producers feel that consumers have money and are willing to spend it. Then inflation spiral will start spinning again.

"If we don't maintain sufficiently tight financial conditions, there is a risk that inflation will pick back up," Logan said. She also said that the labor market remains tight, which encourages wage increases, but it "is rebalancing." "Inflation is in a much more comfortable place than a year ago, but the FOMC still has work to do," Logan said.

Based on the above, I can reiterate that a rate cut in March is unlikely, despite market expectations and the CME FedWatch tool. In my opinion, when it comes to the March meeting, the market may experience deep disappointment, leading to a sharp increase in demand for the US dollar. It would have been better if this had happened much earlier because even if the market is right in its expectations, everything currently points to its being wrong.

If the US dollar continues to fall, it will disrupt the current wave pattern, making it even more challenging to navigate the forex market. In March, when the current picture changes beyond recognition, the dollar will start to rise. It will rise when no one expects it, making it very difficult to trade, as the wave structure will be different.

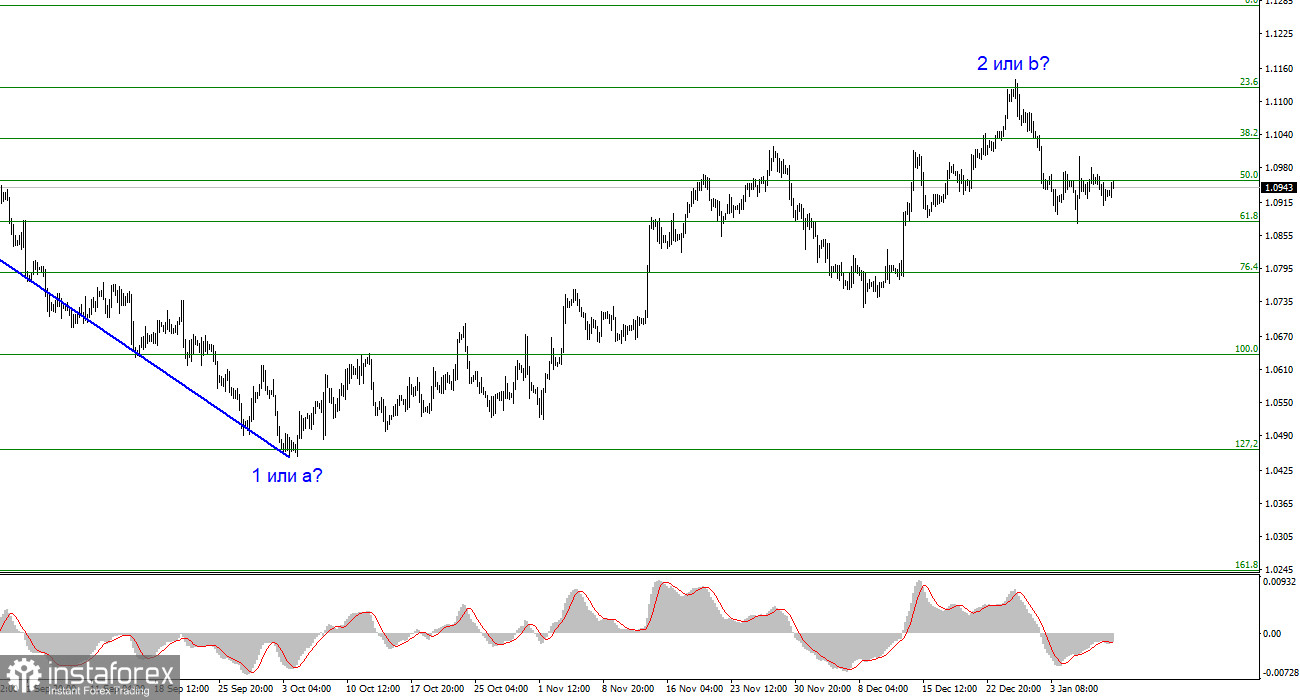

Based on the analysis, I conclude that a bearish wave pattern is being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break the 1.1125 level, which corresponds to 23.6% Fibonacci, suggests that the market is prepared to sell.

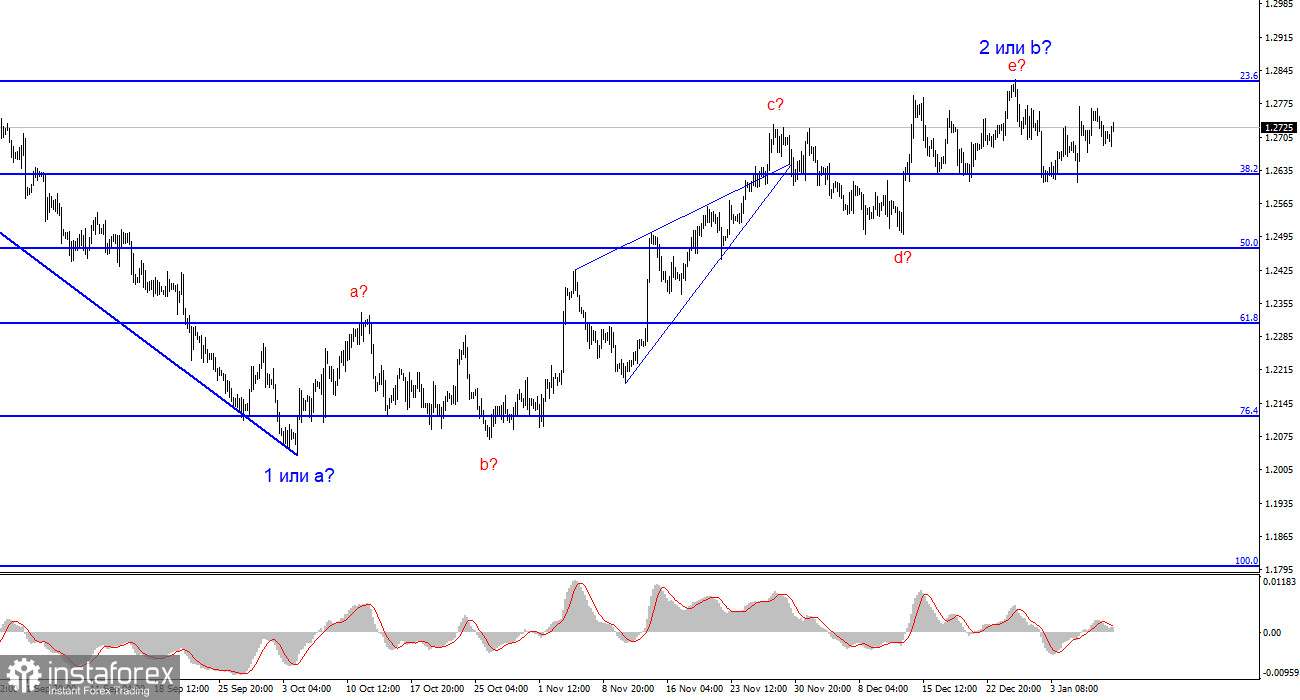

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. In fact, we are already seeing some signs of an imminent end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1,2627 level, afterwards it will be much easier to expect the pair to fall further.