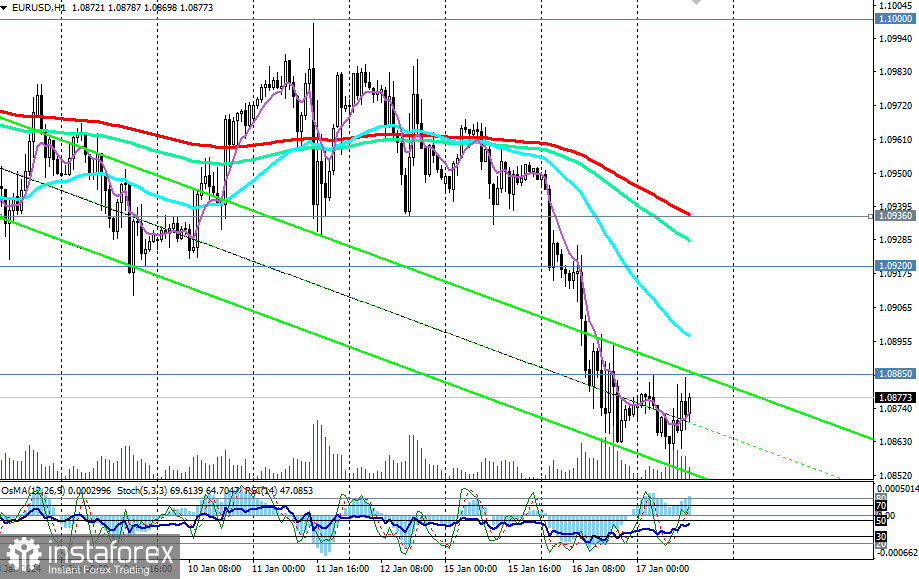

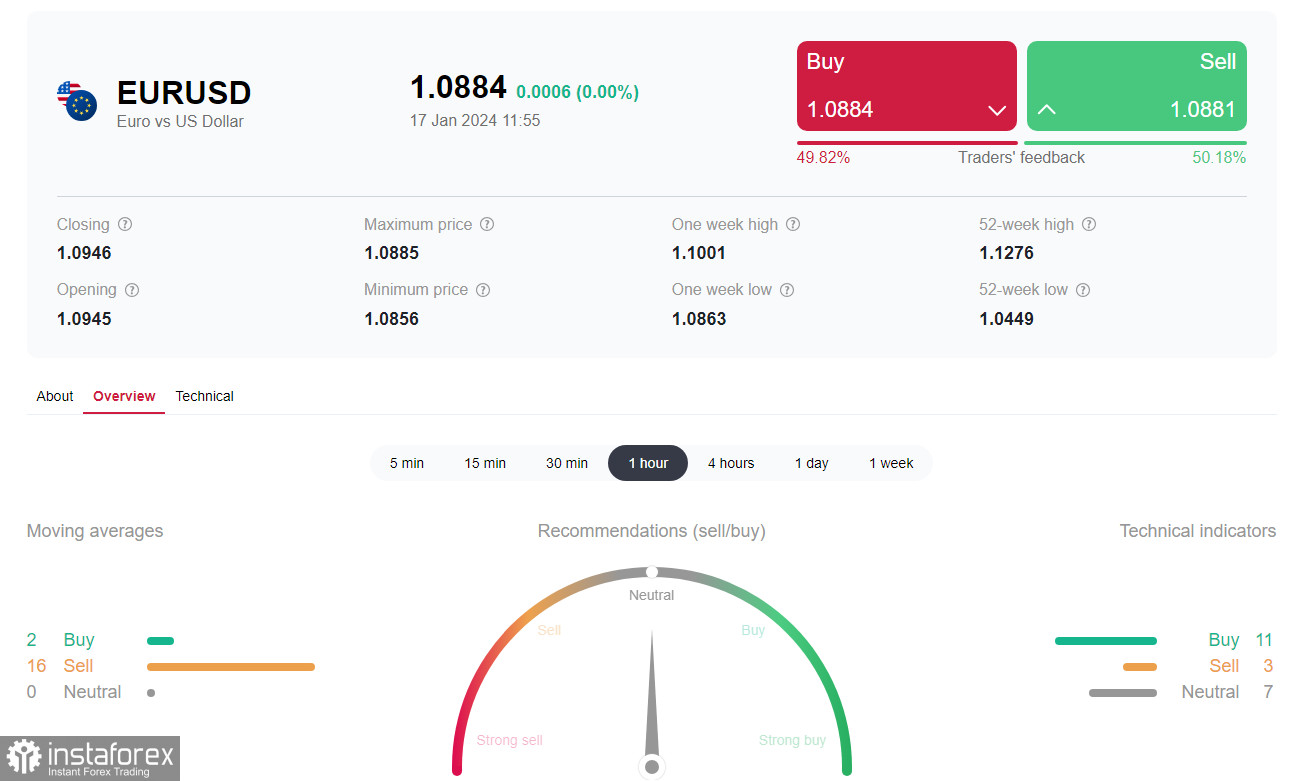

At the beginning of the week, after breaking an important short-term support level of 200 EMA on the 1-hour chart, which was at that time at the level of 1.0962, EUR/USD continued to decline, testing the crucial medium-term support level of 1.0885 (50 EMA on the daily chart).

Today, there are several important events on the economic calendar related to EUR/USD.

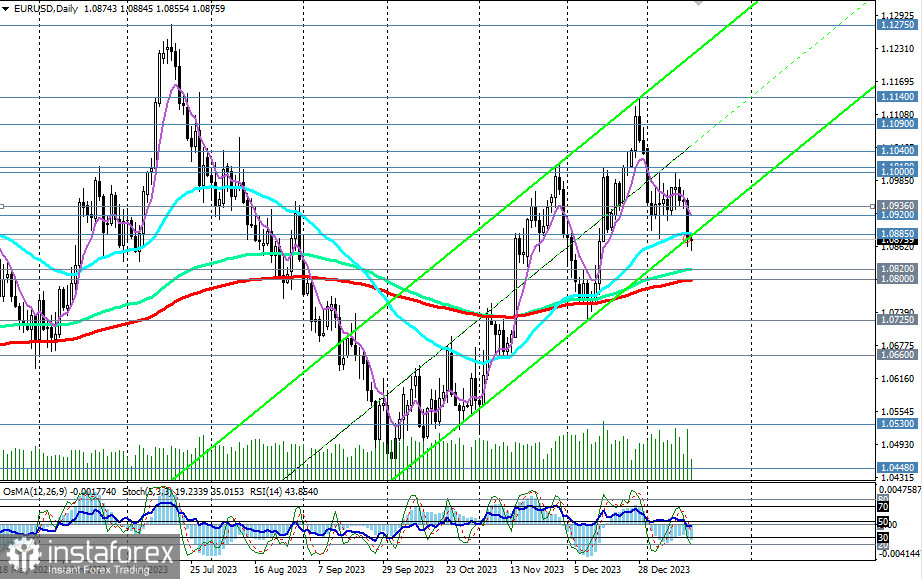

If they turn out to be unfavorable for the euro, then after breaking through today's intraday low of 1.0855, further decline of the pair towards key medium-term support levels at 1.0820 (144 EMA on the daily chart) and 1.0800 (200 EMA on the daily chart) should be expected.

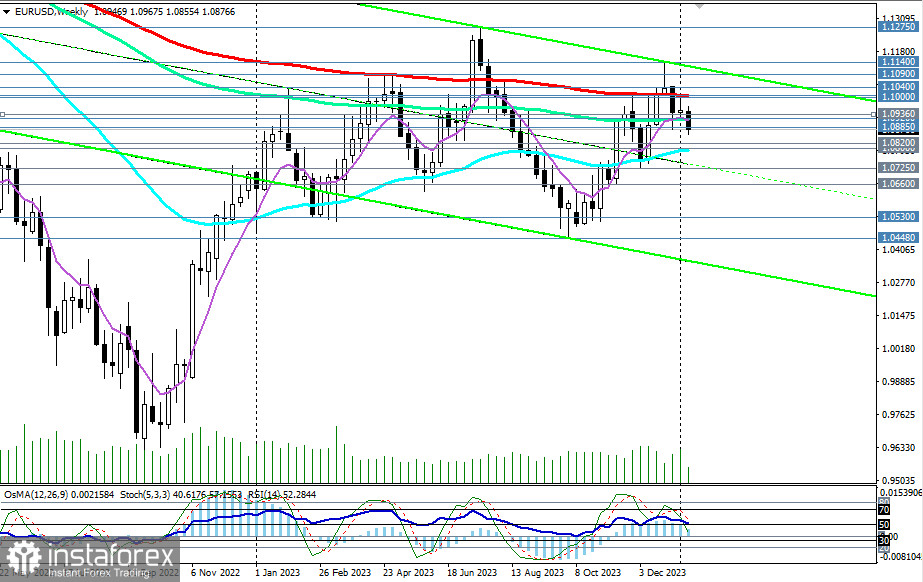

Breaking these levels and continuing to decline will bring EUR/USD into the zone of a medium-term bear market, reinforcing the downward dynamics within the long-term bear market.

The targets for decline in case this scenario materializes are local support levels 1.0530, 1.0450, and then the marks of 1.0400, 1.0300, near which the lower boundary of the downward channel on the weekly chart passes.

In an alternative scenario, the price will break through the 1.0900 mark and resume an upward correction. The signal for purchases will be the consecutive breakout of two important short-term resistance levels at 1.0920 (200 EMA on the 4-hour chart) and 1.0936 (200 EMA on the 1-hour chart), with targets being the resistance levels 1.1000, 1.1010 (200 EMA on the weekly chart).

Breaking the resistance level of 1.1040 (50 EMA on the monthly chart) will bring EUR/USD into the zone of a long-term bull market, making long-term long positions preferable with targets at the global resistance level 1.1630 (200 EMA on the monthly chart).

But for now, short positions remain preferable below the marks of 1.0900 and 1.0885.

Support levels: 1.0855, 1.0820, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0885, 1.0900, 1.0920, 1.0936, 1.0962, 1.1000, 1.1010, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

Trading Scenarios

Main scenario: Sell Stop 1.0855. Stop-Loss 1.0910. Targets 1.0820, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Alternative scenario: Buy Stop 1.0910. Stop-Loss 1.0855. Targets 1.0920, 1.0936, 1.0962, 1.1000, 1.1010, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a reference when planning and placing your trading positions.