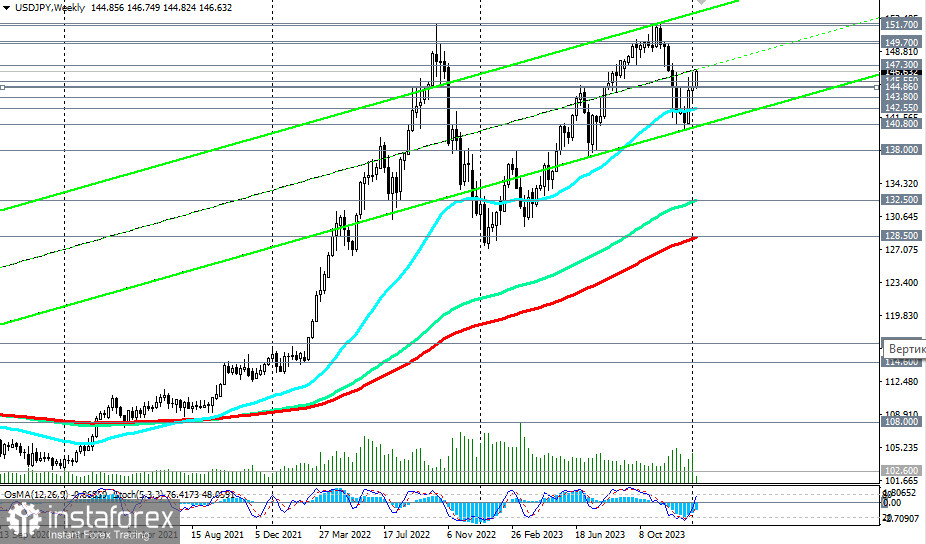

After breaking through the key resistance level of 143.80 (200 EMA on the daily chart) at the beginning of the month, USD/JPY has returned to the medium-term bull market zone, while remaining in the long-term bull market—above the key support level of 128.50 (200 EMA on the daily chart).

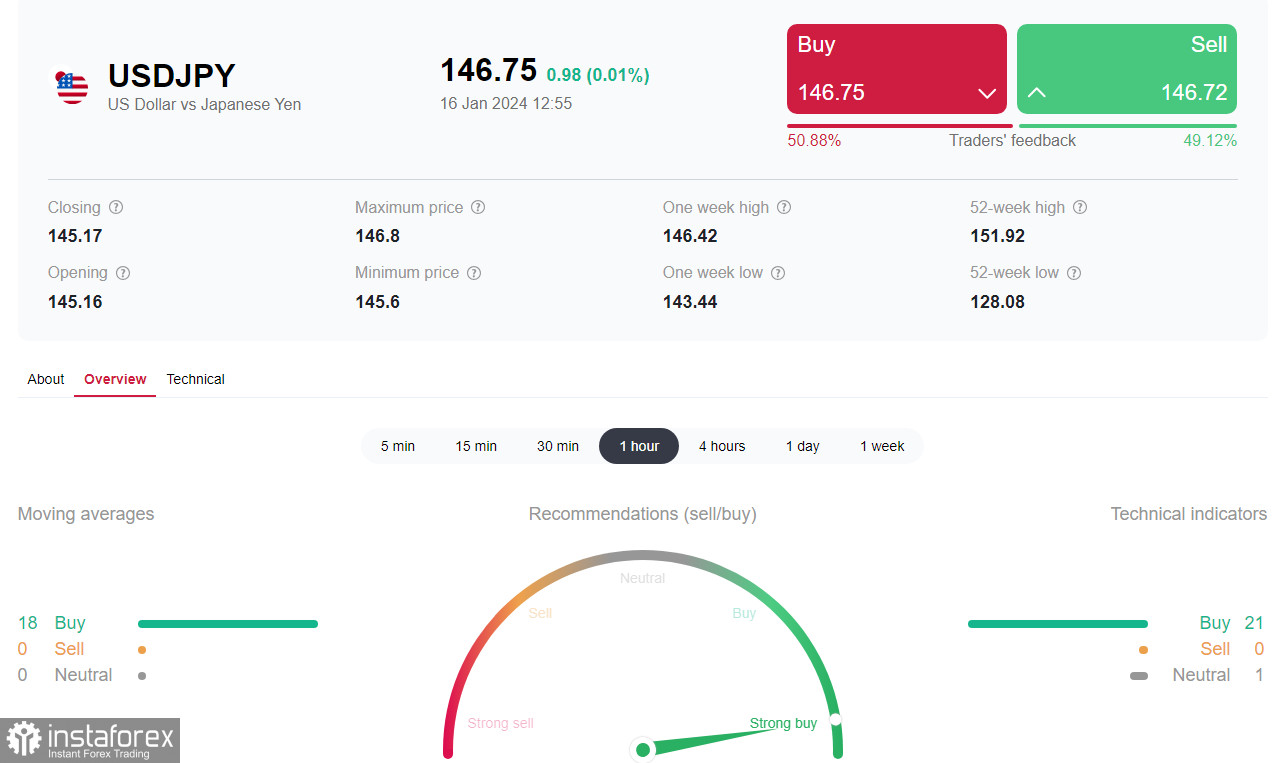

The yen is also weakening against the euro and the pound, while the safe-haven dollar is outperforming its immediate 'competitors'—gold, the franc, and the yen.

In any case, above the important support level of 145.55 (50 EMA on the daily chart), preference should be given only to long positions. The nearest growth target is at the local resistance level of 147.30. Its breakout will be an additional signal to increase long positions with targets at least at the psychologically significant mark of 150.00.

In an alternative scenario, breaking below the support level of 145.55 will be, on the contrary, the first signal for opening short positions, and the breakdown of important support levels 145.00 (144 EMA on the daily chart), 144.86 (200 EMA on the 1-hour chart) will be the confirmation.

The breakdown of the key support level of 143.80 (200 EMA on the daily chart) will return USD/JPY to the medium-term bear market zone, also reviving interest in short positions on the pair.

The breakdown of the local support level of 140.88 and the lower boundary of the upward channel on the weekly chart will strengthen the negative dynamics of USD/JPY.

Support levels: 146.00, 145.55, 145.00, 144.86, 144.00, 143.80, 143.00, 142.55, 142.00, 141.00, 140.80, 140.00, 139.00, 138.00

Resistance levels: 147.00, 147.30, 148.00, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Trading Scenarios

Main Scenario

Aggressively: Buy at market. Stop Loss 146.20

Moderately: Buy Stop 147.40. Stop Loss 146.20

Targets: 148.00, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Alternative Scenario

Aggressively: Sell Stop 146.20. Stop Loss 146.80

Moderately: Sell Stop 145.40. Stop Loss 146.80

Targets: 145.00, 144.86, 144.00, 143.80, 143.00, 142.55, 142.00, 141.00, 140.80, 140.00, 139.00, 138.00

'Targets' correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but they can serve as a reference when planning and placing your trading positions.