US inflation accelerated in December, and this means that traders will have to reconsider their forecasts regarding the timing of the Federal Reserve's first interest rate cut. These conclusions were drawn last week when the December Nonfarm Payrolls were published. It seems that market participants have admitted their mistake - they rushed to premature conclusions about the pace of the Fed's monetary easing. According to the CME FedWatch Tool, market participants are pricing a 60% chance of a U.S. rate cut in March, whereas at the end of last year, this probability was close to 80%. The results of the December Fed meeting, which unexpectedly turned out to be dovish (perhaps even too much so), triggered a market reaction. Fed Chair Jerome Powell acknowledged that the topic of rate cuts would become a major point of discussion in the upcoming meetings. Traders believed that Powell was being straightforward, which led to a sharp increase in dovish expectations, putting pressure on the greenback.

But at the beginning of 2024, traders started to become more skeptical about the prospects of monetary easing at the March meeting. The turning point was the aforementioned Nonfarm Payrolls data. The U.S. added 216,000 jobs last month—far above economists' estimates of 160,000—with an unemployment rate of 3.7% (against a forecast of 3.8%), while the average hourly earnings rose 0.4% in December after increasing an unrevised 0.4% in November (resulting in an annual wage growth of 4.1%, despite a forecast of a decline to 3.9%).

However, it wasn't just the US labor market report that dampened the bulls' enthusiasm. Some representatives of the Fed also played a role in warning against overly dovish conclusions. For instance, Fed Board member Michelle Bowman said that she is ready to support another rate hike, but the scenario is to maintain the rate at its current level "for some time." According to her, it would be appropriate to lower the rate when inflation approaches 2%.

Dallas Fed President Robert Kaplan also expressed his readiness to "support tightening if necessary." He noted that if the central bank does not maintain sufficiently tight conditions, there is a risk that inflation will start rising again, "undoing the progress made." Richmond Fed President Thomas Barkin voiced similar rhetoric, stating that the potential for additional rate hikes "remains on the table."

In other words, the Fed is saying that traders are pricing in aggressive expectations for rate cuts.

There is another factor in favor of maintaining a moderately hawkish stance by the Fed. The fact is that in 2024, officials with more hawkish views gained the right to vote (according to the rotation procedure) compared to those who lost their voting rights this year. To remind you, Neil Kashkari, Lorie Logan, Patrick Harker, and Astan Goolsbee lost their voting rights. They were replaced by Raphael Bostic (President of the Atlanta Fed), Loretta Mester (Cleveland Fed), Thomas Barkin (Richmond Fed), and Mary Daly (President of the San Francisco Fed). In general, we can conclude that this year's voting members are more hawkish compared to the 2023 members.

This is an important point because Thursday's report will strengthen the arguments of proponents of the moderately hawkish position, which involves keeping interest rates at the current level for (at least) the first half of 2024.

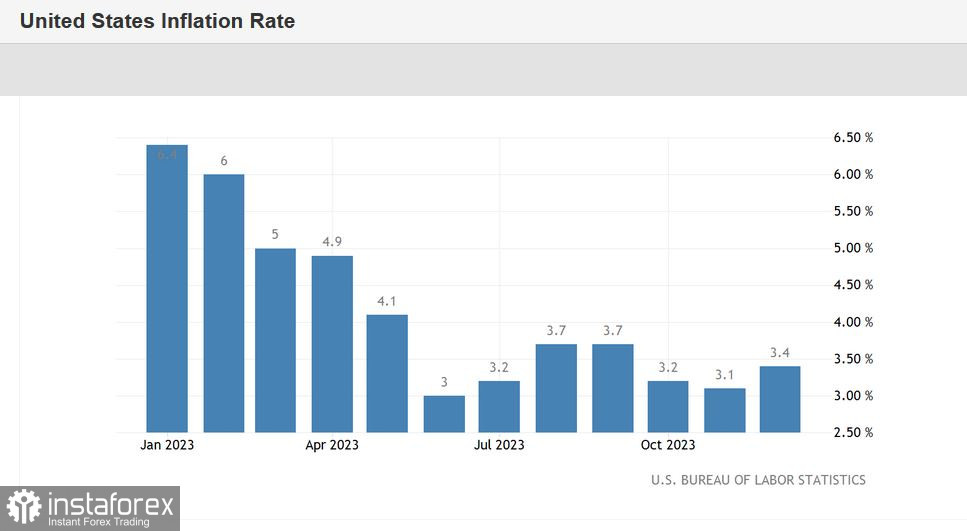

But let's get back to the actual culprit - the latest US inflation report.

The Consumer Price Index increased 0.3% in December on a seasonally adjusted basis, exceeding the forecasted growth of 0.2%. This component of the report has been rising for the second consecutive month. In annual terms, the overall CPI was also in the "green," accelerating to 3.4% (compared to a forecast of 3.2%). This indicator had been declining for two months, reaching 3.1% in November. However, last month, the indicator started to accelerate again. The core CPI, excluding energy and food prices, was also in the "green." In annual terms, the core CPI increased to 3.9%, surpassing the forecast of 3.8%.

The EUR/USD pair fell towards the support level at 1.0930 (the Kijun-sen line on the daily chart) after the report, but the downward momentum waned in this price area. Traders showed a weak reaction to the report, but it doesn't mean that the greenback will ignore this release. The dollar bulls gained an important advantage, which can be used a little later - with the help of Fed representatives, who are likely to tighten their rhetoric.

By the way, immediately after the release, currency strategists at Commerzbank said that the Fed would not lower interest rates in March and would not consider it until at least May (assuming the appropriate conditions prevail). If other Fed members voice similar sentiments, the dollar will strengthen across the board, including against the euro. Given the latest US inflation data, the probability of such a scenario materializing is quite high. However, at the moment, the pair is in a suspended state. It would be better to consider selling only after the bears settle below the 1.0930 support level. The nearest target for a bearish movement is the 1.0850 level - the upper band of the Kumo cloud on the daily chart, coinciding with the lower line of the Bollinger Bands indicator.