Donald Trump's unequivocal victory in Iowa has brought back fears of a rematch between him and Joe Biden, in which, judging by political ratings, the current U.S. President will lose. If so, a huge cloud of uncertainty will descend on the global economy, which will support the U.S. dollar as a safe-haven asset. How to prevent EUR/USD from falling?

While investors were discussing whether the German economy is too weak for the euro to compete with its main rival and whether the expectations of 150 basis points cut in the federal funds rate in 2024 are too high, the Trump factor came into the market. The eccentric Republican has shaken up the entire investment world during his years in power. The slogan "America First," threats to leave NATO, and protectionist policies supported the U.S. dollar. Just consider the trade war with China in 2017–2018, when risks of slowing down the global economy drowned the euro as a pro-cyclical currency even without aggressive rate hikes by the Fed.

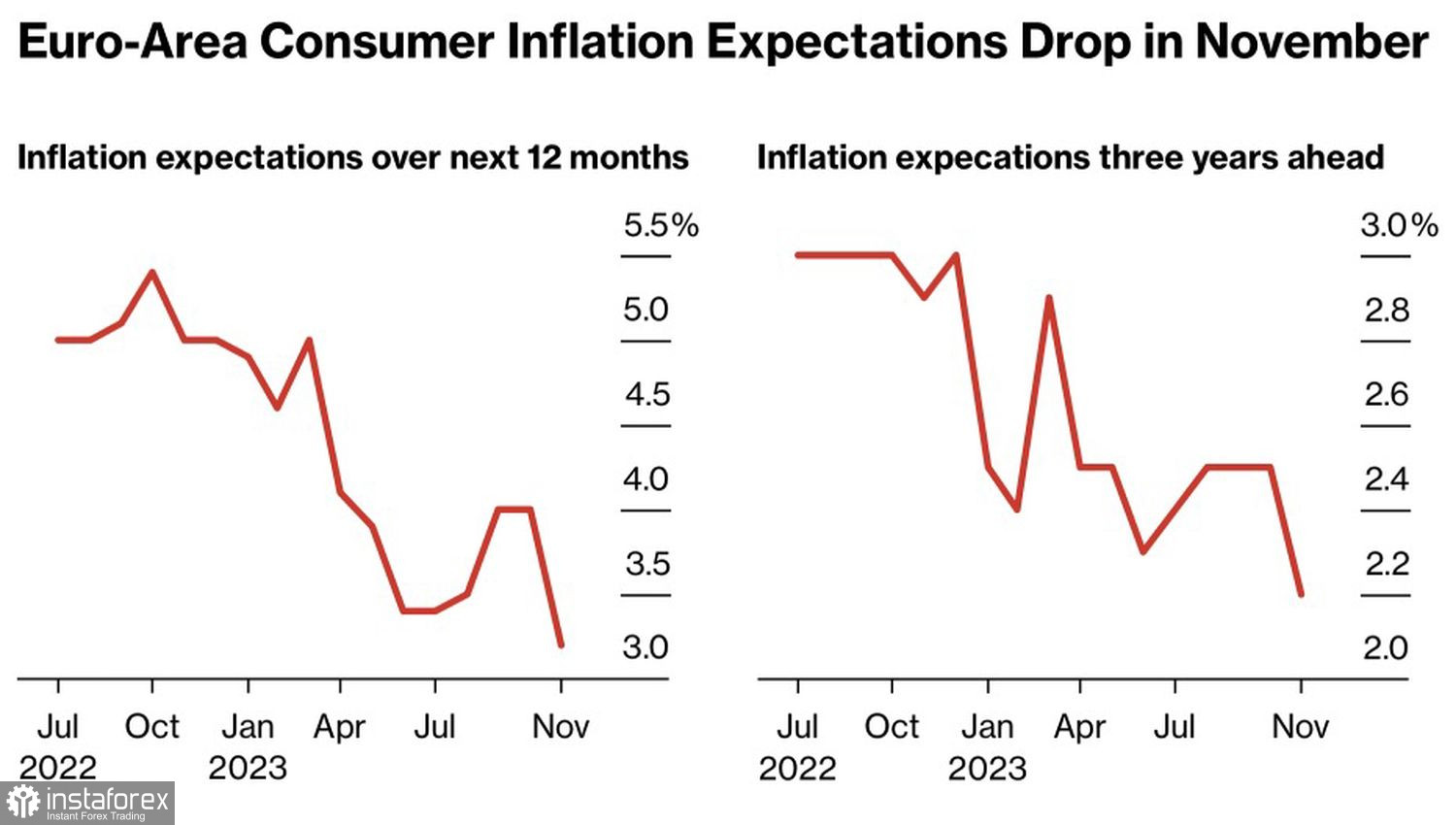

Meanwhile, the fall in inflation expectations in the eurozone for the next year from 4% to 3.2% and for three years from 2.5% to 2.2% added fuel to the fire in the EUR/USD dip. If inflation and related consumer expectations continue to drop so rapidly, the ECB will have no choice. It will be forced to lower the deposit rate. For now, officials of the Governing Council insist that such decisions will depend on the data and, at best, nod towards the second half of the year. In the worst case, they remain silent. Like the head of the Bank of France, Francois Villeroy de Galhau, who stated that the next step would likely be a rate cut, but he cannot say when exactly.

European Inflation Expectations Dynamics

According to the consensus forecast of Bloomberg experts, the European Central Bank will lower the cost of borrowing by 100 basis points in 2024. The process of easing monetary policy will begin in June. Thus, neither the euro nor the dollar should gain an advantage, as experts' assessments of the federal funds rate are as similar as twin brothers.

Conversely, Bank of America believes that the ECB will cut rates only three times, while the Federal Reserve will do so four times. However, the different pace of monetary expansion allows the bank to recommend selling the U.S. dollar on the rise. It seems that now there is a good opportunity to buy in the EUR/USD pair, if you believe in the forecasts of Bank of America.

In reality, forecasts are a thankless task. The court may not allow Donald Trump to participate in the presidential race, and an unexpectedly weak employment report may force the Fed to lower the federal funds rate already in March.

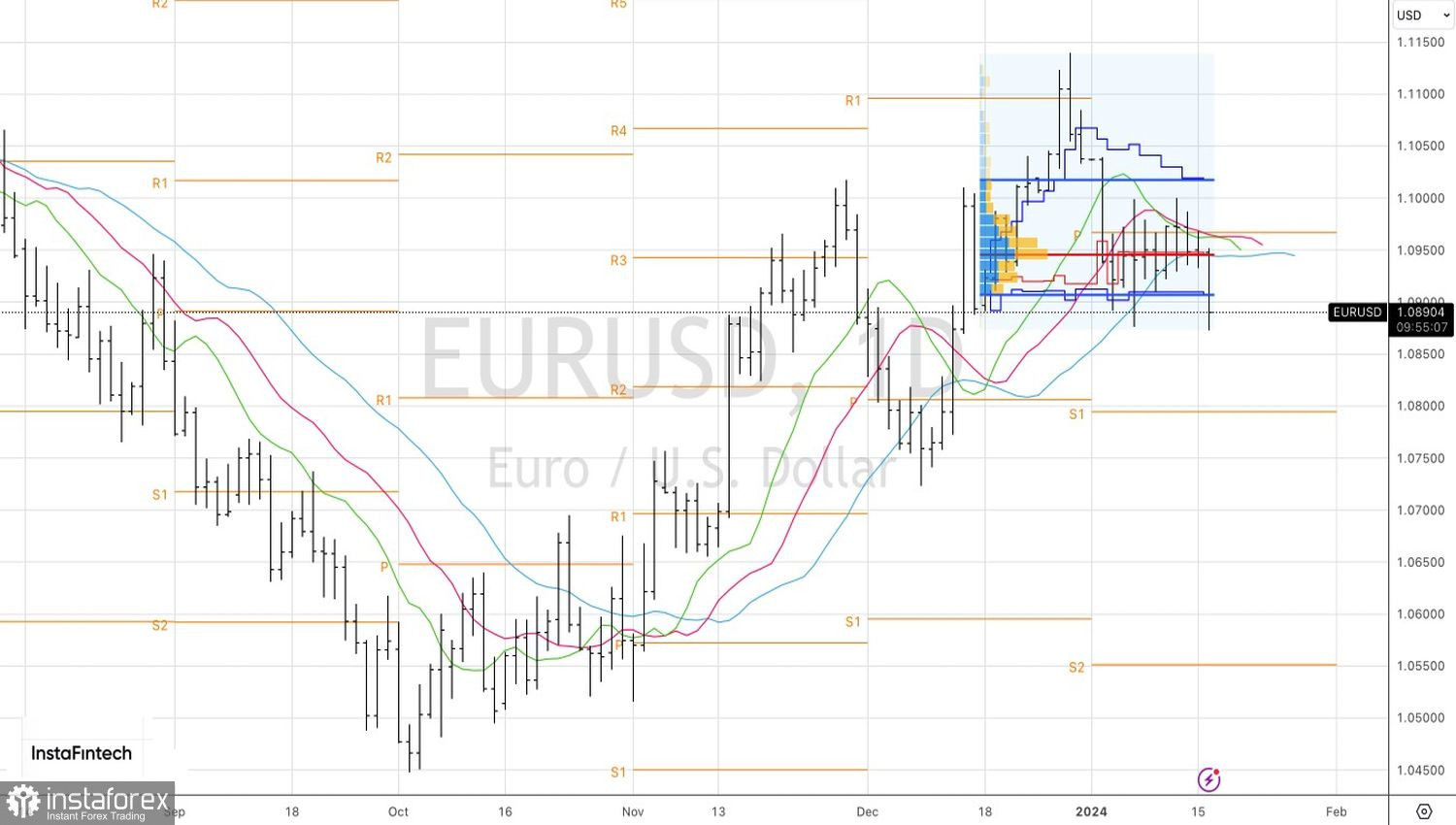

Technically, on the daily chart, EUR/USD has exited the lower boundary of the fair value range 1.0905-1.1020, formed within the pattern of Spike and Ledge. Opening from the level of 1.094, it makes sense to increase shorts, provided that the bears manage to keep the pair below 1.088.