Analysis of Macroeconomic Reports

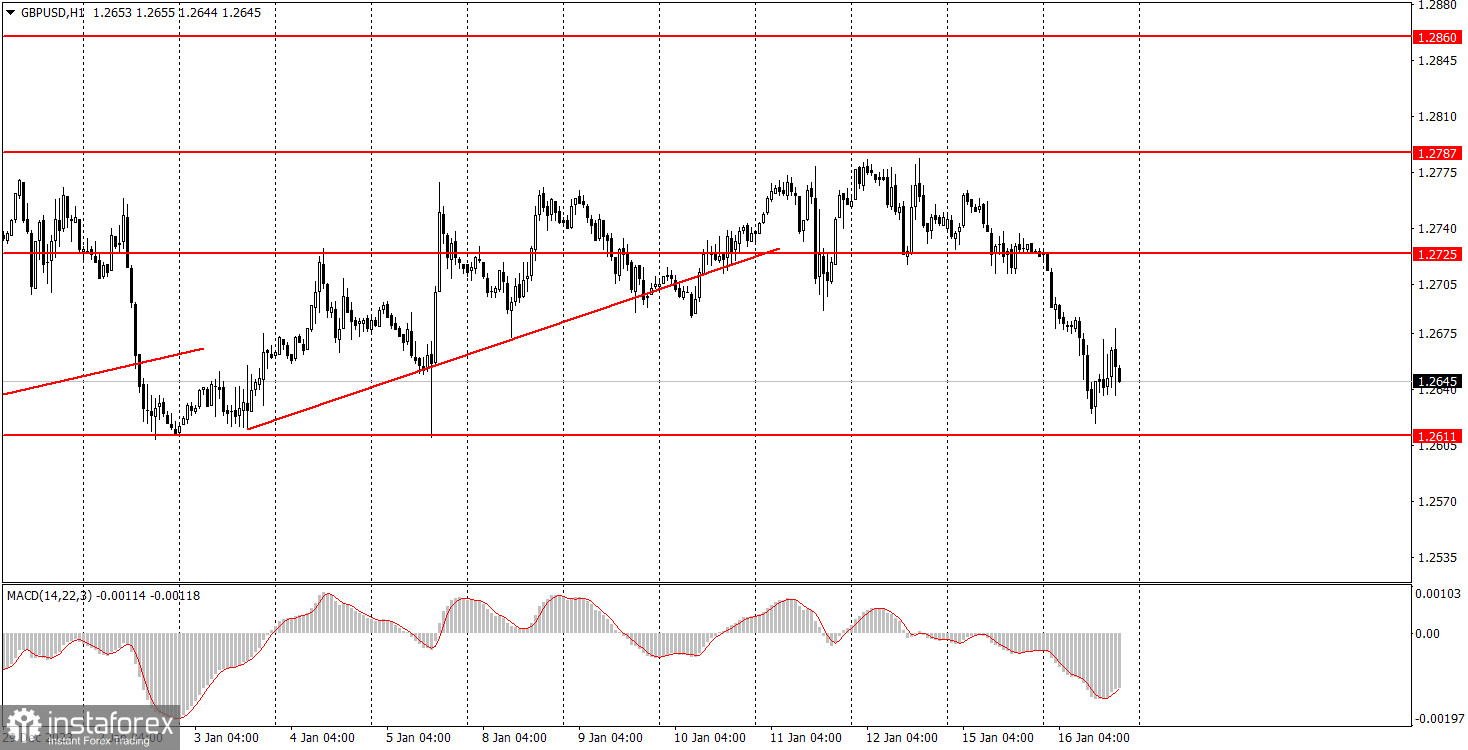

There will be quite a few macroeconomic events on Wednesday. In the UK, the first to be published will be the inflation report for December. Note that inflation in Britain is published in a single, final assessment, so the market's reaction could be quite strong. The higher the inflation relative to the forecast, the greater the chances for a new rise of the pound from the lower boundary of the sideways channel at 1.2611.

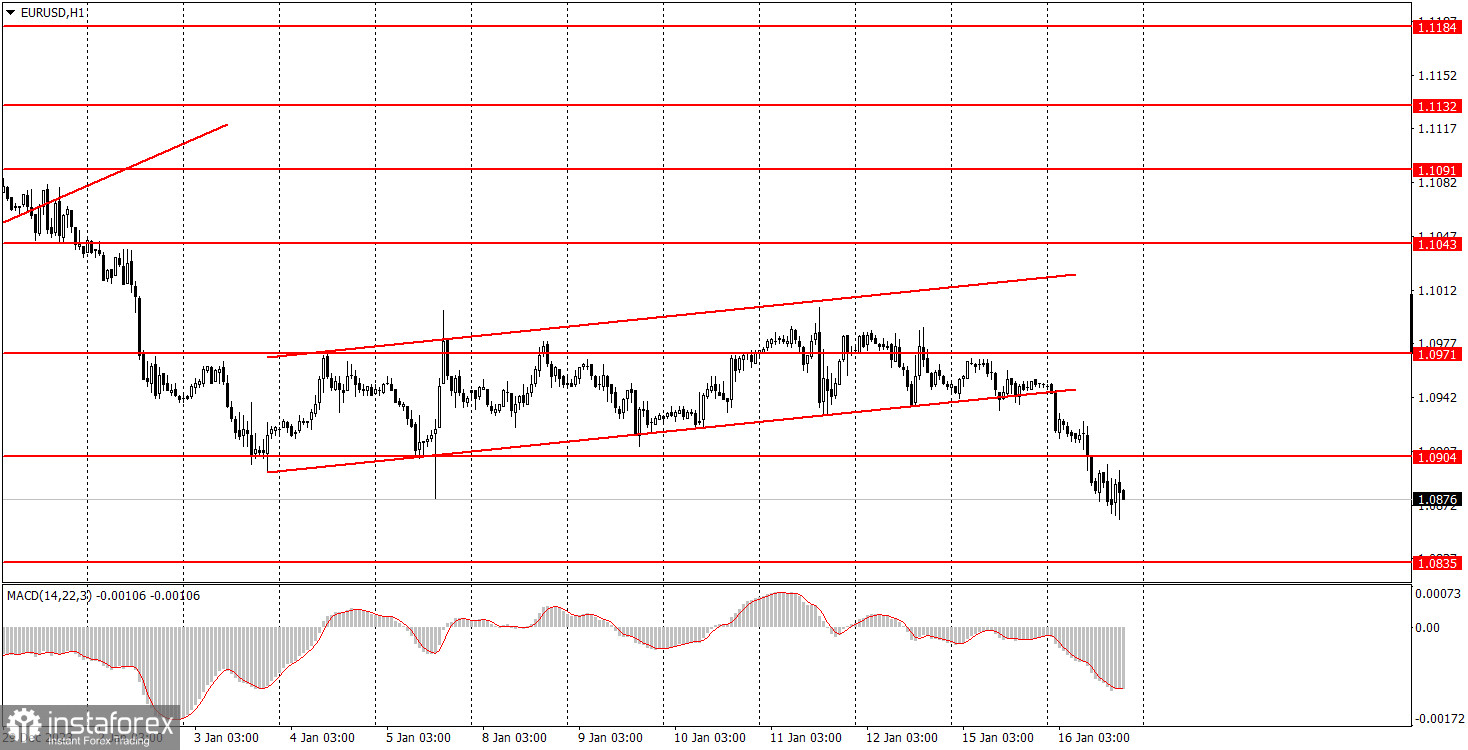

Inflation data in the European Union will also be published but in the second assessment. Therefore, this report is of much less significance in the eyes of traders. The same can be said about the industrial production and retail sales report in the United States. They, of course, may provoke a local market reaction, but it's unlikely to be strong and prolonged.

Analysis of Fundamental Events

There will also be plenty of fundamental events on Thursday. In the European Union, speeches are expected from French central bank Governor Francois Villeroy de Galhau and European Central Bank President Christine Lagarde. In the U.S., Federal Reserve Governor Michelle Bowman and New York Fed President John Williams are to give a speech. Additionally, the Federal Reserve's economic report, the 'Beige Book,' will be published.

In our view, interesting statements can only be expected from Lagarde. De Galhau had already spoken last week, and it is very difficult to expect significant statements from the representatives of the Fed at the moment. Nevertheless, it is the Fed that the market has the most questions for right now. If the FOMC members respond to them, then the market may also react to these speeches.

General Conclusion

On Wednesday, the key event of the day will be the British inflation report. However, there will be so many events and reports that all together they may provoke not only strong movements, but also frequent price reversals. For the pound, it is important to remember the level of 1.2611. Its breakout or failure to break through will determine its further fate. For the euro, the important level is 1.0904, but it has already been surpassed, so the path downwards is open.

Basic rules of a trading system:

- Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

- If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

- In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

- Trading activities are confined between the onset of the European session and mid-way through the U.S. session, after which all open trades should be manually closed.

- On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

- If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Important speeches and reports (always noted in the news calendar) can significantly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.