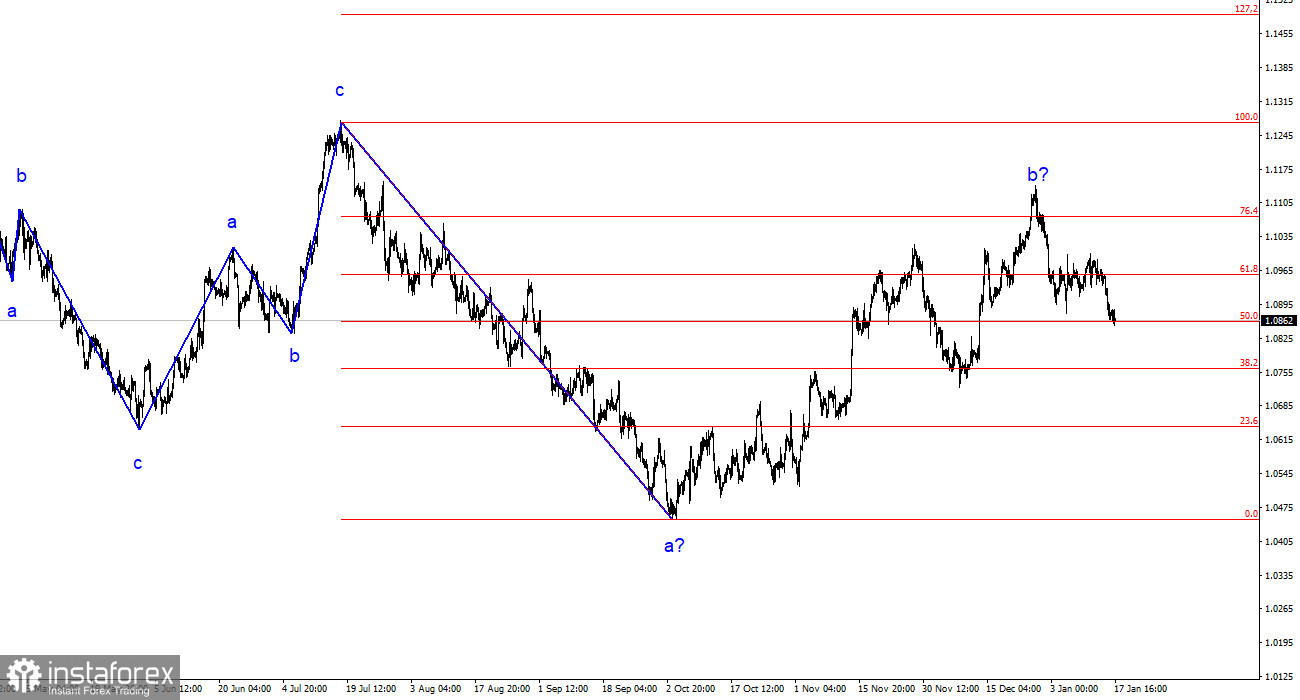

The wave structure on the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have seen only three wave structures that constantly alternate with each other. The construction of another three-wave structure continues, and it's bearish in nature. The presumed wave 1 has been completed, but wave 2 or b has become more complex three or four times, and there are no guarantees that it won't become even more complex.

Although the news background cannot be considered "supportive of the European currency," the market keeps finding new reasons to increase demand for the pair. This situation is not normal. Even if the upward trend resumes, its internal structure will become unreadable.

The internal wave structure of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave 3 or c is currently being constructed, and the entire wave 2 or b is presumably completed. The current pullback from the achieved highs looks convincing.

The market has realized the futility of the European currency.

The euro/dollar pair experienced a mere ten basis point decrease on Wednesday, but it lost 75 points earlier. Yesterday, it became known that inflation in Germany accelerated to 3.7%, and today, in the European Union, it reached 2.9%. These reports could support demand for the euro once again. However, the market has finally remembered the corrective nature of the upward wave and that it has been dragging on for too long in its construction. Therefore, the market has shifted towards constructing a bearish impulsive wave, potentially resulting in a significant decline of the European currency in the coming weeks and months.

Today, aside from the inflation report in the EU, there were a few interesting events. The retail sales report was released in the United States, showing a 0.6% increase in December, surpassing market expectations. A report on industrial production will be released later. Still, the recent rise in demand for the dollar yesterday and today is unlikely to be related to these reports. It was known two weeks ago that inflation in the European Union and separately in Germany would accelerate by the end of December when the initial estimates were released. The retail sales report is undoubtedly important, but it has no direct relation to the dollar's recent uptrend.

The market has begun to temper its exaggerated expectations regarding the FOMC's interest rate cut in March and throughout 2024. Also, this week, it became known that the ECB may cut rates 4-5 times in the current year. Therefore, we are talking about a nearly equal reduction in the ECB and the Fed's rates, with the Fed's rate remaining 1% higher.

General Conclusions.

Based on the analysis conducted, I conclude that the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so I expect the continuation of building an impulsive downward wave 3 or c with a significant decline in the pair soon. The unsuccessful attempt to break the 1.1125 mark, corresponding to 23.6% according to Fibonacci, indicated the market's readiness for sales.

On a larger wave scale, it is evident that the construction of the corrective wave 2 or b continues, which, in terms of length, is already more than 61.8% from the first wave, according to Fibonacci. As I have already mentioned, this is not critical, and the scenario of building wave 3 or c with a decline in the pair below the 4-figure level is still valid.