To a larger extent, the market is treading water, and there is nothing surprising about that. First of all, the economic calendar is completely empty on Monday and Tuesday. Secondly, the European Central Bank's governing council meeting will take place on Thursday, and the approximate time period of the start of the ECB's monetary easing process will likely be announced on this day. In anticipation of such a significant event, risk appetite is somewhat diminishing. Of course, this does not rule out some fluctuations, but their scale will be quite insignificant. Just like the outcome, where quotes are likely to remain at their current levels.

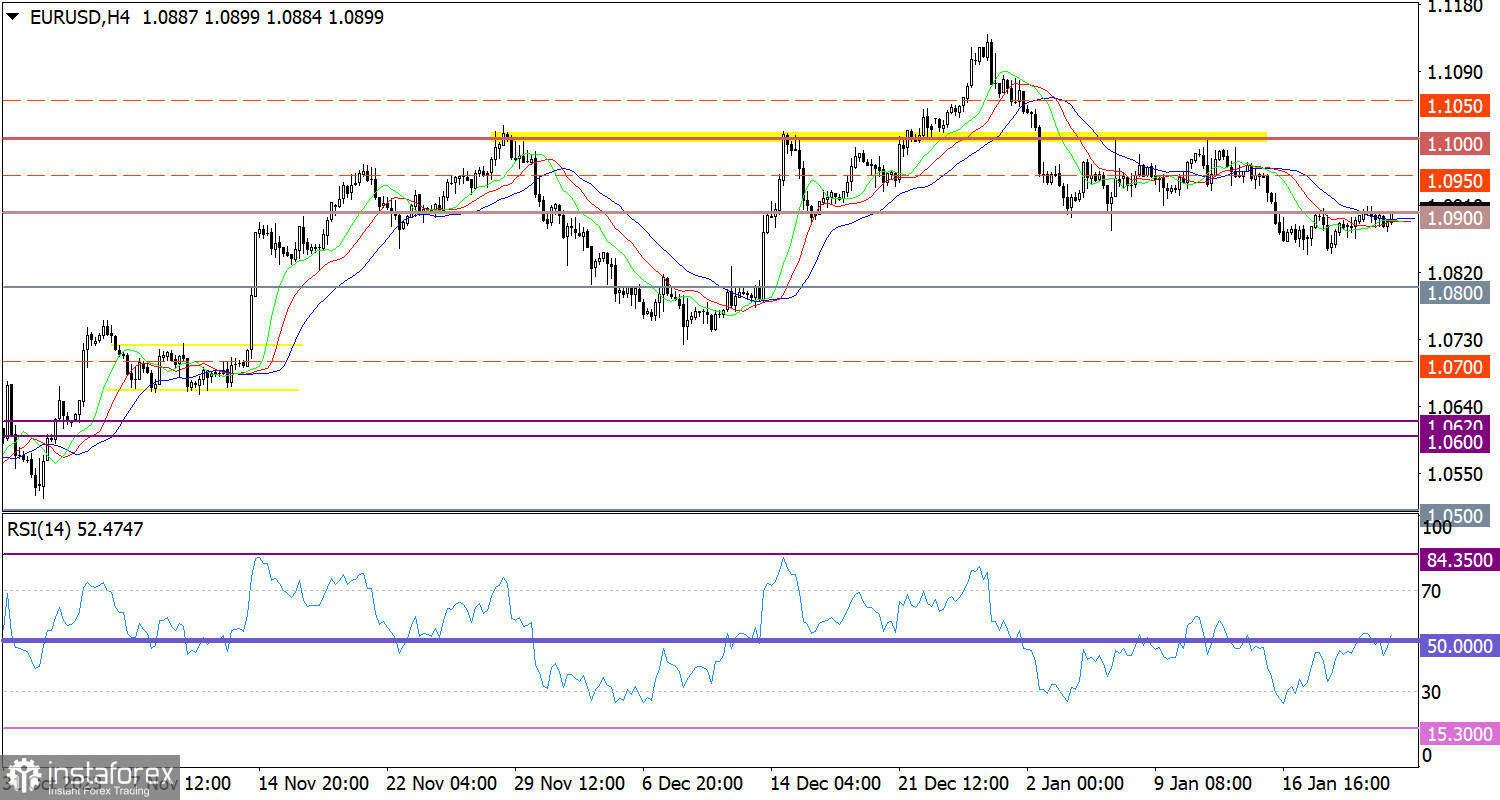

For the third consecutive day, the EUR/USD pair has been trading around the 1.0900 level, showing low activity. The value of 1.0850 will serve as a support on the way of the bears, and in relation, there has been a decrease in the volume of short positions on the euro.

On the four-hour chart, the RSI is moving within the 50 middle line, which indicates that the price is stagnant.

On the same time frame, the Alligator's MAs are intersecting each other, also indicating a standstill.

Outlook

Keeping the price above the 1.0900 level during the day may lead to an increase in the volume of long positions towards 1.1000. The bearish scenario will come into play if the price returns below 1.0850.

The complex indicator analysis unveiled that in the intraday and short-term periods, technical indicators are pointing to a standstill as the pair trades within the range of 1.0850/1.0900.