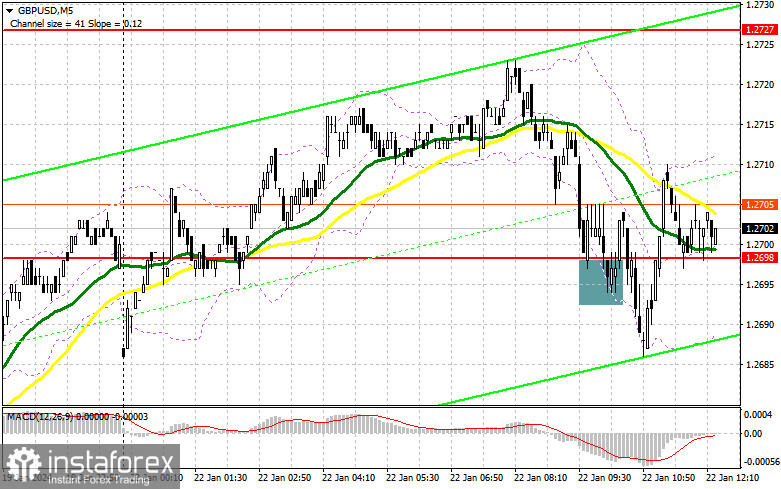

In my morning forecast, I highlighted the level of 1.2698 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at this level provided an entry point for buying. Still, as you can see on the chart, there was no significant upward movement, so I decided to exit positions and reevaluate the technical picture for the second half of the day.

To open long positions on GBP/USD, the following conditions are required:

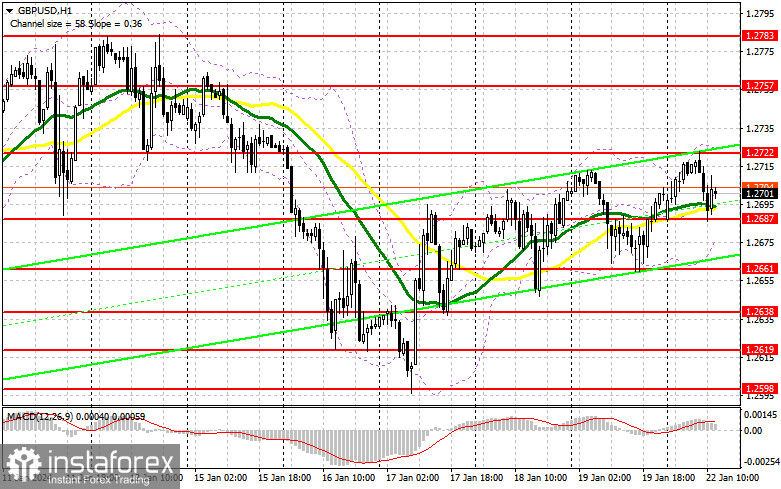

The absence of significant UK statistics has affected the pound's direction, but after a slight downward movement, buyers quickly regrouped, defending the support at 1.2690. This maintains a good upward potential for continuing the bullish trend formed in the middle of last week. Considering that there is no US data today, buyers will likely attempt to push the pound towards 1.2722. If trading remains above 1.2687, we can expect the pair's uptrend to continue. If pressure on the pound increases, bulls will again have to prove their presence around 1.2687, where the moving averages are working in their favor. I will act similarly to the first half of the day: buying on a false breakout around the support at 1.2687 will provide an excellent entry point for long positions in continuing the bullish trend to reach 1.2722. A breakthrough and consolidation above this range will strengthen demand for the pound and open the way to 1.2757. The ultimate target will be around 1.2783, where I plan to take profits. With a pair's decline and a lack of activity from the bulls at 1.2687, trading will move within a sideways channel, and pressure on the pound will increase. In such a case, I will postpone buying until testing 1.2661. Only a false breakout there will confirm the right entry point into the market. I plan to buy GBP/USD immediately on a rebound from the minimum of 1.2638, targeting a 30-35 point intraday correction.

To open short positions on GBP/USD, the following conditions are required:

Sellers are currently acting fairly calmly and continue to test the market. Considering they did not defend last week's highs, there is no real reason to expect a significant drop in the pair today. I will act on the rise after the formation of a false breakout around 1.2722 - the daily maximum. This will confirm the entry point for selling to return to the new support at 1.2687, formed after the first half of the day. A breakthrough and a retest from the bottom to the top of this range will deliver a more serious blow to the bull positions, restoring balance to the market and opening the way to 1.2661. The ultimate target will be around 1.2638, where I plan to take profits. In the scenario of GBP/USD rising and a lack of activity at 1.2722 in the second half of the day, buyers will continue to have the upper hand in anticipation of a move to the yearly high. In such a case, I will postpone selling until a false breakout occurs at 1.2757. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2783, but only in anticipation of a pair's correction downwards by 30-35 points.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The period and prices of moving averages mentioned by the author are based on the hourly H1 chart and differ from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2670, will act as support.

Indicator Descriptions:

• Moving Average (defines the current trend by smoothing out volatility and noise). Period 50. Marked on the chart in yellow.

• Moving Average (defines the current trend by smoothing out volatility and noise). Period 30. Marked on the chart in green.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.