EUR/USD

Higher Timeframes

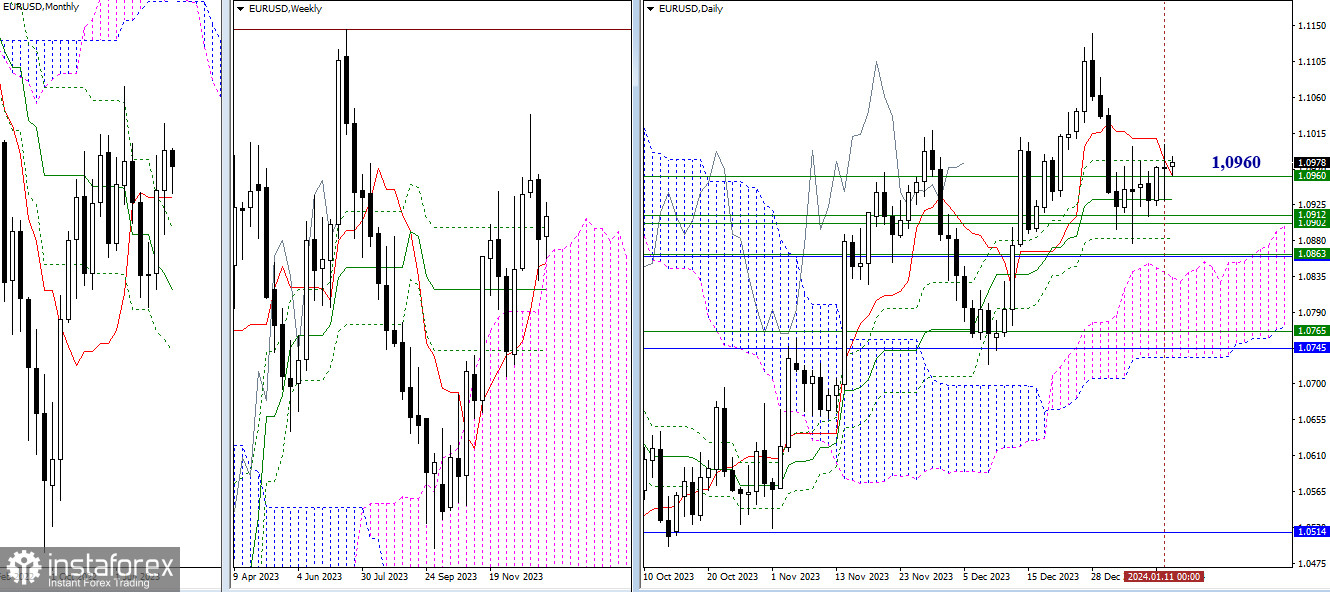

The situation has not undergone significant changes over the past day. Uncertainty persists. The daily (1.0981 - 1.0961 - 1.0932 - 1.0883) and weekly (1.0960 - 1.0912 - 1.0902) levels of the Ichimoku indicator continue to exert attraction and influence, strengthening from the monthly short-term trend and the weekly medium-term trend, currently located just below around 1.0862. These mentioned supports are the nearest and most important bearish reference points in this market segment. For bullish players, new prospects may only emerge after exiting the current correction zone (1.1140 high).

H4 - H1

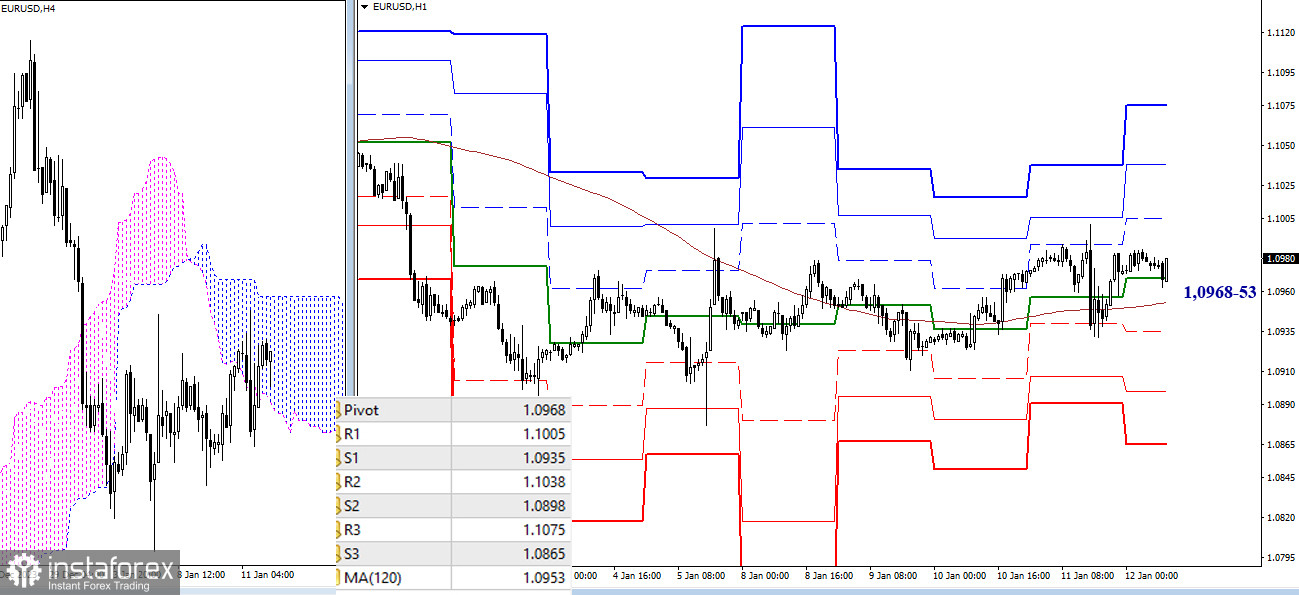

Bulls currently maintain an advantage by trading above key levels on the lower timeframes. These key levels today serve as support, situated around 1.0968-53 (central pivot point + weekly long-term trend). Additional reference points for intraday movement are currently positioned at 1.1005 - 1.1038 - 1.1075 (resistances of classic pivot points) and 1.0935 - 1.0898 - 1.0865 (supports of classic pivot points).

***

GBP/USD

Higher timeframes

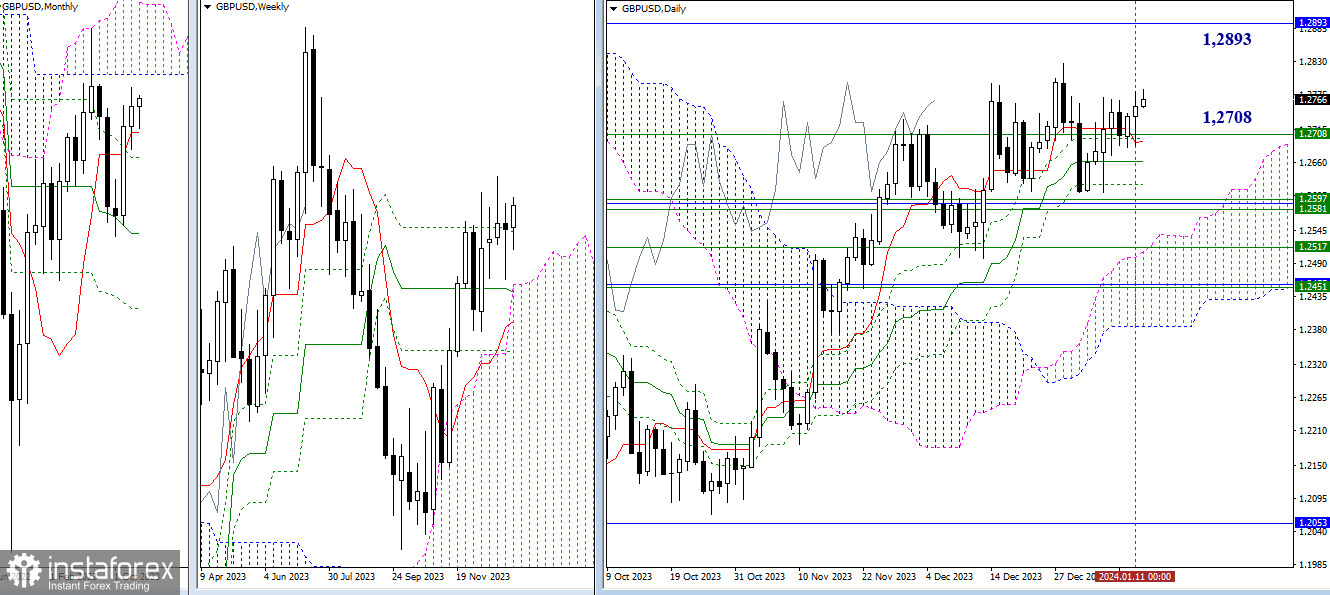

The pound continues consolidation, preserving the conditions for a recovery of the upward trend (1.2826). The next bullish target will be the lower boundary of the monthly cloud (1.2893). The recent accumulation of levels around 1.2708 has served as an attraction and support zone in recent days. If new bearish activity occurs, breaking the daily levels (1.2662 - 1.2624) will lead the pair to interact with the important and reinforced zone of 1.2581 - 1.2597, where several significant and strong levels of the Ichimoku indicator converge.

H4 - H1

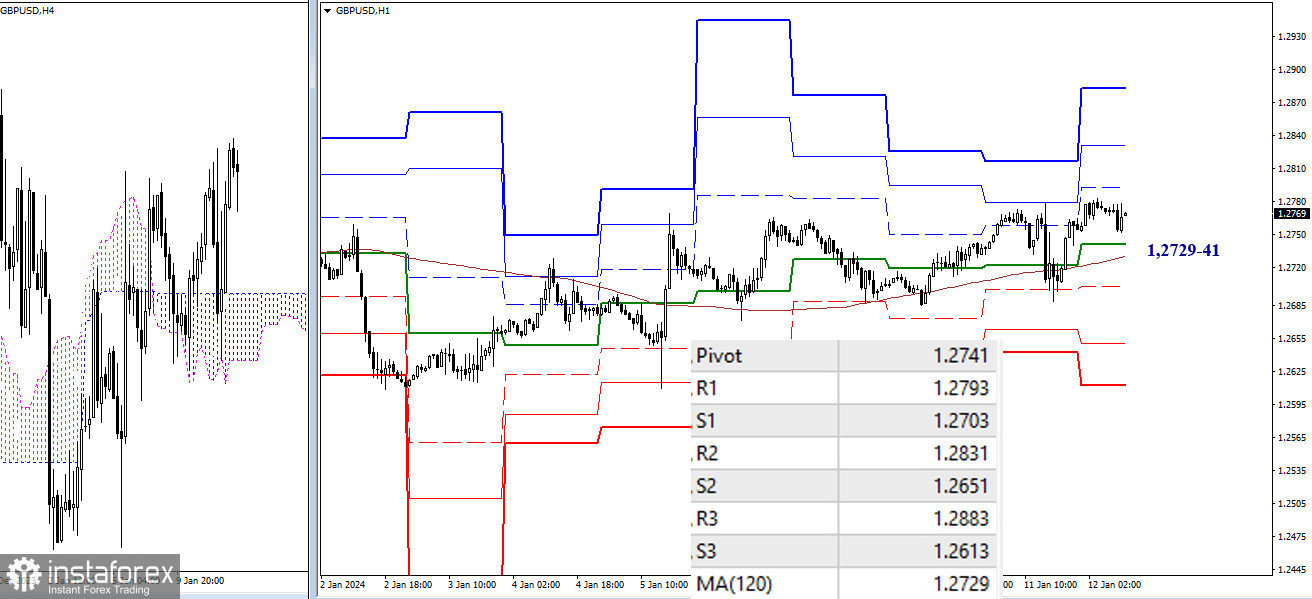

On the lower timeframes, the advantage remains on the side of bullish players. Continuing the upward movement will allow intraday testing of the resistances of classic pivot points (1.2793 - 1.2831 - 1.2883). If bearish players become active, the main advantage on the lower timeframes can only be gained after breaking through the key levels of 1.2729-41 (weekly long-term trend + central pivot point). Further decline will occur through the supports of classic pivot points (1.2703 - 1.2651 - 1.2613).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)