Just a few weeks ago, traders saw an 80% probability of an interest rate cut in March, according to the CME Fedwatch tool. As I write this article, it's down to just 56%, and there are still two weeks to go until the meeting. The decrease in the likelihood of a rate cut is due to the statements of the FOMC members, which were aimed at conveying a simple message to the market: the first rate cut will take place when the central bank is confident that the inflation is firmly falling.

I have already pointed out that over the past 6-7 months, it has been difficult to argue that inflation is slowing down in the United States. According to the Consumer Price Index, inflation fell to a yearly rate of 3% in June, and has since fluctuated between 3% and 4%, making it difficult to conclude that a downward trajectory is in place. If that's the case, can we expect a rate cut in just two months?

The answer seems obvious to me, but the market has become a hostage to its own high expectations. For some reason, most market participants believed that March would be an excellent month for the first rate cut, and now we are witnessing how that belief is fading away.

Expectations have also decreased regarding a rate cut at the third meeting of the year, in May. It currently stands at 52%. As we can see, the market has significant doubts about rate cuts in the upcoming FOMC meetings. This is a good thing for the dollar because it suggests that the Fed may hold rates for longer than the market anticipated just a month ago.

In my opinion, if FOMC members, including Fed Chair Jerome Powell, signal that they are not in a hurry to lower the interest rate, this will increase the demand for the US dollar.

Currently, we can see that the EUR/USD and GBP/USD pairs are moving differently, which happens quite rarely. The euro is forming a bearish wave, so the conclusions we made above are applicable to it. The British pound is in a horizontal trend, with high demand, making it more difficult to anticipate a decline.

I believe that it's better to focus on the EUR/USD pair at the moment, while it might be prudent to wait a bit with the GBP/USD pair. Perhaps, the central bank meetings that will be held this week and the next will provide answers to some questions regarding monetary policy, and then the market will be able to move towards the wave I am expecting.

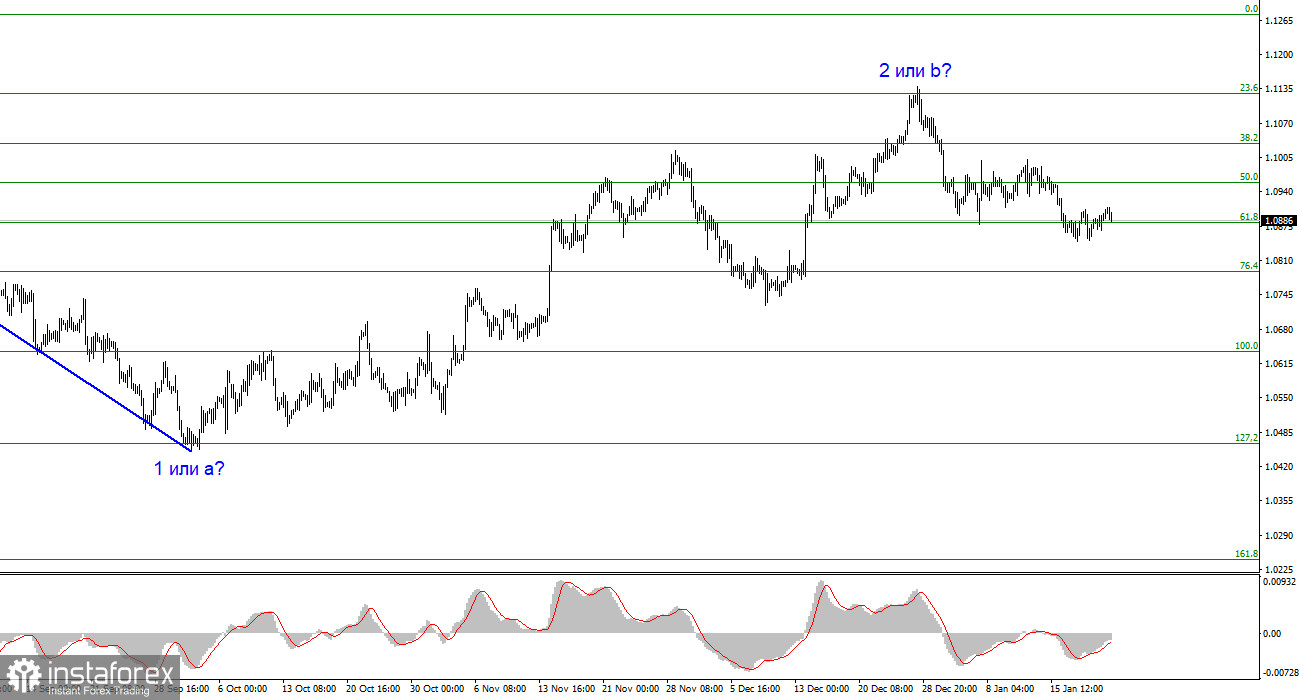

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break above the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell.

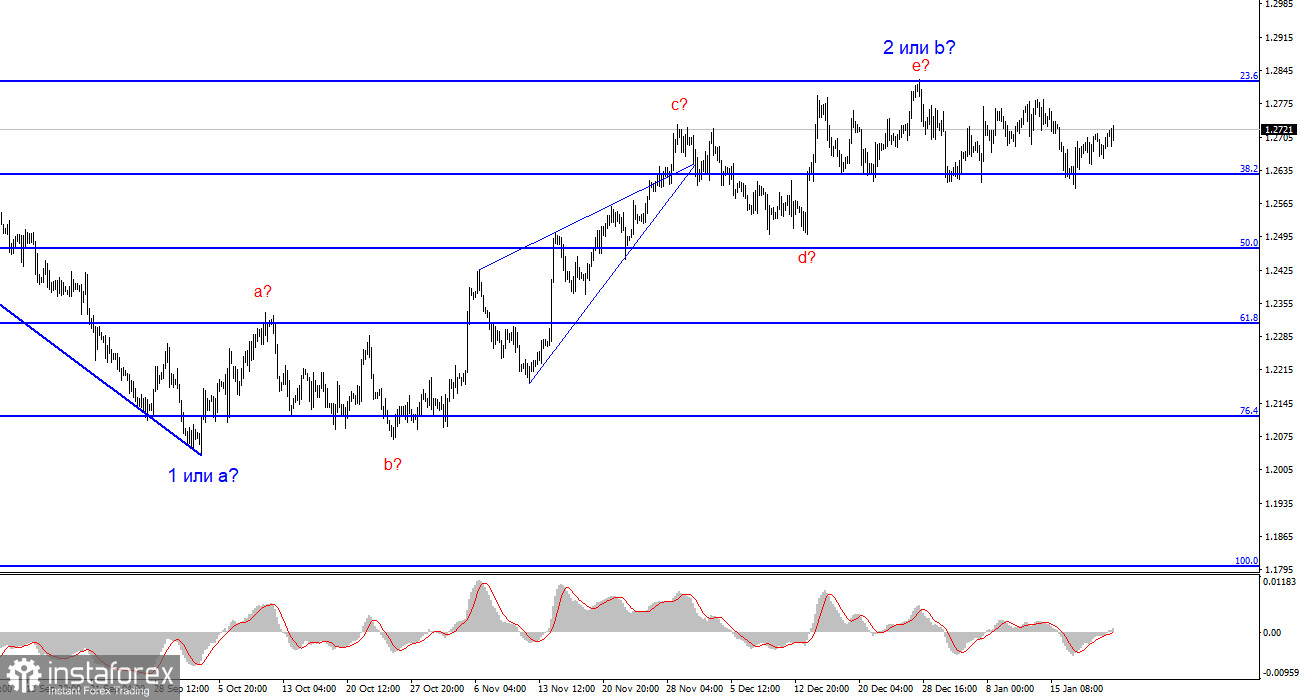

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. In fact, we are already seeing some signs of its end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break below the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.