Following today's meeting, the Bank of Japan maintained its interest rate and the target 10-year JGB yields at the previous levels, -0.1% and 0%, respectively. The yield curve control (YCC) policy, under which the yield of 10-year government bonds can rise to 1.0%, was also left unchanged.

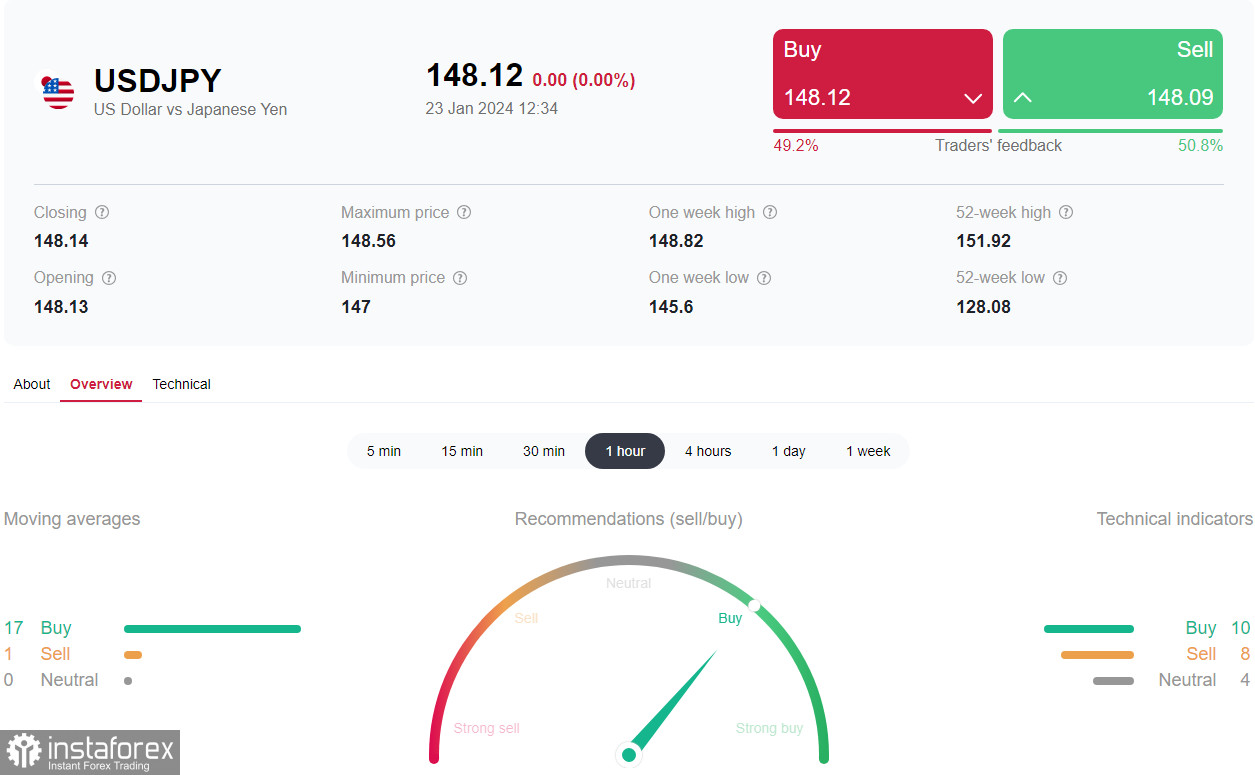

Immediately after the announcement of the Bank of Japan's decision, the yen weakened moderately but quite sharply, and the USD/JPY pair jumped to an intraday high of 148.55.

However, following the statements of Bank of Japan Governor Kazuo Ueda, it started to decrease, reaching the 146.98 mark by the beginning of the European trading session, through which the important short-term support level passed at that moment (200 EMA on the 1-hour chart).

As of writing, USD/JPY was near the mark of 148.00, 10 points below the opening price of today's trading day.

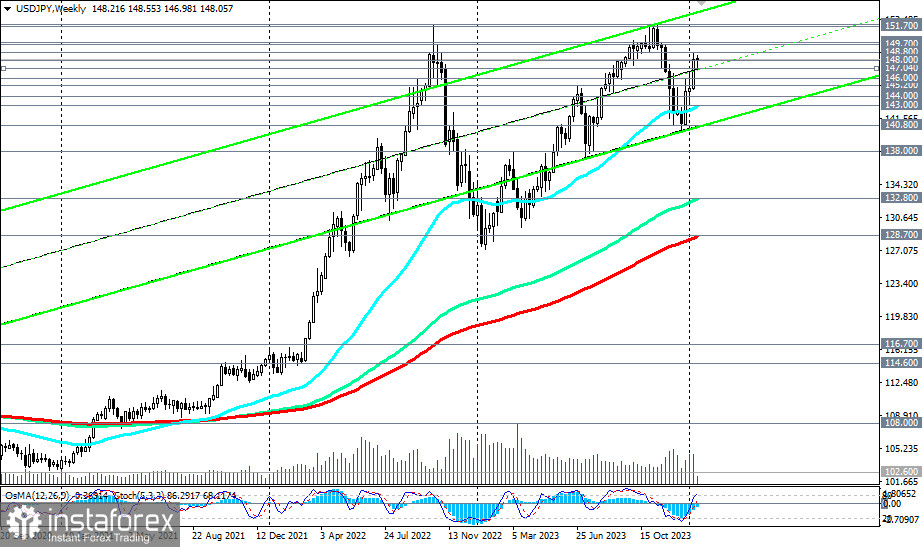

At the same time, the pair remains in the zone of medium-term bullish market—above the key support level of 144.00 (200 EMA on the daily chart) and long-term bullish market—above the key support level of 128.70 (200 EMA on the weekly chart).

Therefore, from a technical point of view, it is logical to expect the continuation of the upward dynamics and further growth of USD/JPY, and a breakout of today's high of 148.55 and the local high of 148.80, reached last Friday, could be a signal to increase long positions with targets, at least, at the psychologically significant mark of 150.00.

Earlier, the market expected active actions from the Bank of Japan and the defense of this level. However, in November, the price approached the mark of 152.00.

If there are no unexpected statements from the Fed, whose meeting will take place on January 30–31, about a quick transition to a cycle of easing monetary policy, then one should expect the growth of USD/JPY towards the November highs and the mark of 152.00. A breakout of this mark is also not excluded.

In an alternative scenario, a break below the important short-term support level of 147.04 (200 EMA on the 1-hour chart) may become the first signal for opening short positions, and a break below important support levels of 146.00 (50 EMA on the daily chart), 145.70 (200 on EMA the 4-hour chart) will be a confirmation.

A breaktdown of the key support level of 144.00 will return USD/JPY to the zone of the medium-term bearish market, also reviving interest in short positions on the pair with the prospect of a decrease to the zone of long-term support levels 132.80 (144 EMA on the weekly chart), 128.70 (200 EMA on the weekly chart) with intermediate targets at local support levels 140.80, 138.00.

Support levels: 147.04, 146.00, 145.20, 144.00, 143.00, 140.80, 138.00, 132.80, 128.70

Resistance levels: 148.80, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Trading Scenarios

Main Scenario

Aggressively: Buy at the market. Stop Loss 147.80

Moderately: Buy Stop 148.90. Stop Loss 147.80

Targets: 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Alternative Scenario

Aggressively: Sell Stop 147.80. Stop Loss 148.40

Moderately: Sell Stop 146.90. Stop Loss 148.40

Targets: 146.00, 145.60, 145.20, 144.00, 143.00, 140.80, 138.00, 132.80, 128.70

"Targets" correspond to support/resistance levels. This also does not mean that they will definitely be reached, but they can serve as a reference point when planning and placing your trading positions.