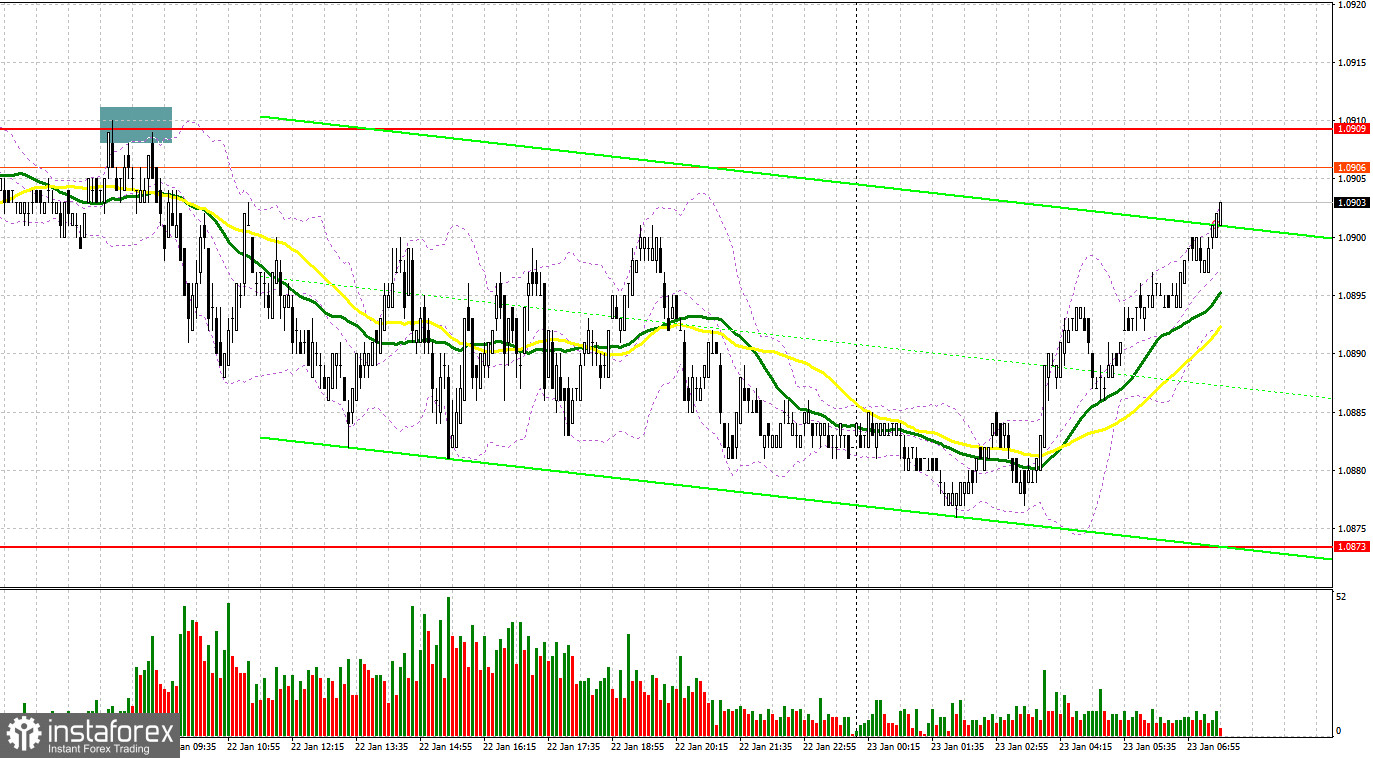

Yesterday, there was only one signal for market entry. Let's take a look at the 5-minute chart and discuss what happened. In my previous forecast, I focused on the level of 1.0909 and recommended making market entry decisions based on it. A rise and false breakout near 1.0909 generated an excellent sell signal from the upper boundary within the sideways channel. As a result, the pair fell by 30 pips. In the second half of the day, we did not get any good entry points.

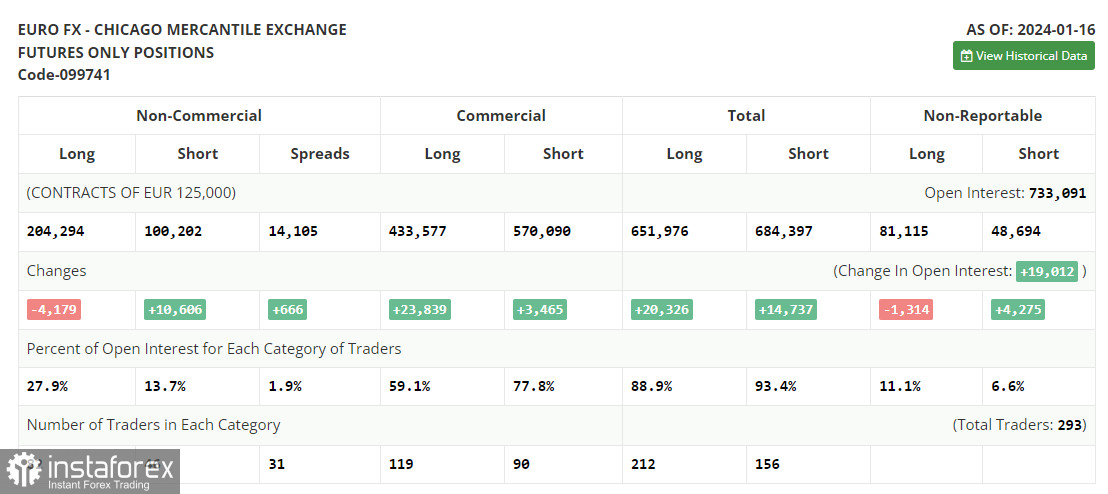

COT report:

Before discussing the outlook for EUR/USD, let's see what happened in the futures market and how the Commitment of Traders positions changed. In the COT report (Commitment of Traders) for January 16, there was a decrease in long positions and an increase in short positions, which indicates a change in the balance of power in favor of the U.S. dollar. Obviously, a strong labor market and a high probability of a new spike in U.S. inflation early this year helps maintain the chances of a tight policy from the Federal Reserve. If the timing of the first Federal Reserve rate cut is pushed to a later period, this will help the dollar strengthen against the euro. The European Central Bank meeting will be held this week, and the Bank may also leave rates unchanged in its fight against inflation, which should level the euro's position in the EUR/USD pair, and help keep the price within the channel. The COT report indicated that long non-commercial positions fell by 4,179 to 204,294, while short non-commercial positions increased by 10,606 to 100,202. As a result, the spread between long and short positions increased by 666.

For long positions on EUR/USD

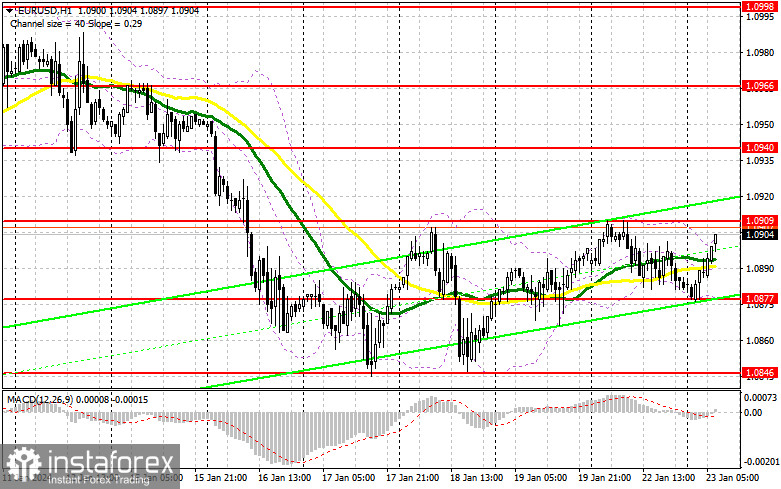

Today, the eurozone will not release any important data, and the January data on the eurozone consumer confidence indicator is unlikely to lead to strong market changes. In this case, I plan to stick to trading within the channel, similar to the day before. I expect the buyers to appear only near the middle of the channel at 1.0877. A false breakout there could provide a good entry point for long positions, with the goal of pushing the pair to the upper boundary of 1.0909, established yesterday. A breakout and a downward test of this range will produce a buy signal, offering a chance to test the high near 1.0940. The ultimate target here is the 1.0966 area, where I plan to take profits. Should EUR/USD decline and show no activity at 1.0877 in the first half of the day, the pair will continue to trade within the sideways channel, but sellers will get a bigger advantage. In this case, I will try to enter the market after a false breakout forms near the next support at 1.0846. I would consider opening long positions immediately on a rebound from 1.0817, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

In the first half of the day, sellers should try their best to prevent the pair from going beyond the new resistance at 1.0909, as this level may be tested in the near future. Protecting 1.0909 would be a suitable scenario for opening short positions within the sideways channel, with the goal of pushing the price towards 1.0877. Above this level, we have the moving averages that favor the bulls. After a breakout and consolidation below this range, as well as an upward retest, do I expect another sell signal at 1.0846 - the lower boundary of the sideways channel. The ultimate target here is the 1.0817 low, where I plan to take profits. Testing this level will bring back the downtrend. In case EUR/USD moves upwards during the European session without bearish activity at 1.0909, buyers will aim for the 1.0940 high. It is also possible to sell there but only after unsuccessful consolidation. I would consider opening short positions immediately on a rebound from 1.0966, aiming for a downward correction of 30-35 pips.

Indicator signals:

Moving averages:

Trading above the 30- and 50-day moving averages indicates a possible upward movement.

Please note that the time period and levels of the moving averages are analyzed only for the 1H chart, which differs from the general definition of the classic daily moving averages on the 1D chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0877 will serve as support. In case of an upward movement, the upper band of the indicator at 1.0900 will act as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.