EUR/USD

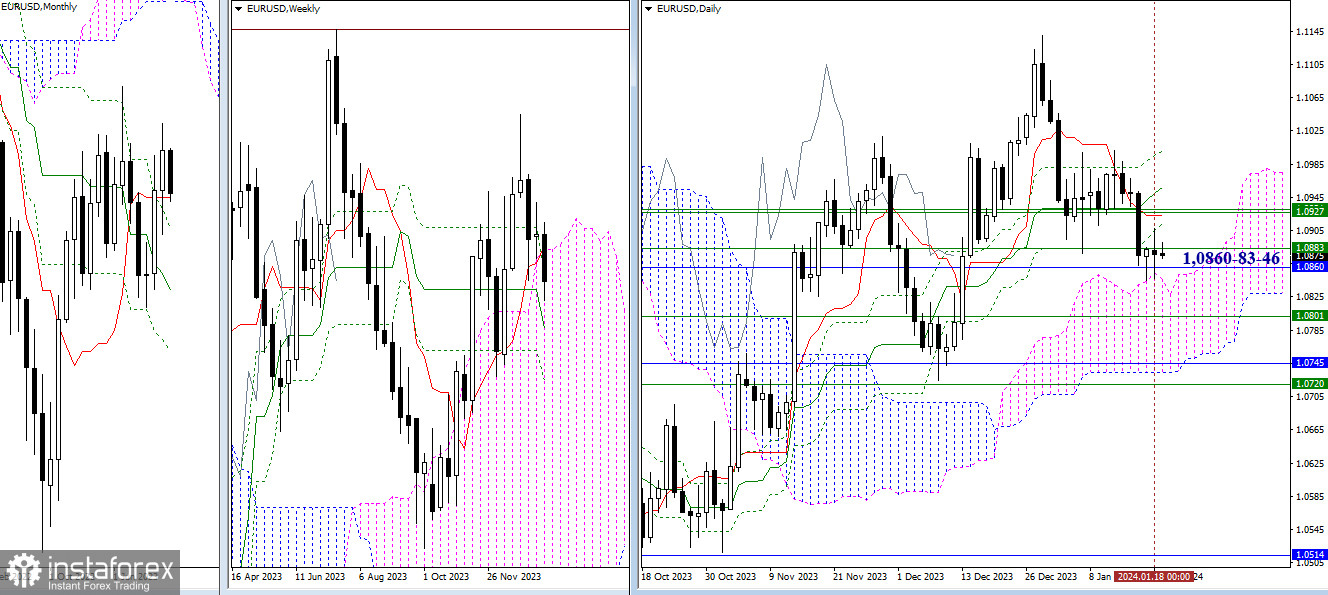

Higher Timeframes

The effectiveness of yesterday's actions does not allow us to speak of clear intentions and plans. In the current situation, uncertainty prevails. The market continues to remain within the influence of significant levels: the weekly Fibonacci Kijun (1.0883), the monthly short-term trend (1.0860), and the upper boundary of the daily cloud (1.0846). The opportunities that will arise in case of a breakout or a rebound have not changed. In case of a rebound, buyers will test the daily (1.0914 - 1.0923 - 1.0957 - 1.1000) and weekly (1.0927 - 1.0932) levels, which they lost quite easily the day before. A breakout of 1.0883-60-46 will open up new prospects, with the next support being the weekly medium-term trend (1.0801).

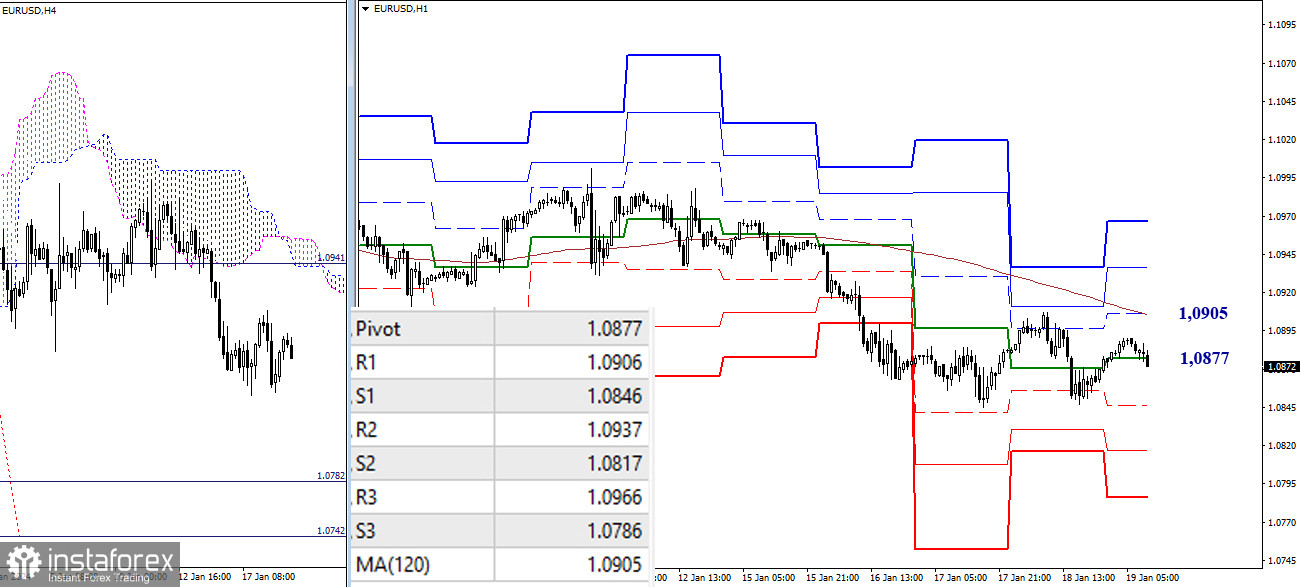

H4 – H1

On the lower timeframes, the pair continues to trade in a bearish zone today, below the weekly long-term trend (1.0905), so the potential for bearish sentiment remains predominant. After completing the corrective ascent (1.0845), attention on the lower timeframes will be directed towards the support levels of classic pivot points (1.0817 - 1.0786) and the target objectives for breaking through the Ichimoku cloud on H4 (1.0782 - 1.0742). In case of testing the weekly long-term trend (1.0905), bulls need to overcome the resistance of the trend (1.0905) and reverse the movement to gain an advantage and new targets. In this case, the resistance levels of classic pivot points R2 (1.0937) and R3 (1.0966) may come into play within the day.

***

GBP/USD

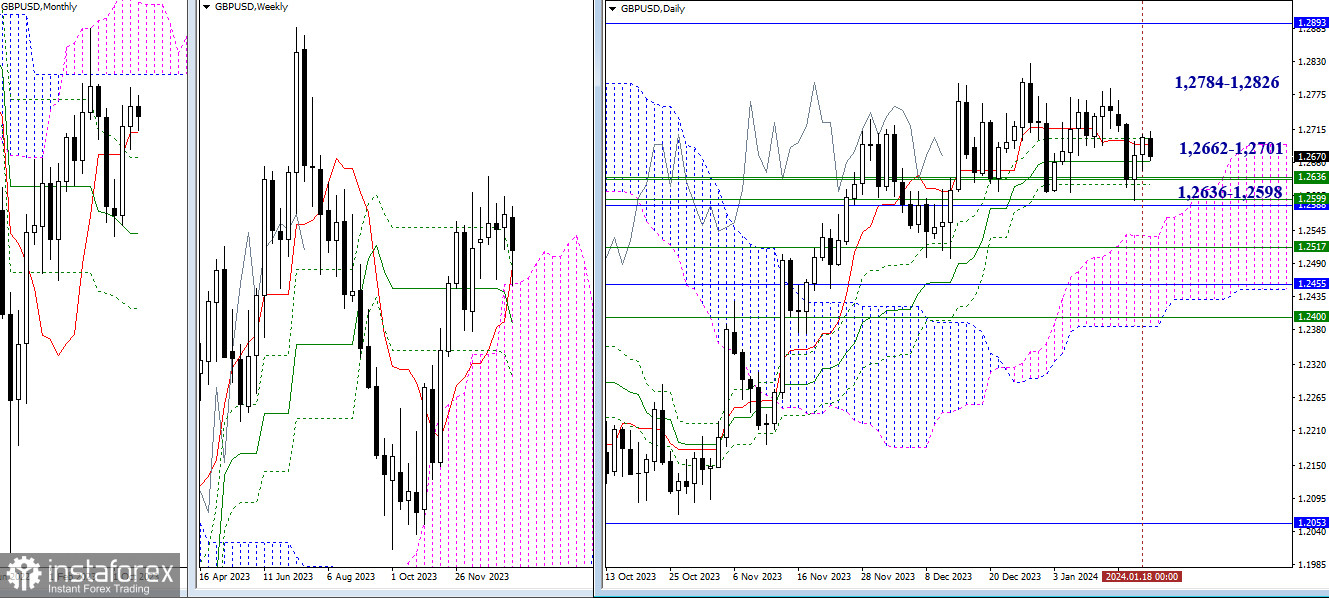

Higher Timeframes

Yesterday, the pound could not escape the attraction and influence of the daily levels (1.2662 – 1.2690 – 1.2701). Moving away from these levels will allow bulls to focus on updating the nearest highs (1.2784 – 1.2826). However, if the opponent shows activity, the pair will face supports at 1.2624-36 and 1.2588-98, tested the day before. Only after that will bears have new prospects, such as the upper boundary of the daily cloud.

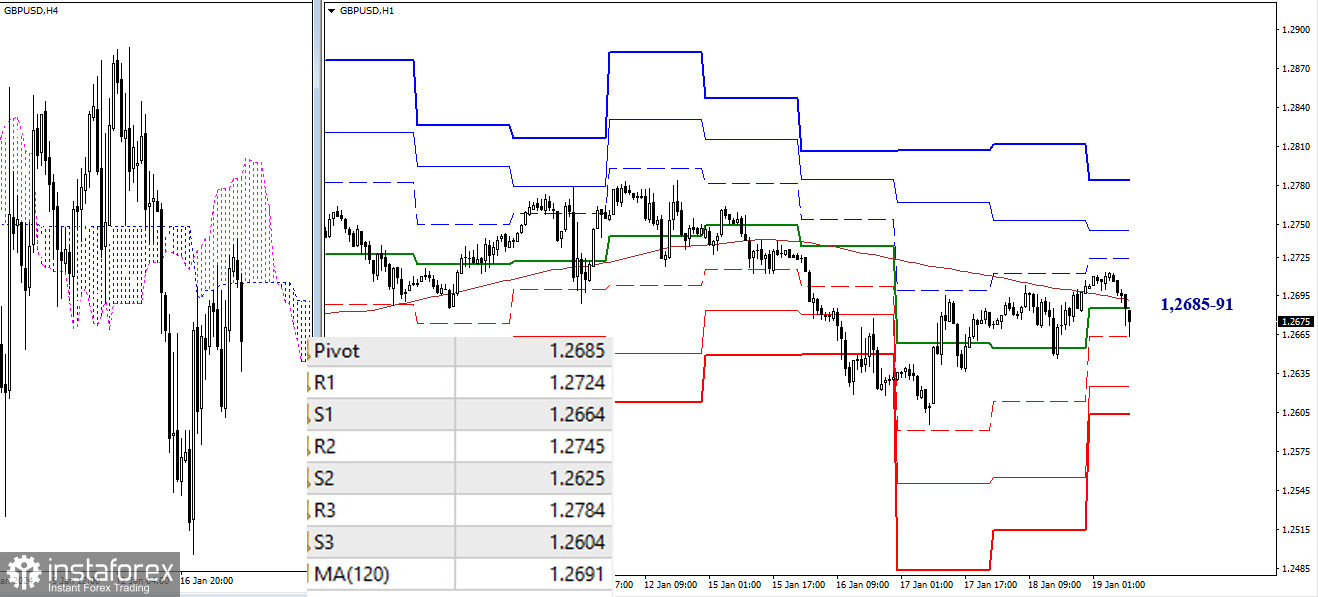

H4 – H1

On the lower timeframes, there is currently a battle for key levels, which are converging around 1.2685-91 (central pivot point + weekly long-term trend). If buyers take control of these levels, we can expect further strengthening of bullish sentiment. The resistance levels of classic pivot points (1.2724 - 1.2745 - 1.2784) will serve as targets for an upward movement within the day. If bears manage to maintain their advantage, they will aim for a decline today through the support levels of classic pivot points (1.2664 - 1.2625 - 1.2604). To exit the correction zone and restore the trend, they will need to update its low (1.2596).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)