Investors awaited the December U.S. inflation data like a savior, but it risks being the destruction for stock indices and EUR/USD. Since the start of the year, neither the S&P 500 nor the main currency pair could decide on the direction of their further movement, so guidance from the CPI was supposed to calm the markets. However, the data turned out to be higher than Bloomberg experts' forecasts, triggering a sell-off of the euro.

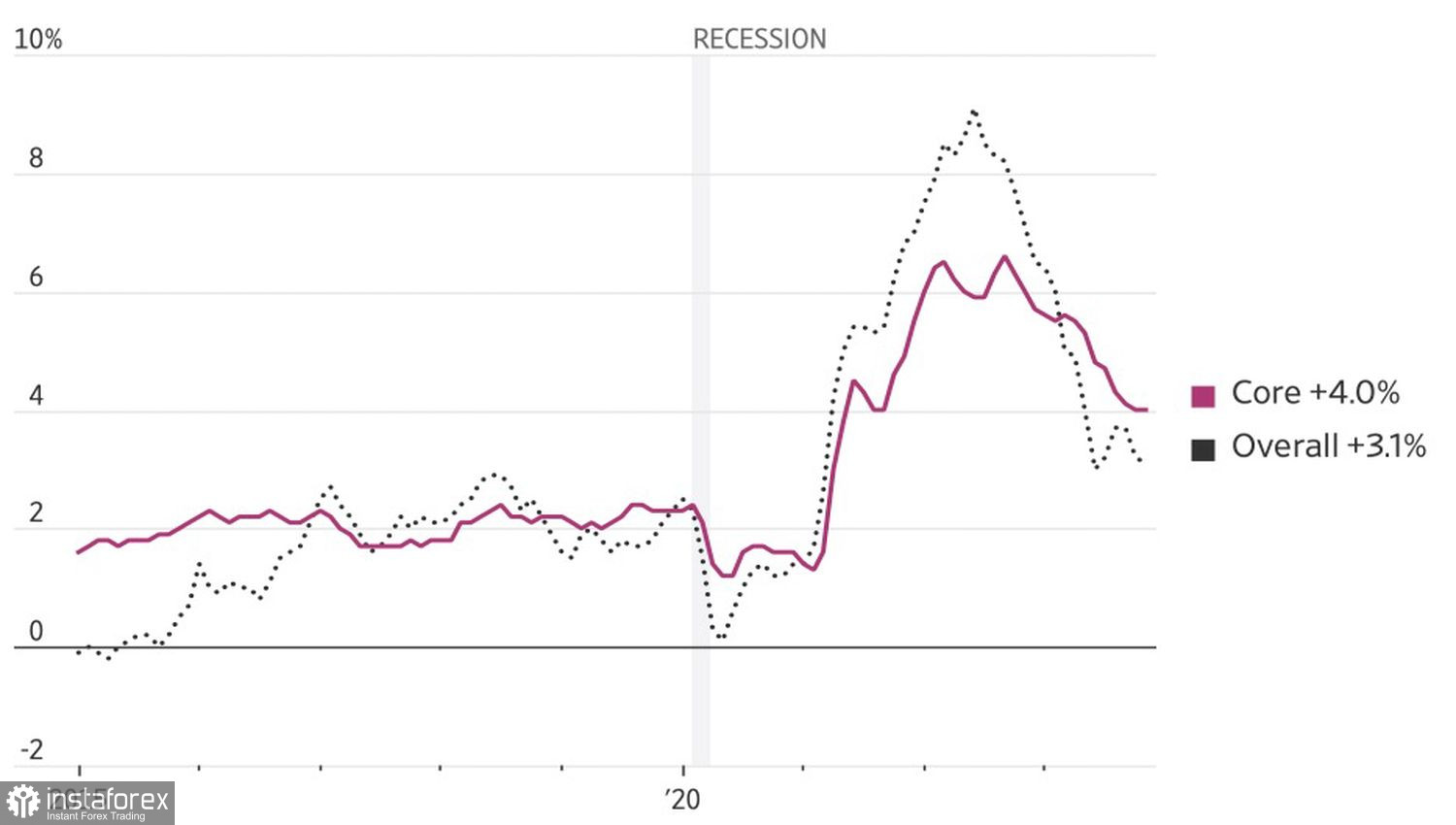

Dynamics of American Inflation

By the end of 2023, it became evident that high inflation in the U.S. was a temporary phenomenon. What the Fed said in 2022 turned out to be true. However, prices kept rising higher and higher, exceeding 9%, which forced the Central Bank to act. Now the decrease in inflation to 3% is perceived as its merit. By raising the federal funds rate from 0.25% to 5.5%, in theory, it cooled domestic demand. In practice, the slowdown in the growth rate of CPI is the result of the restoration of supply chains. Since the inflation was driven by a demand shock, the Federal Reserve was unable to influence it. Therefore, the key question is, what will be the outcome of its most aggressive monetary policy tightening cycle in decades?

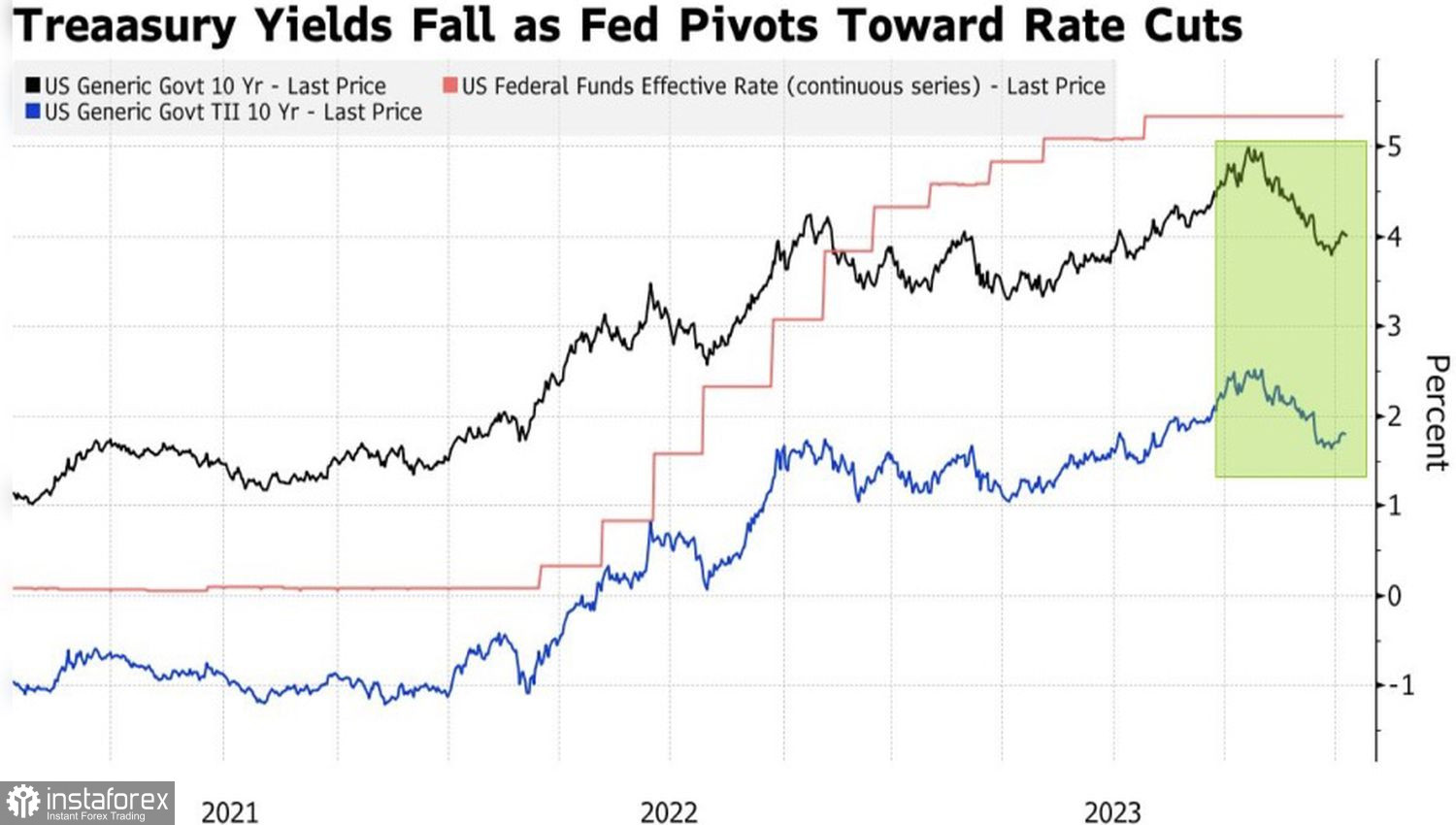

Fed Chairman Jerome Powell and his colleagues were worried in December that this could lead to deflation. If the personal consumption expenditures index on a 6-month basis itself fell below the 2% target, it risks falling even lower due to high rates. As a result, the FOMC forecasts three acts of monetary expansion in 2024, but the market believes there will be six.

Dynamics of Market Expectations for the Federal Reserve Rate

The acceleration of consumer prices from 3.1% to 3.4% annually and to 0.3% monthly in December, as well as the slowdown of core inflation to 3.9% coupled with a strong labor market, suggest that the truth was on the side of the Federal Reserve. The chances of a decrease in the federal funds rate in the futures market for the March FOMC meeting fell from 70% to 62%, and EUR/USD quotes went down. It seems Powell and his colleagues will not rush to ease monetary policy, which is bad for the euro.

In fact, ING turned out to be right. The bank believed that the CPI data release would push market expectations towards FOMC forecasts. Goldman Sachs was confident in the opposite. The Fed would be forced to revise its views in line with market expectations. It seems the main currency pair has determined its direction of further movement. And that direction is downwards. Unless, of course, Greed continues to dominate the U.S. stock market, resulting in purchases of the S&P 500 on the decline of the broad stock index. Then everything will change for the euro.

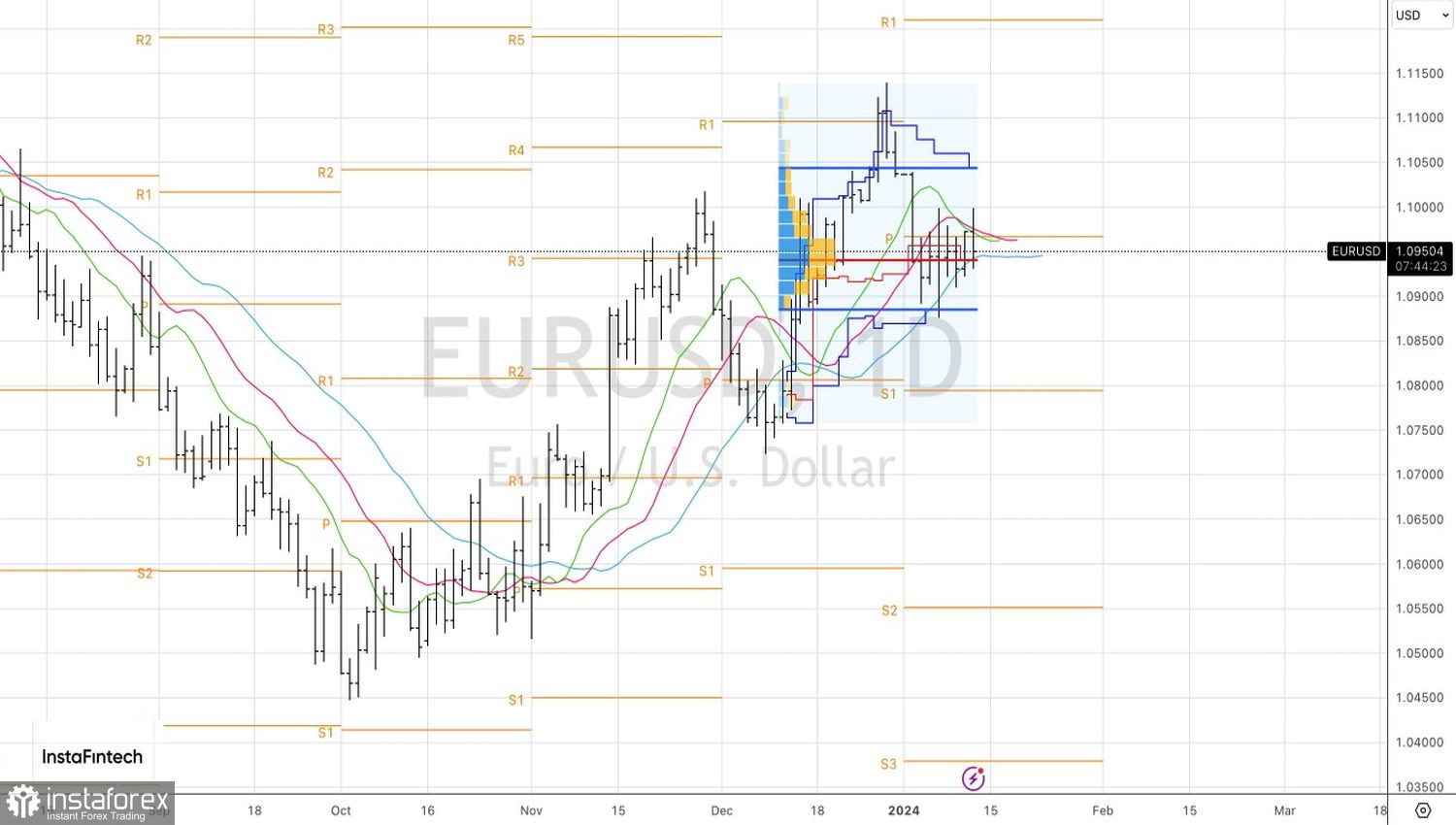

Technically, on the daily chart of EUR/USD, the inability of the "bulls" to storm the psychologically important level of 1.1 is a sign of their weakness. The consolidation of quotes below the fair value of 1.094 will be a reason to sell the euro, at least towards the lower boundary of the trading range of $1.088-1.1. Breaking its limits will increase the risks of the main currency pair's dive to 1.08.