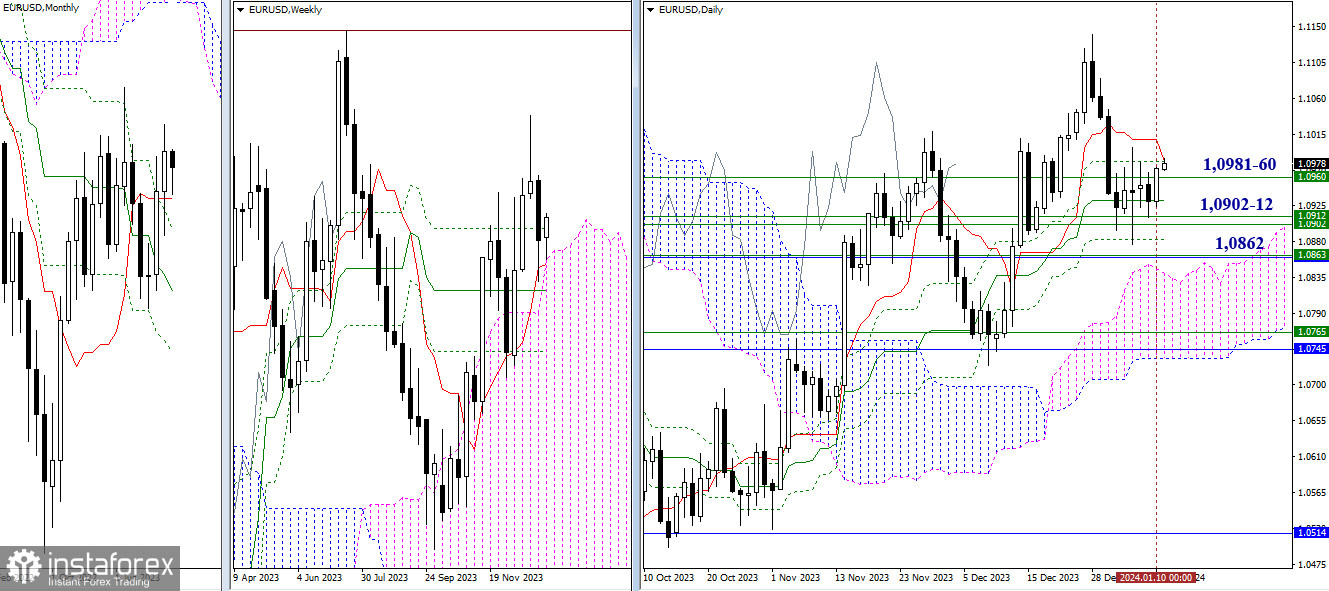

EUR/USD

Higher Timeframes

The consolidation in the area of the accumulation of daily and weekly levels continues. For bulls, it is now important to overcome and break away from the zone of 1.0981 – 1.0960 (weekly Fibonacci Kijun + daily short-term trend), which will open the road to the December high (1.1140). Renewing this will allow the recovery of the upward trend on the higher timeframes. For bears in the current conditions, it is necessary to free themselves from a fairly wide zone that combines both daily (1.0932 – 1.0883) and weekly (1.0912 – 1.0902) levels, as well as the nearby reinforced frontier at 1.0862 (monthly short-term trend + weekly medium-term trend).

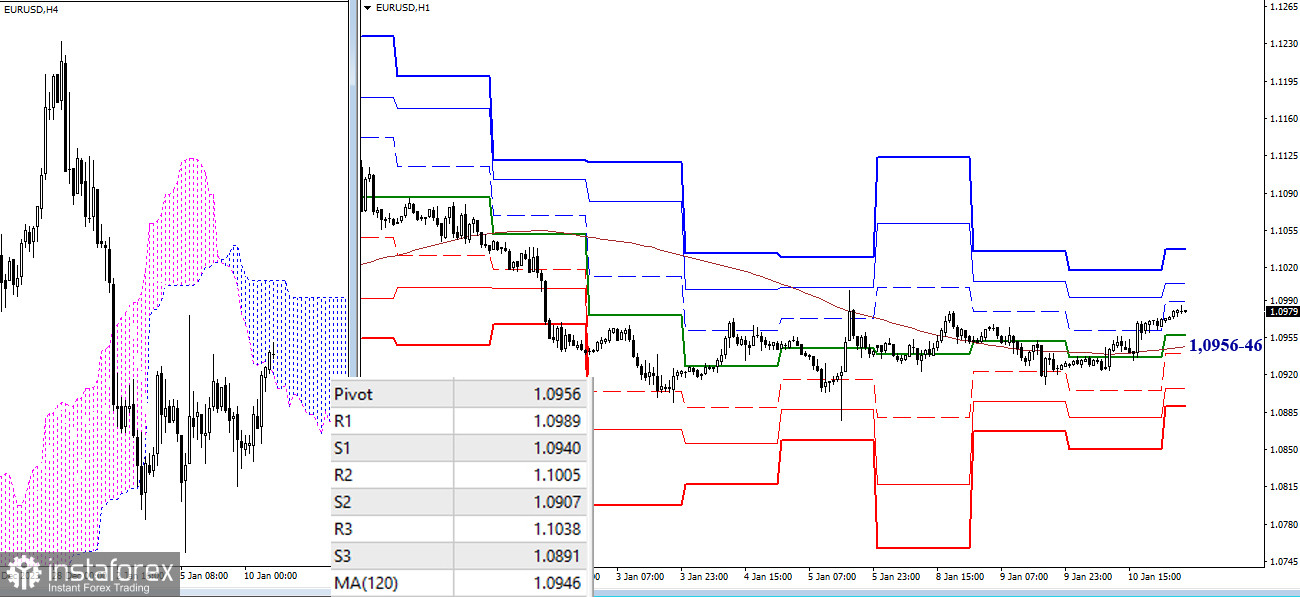

H4 – H1

On the lower timeframes, the advantage has shifted again towards strengthening bullish sentiments. Currently, trades are taking place above the key levels, which today are supports. In case of a correction, they will meet the market in the area of 1.0956-46 (central pivot point + weekly long-term trend). Other additional targets within the day are now located at 1.0989 – 1.1005 – 1.1038 (resistances of classic pivot points) and 1.0940 – 1.0907 – 1.0891 (supports of classic pivot points).

***

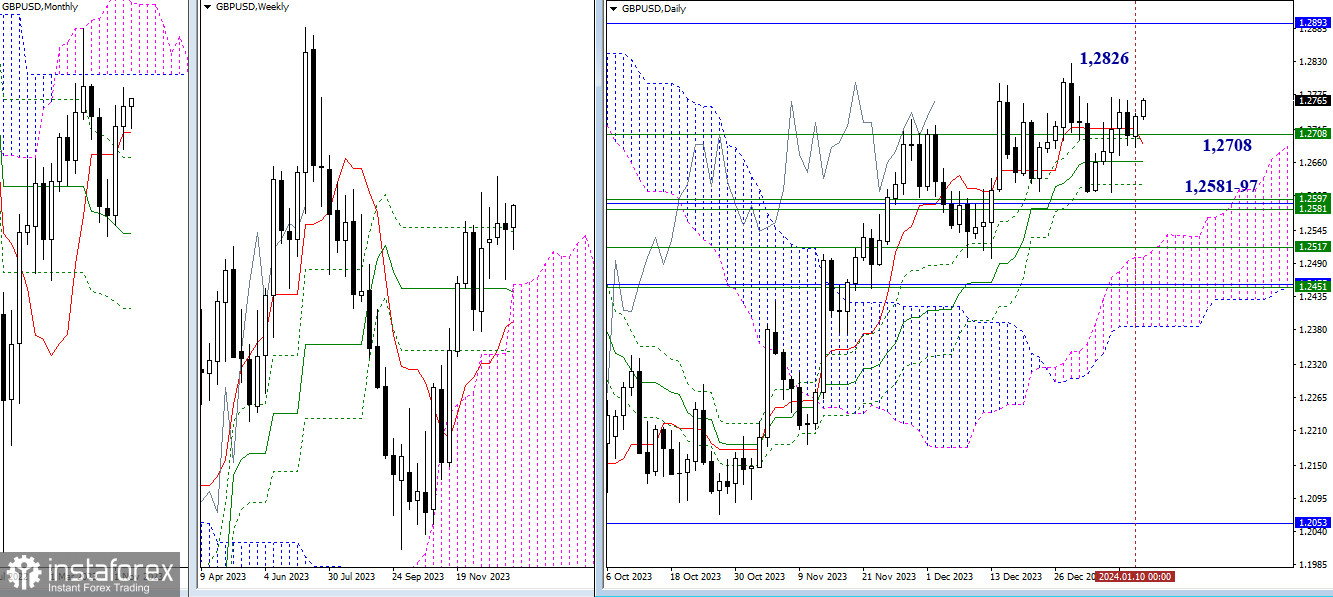

GBP/USD

Higher Timeframes

Uncertainty on the daily chart continues, but bulls do not lose hope that they will be able to leave the attraction zone of daily and weekly levels at the frontier of 1.2708 and restore the upward trend (high of 1.2826). However, if bullish plans do not materialize, bears will seek advantage through the breach of daily levels (1.2662 – 1.2624), reinforced by the accumulation of strong supports in the area of 1.2581-97 (monthly short-term trend + weekly levels).

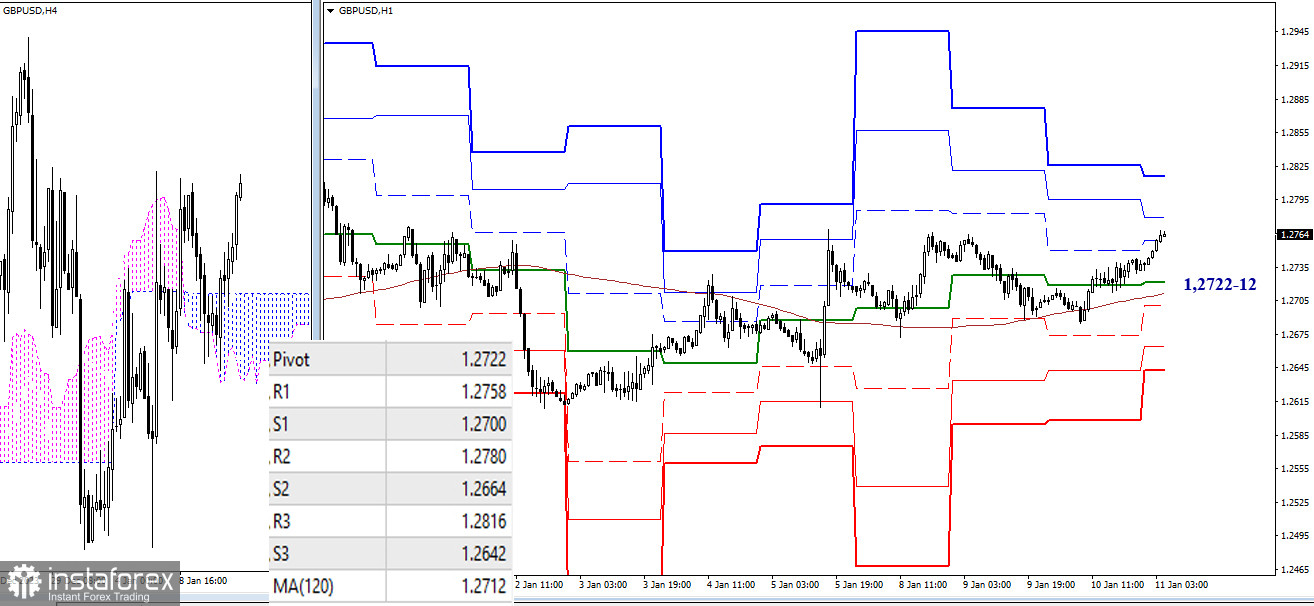

H4 – H1

The weekly long-term trend yesterday again maintained the situation, keeping the advantage on the bulls' side. Today, bulls are trying to develop their advantage. The pair is currently testing R1 (1.2758), followed by encounters with R2 (1.2780) and R3 (1.2816) of the classic pivot points. The current balance of power and preferences can change if bulls manage to overcome the key levels, which today have combined in the area of 1.2722-12 (central pivot point of the day + weekly long-term trend). If breached, supports of the classic pivot points (1.2700 – 1.2664 – 1.2642) may come into play.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)