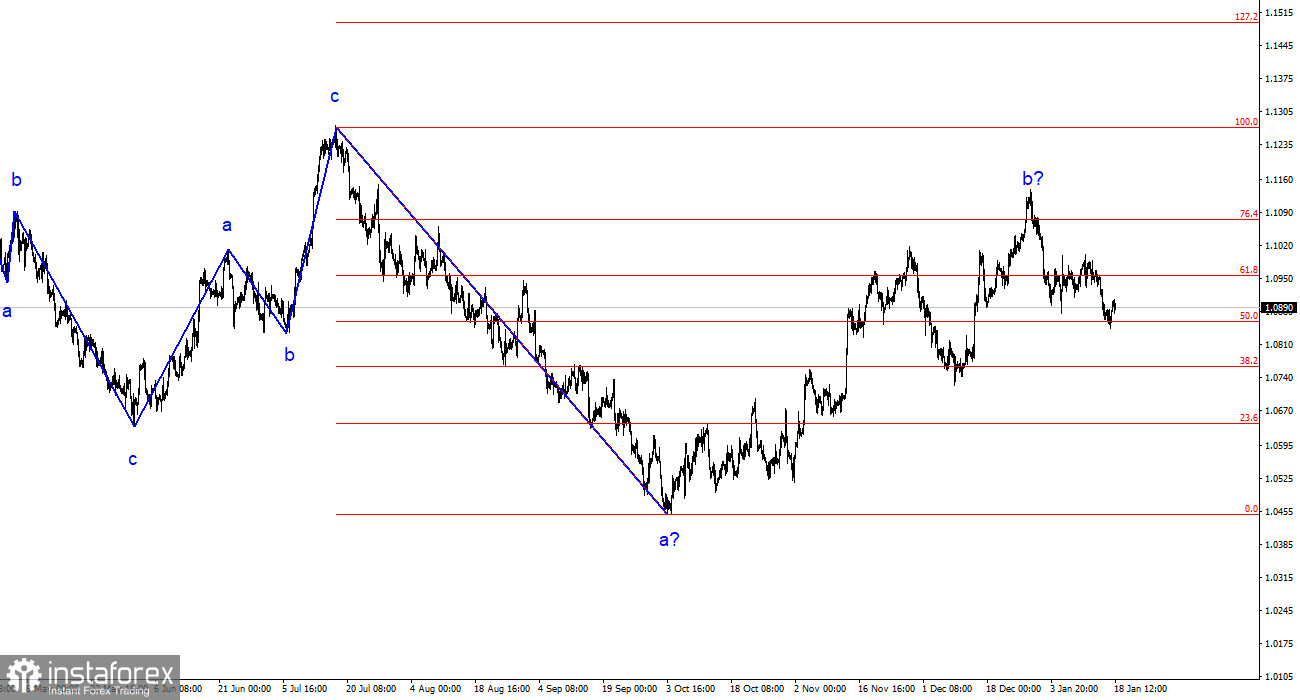

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have seen only three-wave structures that constantly alternate with each other. The construction of another three-wave structure, a downward one, is ongoing. The presumed wave 1 is complete, but wave 2 or b has complicated three or four times, and there are no guarantees that it won't complicate further.

Although the news background cannot be considered "supportive of the European currency," the market always finds new reasons to increase demand for the pair. Such a situation is not normal. Even if the upward part of the trend is resumed, its internal structure will become completely unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave 3 or c is currently being formed, and the entire wave 2 or b is presumably complete. The current retreat of quotes from the achieved highs looks convincing.

The market will continue to reduce demand for the euro cautiously.

The euro/dollar pair rate increased by just five basis points on Thursday (when writing the review). However, what is more interesting is the indicator of the range of movements yesterday and today rather than the price change of the pair. Yesterday's range was 20 basis points, and today's is 15. I understand that the day is not over yet, and the entire American session is ahead; anything can happen. However, the market is reluctant to rush to conclusions and trading decisions for the second day in a row.

Today's news background will consist of only a few reports in America, which will be released in the next hour. We are talking about real estate market data and jobless claims. Regardless of the outcome of these reports, it is not worth expecting a strong market reaction to them. In two weeks, meetings of the ECB and the Fed will take place, and it is 100% likely that interest rates will remain unchanged.

The market has received a lot of information from FOMC and ECB members, but the situation with interest rates and their prospects has become unclear. Therefore, the market wants to make good decisions. It prefers to wait to confirm its correctness or incorrectness and only open new deals. Of course, this applies only to market participants who seek to profit from exchange rate differences.

Based on this, strong movements are unlikely to be seen soon. Demand for the European currency may continue to decline slowly as the market's belief in the imminent rate cuts by the FOMC gradually weakens. At the same time, Christine Lagarde has stated that the ECB may begin easing as early as the second quarter, although the market had previously expected rate cuts in Europe to occur later. The news background is very slowly turning away from the euro.

General conclusions.

Based on the analysis, the construction of a bearish set of waves is continuing. Wave 2 or b has taken a complete form, so I expect the construction of an impulse downward wave 3 or c with a significant decline in the pair. An unsuccessful attempt to break through the 1.1125 mark, corresponding to 23.6% Fibonacci, indicated the market's readiness for sales a month ago. I am currently in sales.

On a larger wave scale, it can be seen that the construction of corrective wave 2 or b continues, which in length is already more than 61.8% Fibonacci from the first wave. As I have already mentioned, this is not critical, and the scenario of building wave 3 or c with a decline in the pair below the 1.4 figure is still in force.