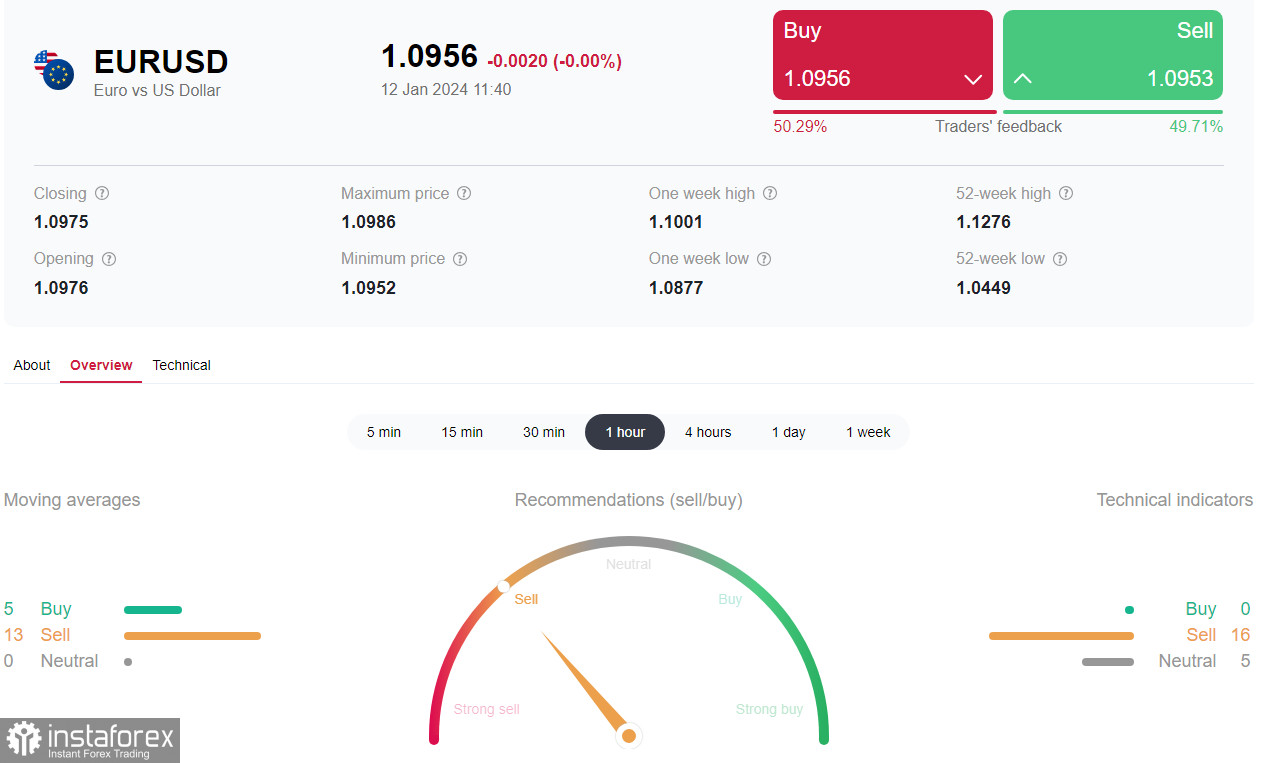

Market participants' attention has shifted to the release (at 13:30 GMT) of data on U.S. Producer Price Index (PPI) inflation. The PPI is expected to rise from 0.0% to +0.1% in December and from +0.9% to +1.3% on an annual basis.

Clearly, dollar buyers need additional evidence and reasons to support the resumption of long positions. Today's publication of the PPIs may serve as a driver for market participants to have stronger belief in the possibility of the Federal Reserve's interest rate staying at current levels for a longer period.

In this case, the decline in EUR/USD may resume with renewed force.

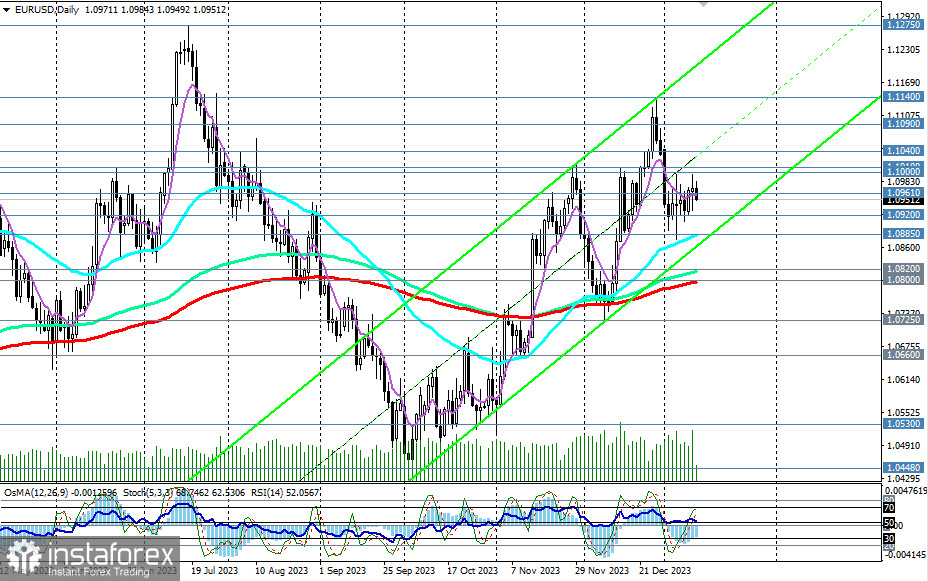

After breaking through the important support level of 1.0920 (200 EMA on the 4-hour chart), the nearest target for a decline in this scenario could be the significant support level at 1.0885 (50 EMA on the daily chart). In the event of its breakdown and further decline, EUR/USD may head towards key medium-term support levels at 1.0820 (144 EMA on the daily chart) and 1.0800 (200 EMA on the daily chart).

Their breakdown, in turn, will lead EUR/USD into the zone of the medium-term bearish market and return it to the long-term downward trend, making long-term short positions preferable.

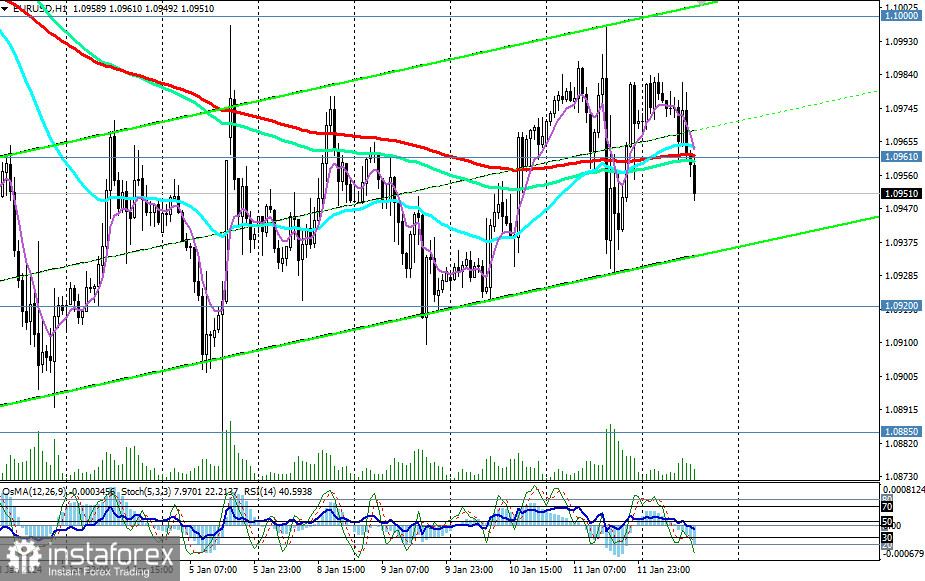

It is worth noting that the first signal for implementing this scenario has already occurred: the price broke through the important short-term support level at 1.0961 (200 EMA on the 1-hour chart).

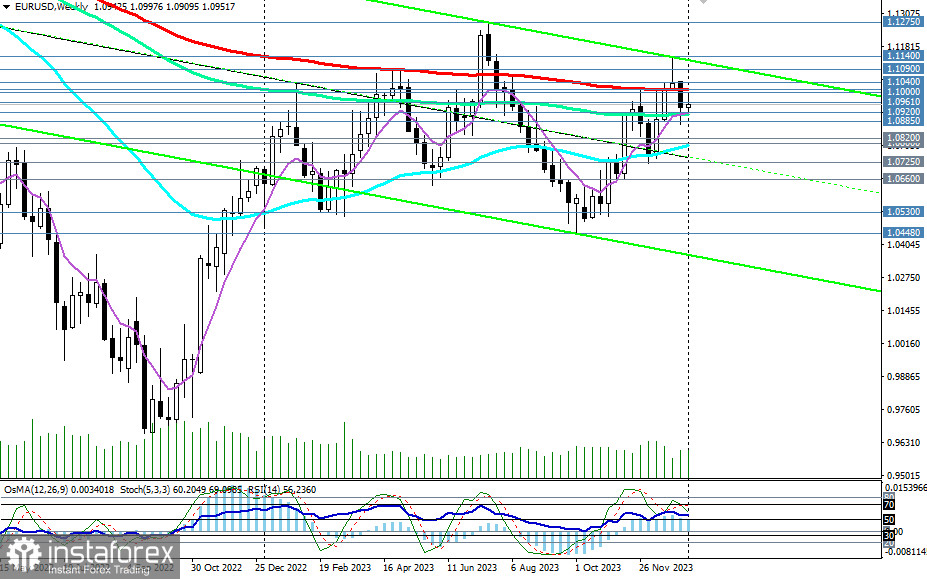

On the other hand, a return of the price above this level may become the beginning of implementing an alternative scenario: a breakout of resistance levels at 1.1000, 1.1010 (200 EMA on the weekly chart), 1.1040 (50 EMA on the monthly chart) will lead EUR/USD into the zone of the long-term bullish market and direct the pair towards the upper boundary of the upward channel on the daily chart and the levels of 1.1100, 1.1140.

In any case, above the resistance levels of 1.1010, 1.1040, long positions will be prioritized.

Support levels: 1.0920, 1.0900, 1.0885, 1.0820, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0961, 1.1000, 1.1010, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530

Trading Scenarios

Main Scenario: Sell at the market. Sell Stop at 1.0910. Stop-Loss at 1.0980. Targets at 1.0900, 1.0885, 1.0820, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Alternative Scenario: Buy Stop at 1.0980. Stop-Loss at 1.0910. Targets at 1.1000, 1.1010, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but they can serve as a reference when planning and placing your trading positions.