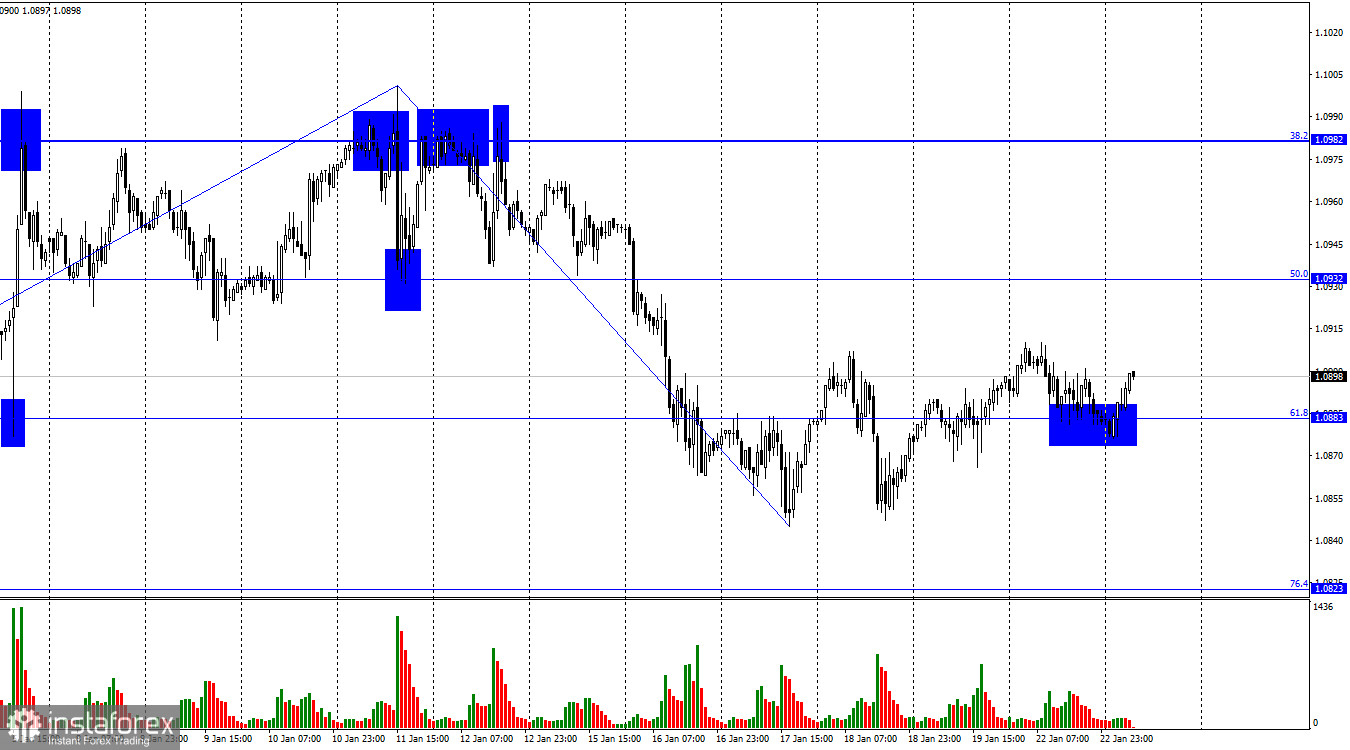

On Monday, the EUR/USD pair retraced to the corrective level of 61.8% (1.0883), rebounded, and favored the European currency. Therefore, the upward movement process may continue towards the next Fibonacci level at 50.0%–1.0932. If the pair's rate consolidates below 1.0883, it will favor the US dollar and may lead to a resumption of the decline towards the corrective level of 76.4% (1.0823).

The wave situation remains unchanged. The last upward wave was quite weak and could not break the peak on December 28th. Thus, the first sign of the end of the bullish trend was obtained. The new downward wave confidently broke the lows of January 3rd and 5th, which was the second sign of the end of the bullish trend. Accordingly, we currently have a new bearish trend. The decline of the euro currency in the coming weeks remains the most likely scenario. To cancel the bearish trend, the euro would need to rise above the peak on January 11th, which is extremely unlikely in the coming days.

There was no significant news background on Monday. The news calendar for Tuesday is not any better, as it is once again empty. Meanwhile, the market has already fully shifted its focus to the ECB meeting, which will take place on Wednesday and Thursday. Expecting significant decisions from the ECB at the moment is unlikely, as many of its officials stated in January that there is no need to expect a reduction in the deposit rate soon. However, Christine Lagarde has mentioned that the rate may start to decrease by the summer. If she repeats this statement on Thursday at the press conference, bearish traders may receive the necessary support to continue forming the trend. However, I wouldn't be too confident in Christine Lagarde's "dovish" stance. "By the summer" does not mean the rate will start decreasing in the second quarter. Everything will depend on inflation indicators.

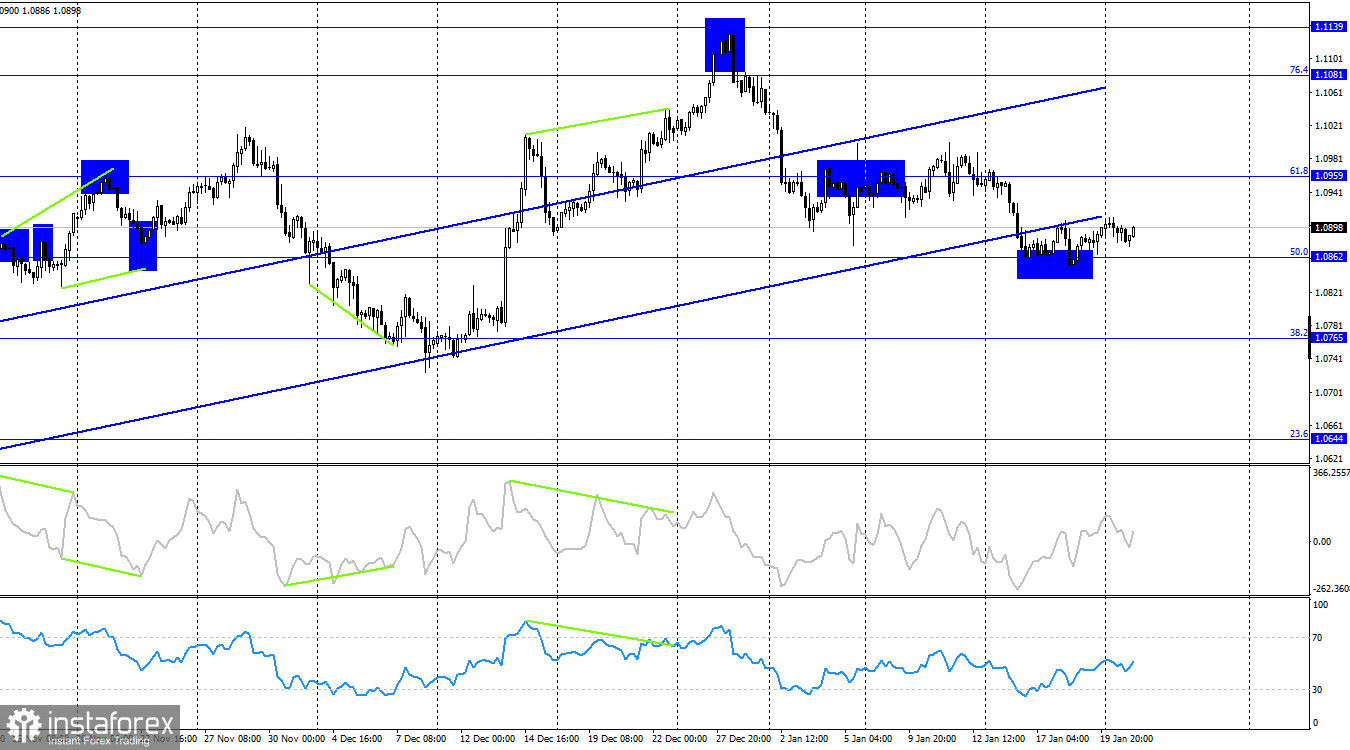

On the 4-hour chart, the pair has reversed in favor of the European currency after bouncing from the corrective level of 50.0% (1.0862). The rebound from this level allows for some growth towards the Fibonacci level of 61.8% (1.0959). If the quotes consolidate below the 50.0% level, it will favor the US dollar and may lead to a resumption of the decline towards the 38.2% Fibonacci level at 1.0765. No imminent divergences are observed with any of the indicators. The consolidation below the ascending trend corridor signifies a trend change to bearish.

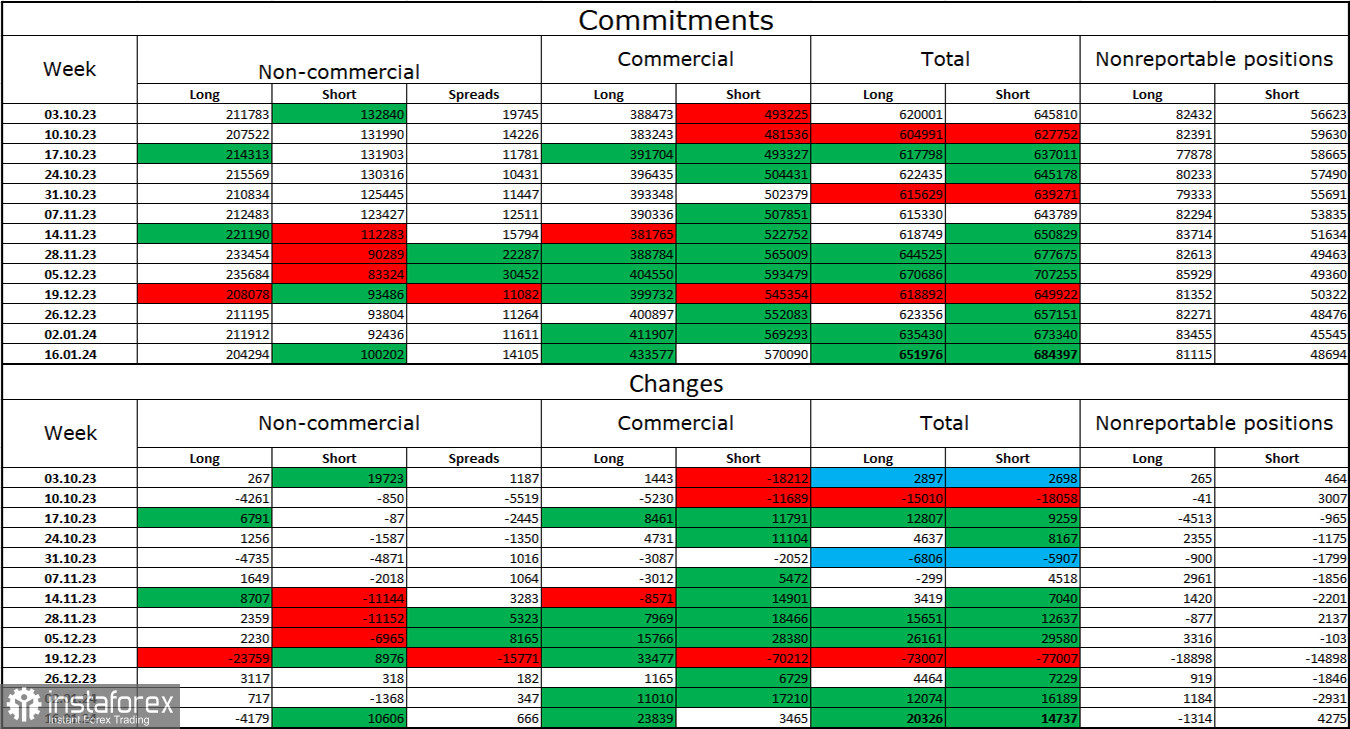

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,179 long contracts and opened 10,606 short contracts. The sentiment of major traders remains "bullish" and continues to weaken. The total number of long contracts held by speculators now stands at 204,000, while short contracts amount to 100,000. Despite a relatively large difference, the situation will shift toward the bears. Bulls have dominated the market for too long, and now they need strong news to maintain the bullish trend. I don't see such a news background at the moment. Professional traders may continue to close their long positions soon. The current figures allow for a resumption of the euro's decline in the coming months.

News Calendar for the US and the Eurozone:

On January 23rd, the economic events calendar has yet to feature any significant entries. Therefore, the news background's impact on traders' sentiment today may be weak.

Forecast for EUR/USD and Trader Recommendations:

Selling the pair may be possible today if there is a rebound from the 1.0932 level on the hourly chart, with a target of 1.0883. Alternatively, if the rate consolidates below 1.0883, the targets could be 1.0850 and 1.0823. Buying could have been considered after the consolidation above the 1.0883 level on the hourly chart, with a target of 1.0932. These trades can still be held open.