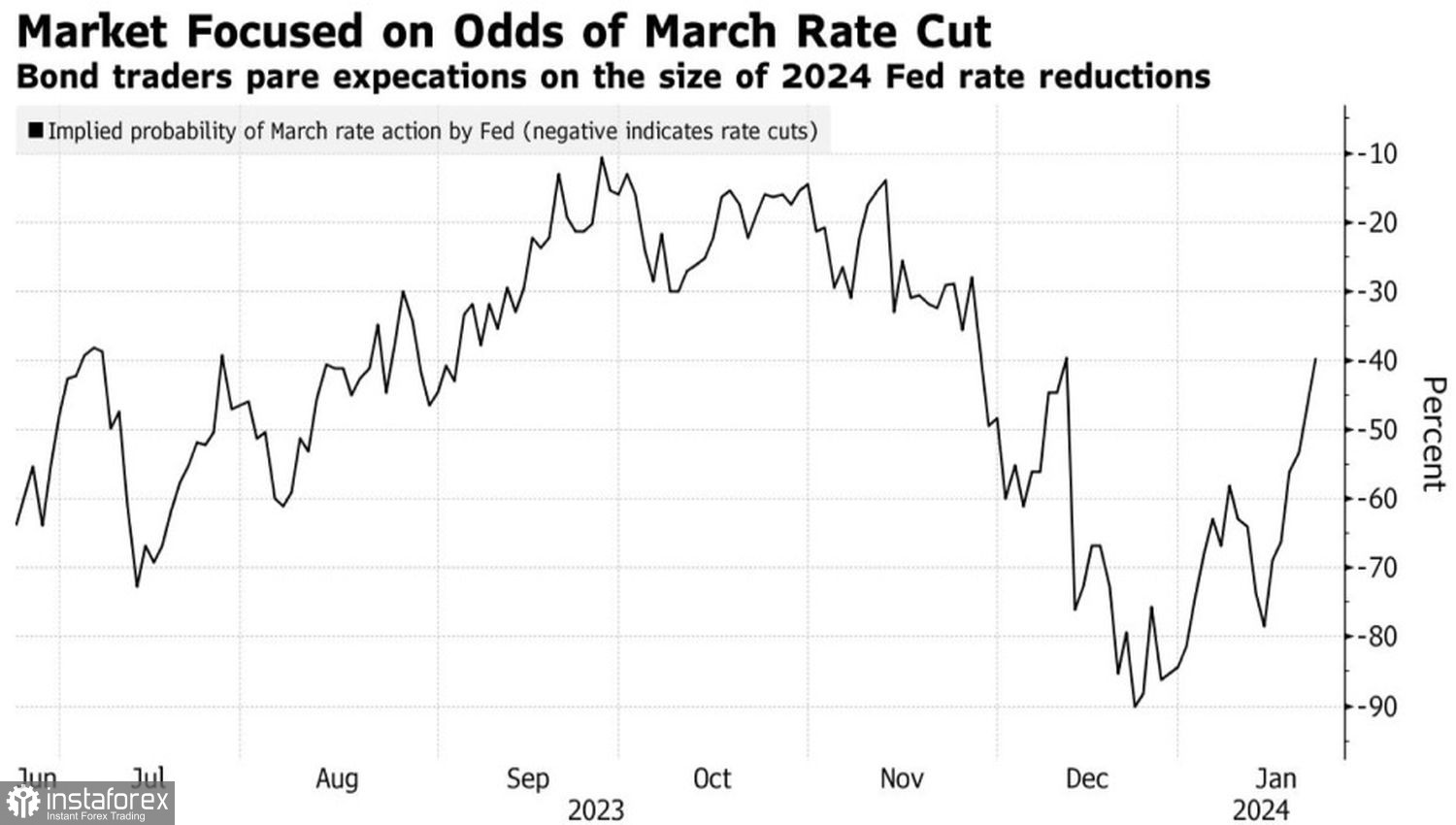

Lower interest rates are a remedy for a sick economy. But according to the latest reports, the U.S. economy is healthy. It does not need stimulus. And gradually, the markets are understanding this. They have shifted expectations for the Federal Reserve's first rate cut from March to May. Moreover, derivatives now anticipate a decrease in the federal funds rate by 135 basis points in 2024, not 150 basis points, which was the case just a few days ago. These changes are enthusiastically embraced by EUR/USD bears.

Dynamics of Expectations for the Federal Reserve's Federal Funds Rate Cut in March

Indeed, the increase in non-farm employment by 216,000, the acceleration of consumer prices from 3.1% to 3.4% year-on-year, and the increase in retail sales by 0.4% month-on-month in December indicate that the U.S. economy is standing firmly on its feet. This allows FOMC officials not to rush with reducing the cost of borrowing. According to Christopher Waller, the Central Bank should use a cautious and methodical approach to easing monetary policy. New York Fed President John Williams believes that the federal funds rate should be maintained at 5.5% for some time. His colleague from Dallas, Mary Daly, asserts that there are no guarantees of its reduction in 2024.

Judging by the newly emerged problem of supply chain disruptions due to Houthi attacks on ships in the Red Sea, she is right. Inflation could easily reach a new peak in the U.S., which would first shift market expectations of the Fed's monetary expansion from May to June–July, and then completely free the markets from illusions. If the Federal Reserve maintains the cost of borrowing at current levels in 2024, EUR/USD bears will celebrate victory.

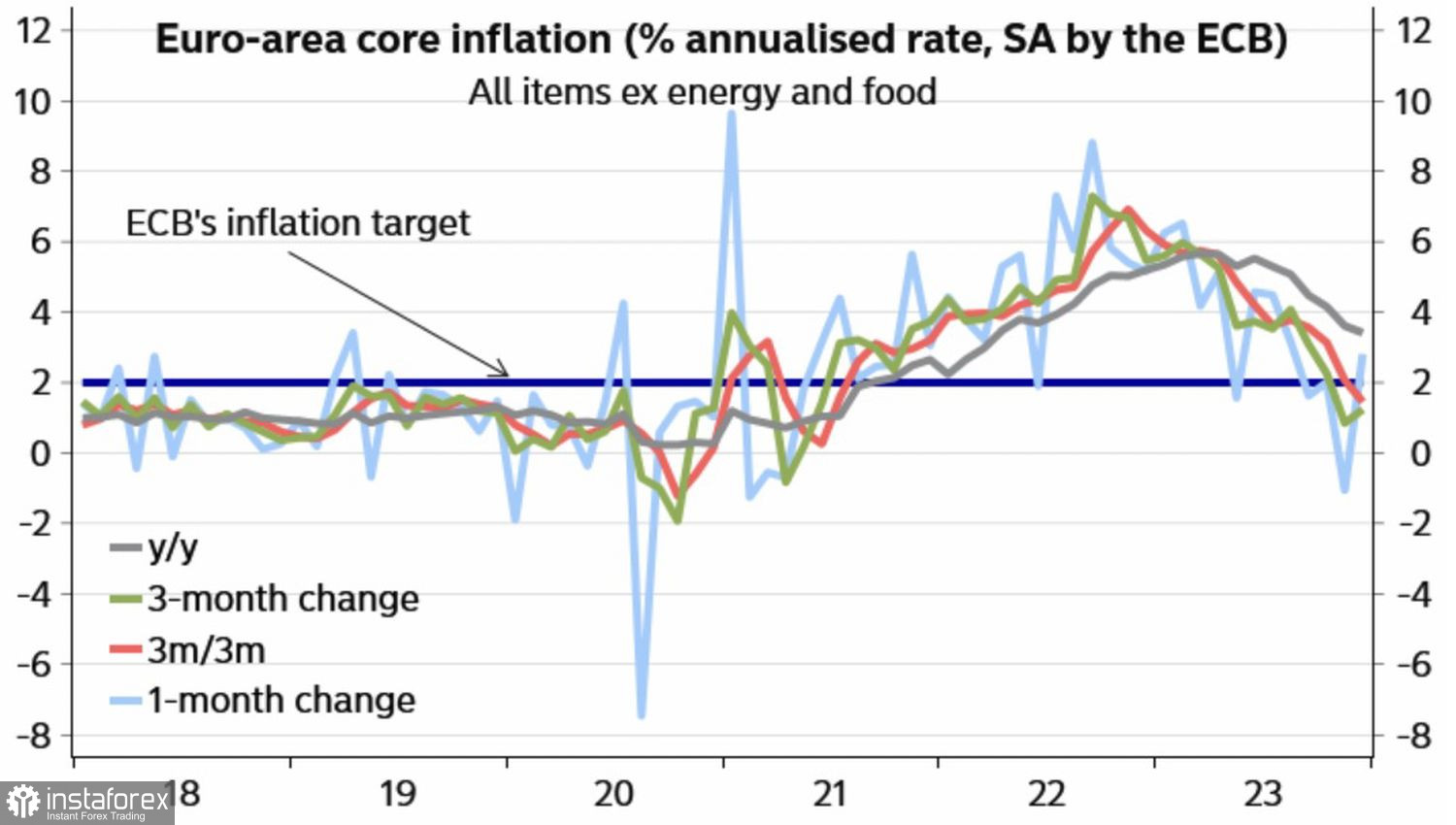

What can the ECB do to help the euro? Its representatives are also using almost hawkish rhetoric. ECB executive board member Isabel Schnabel stated that it is still too early to discuss issues of easing monetary policy. Chief Economist Philip Lane noted that a full picture of wage data will only be available by the July meeting of the Governing Council. ECB President Christine Lagarde speculated that the first cut in the deposit rate seems likely in the summer. However, everything will depend on the data, particularly inflation statistics.

Dynamics of European Inflation

The speeches of ECB officials have led the futures market to reduce the assumed scale of monetary expansion from 150 basis points to 135 basis points in 2024, which at first glance seems like good news for EUR/USD. In reality, a reduction in the size of stimulus is bad news for risky assets and pro-cyclical currencies. The euro is typically counted among the latter.

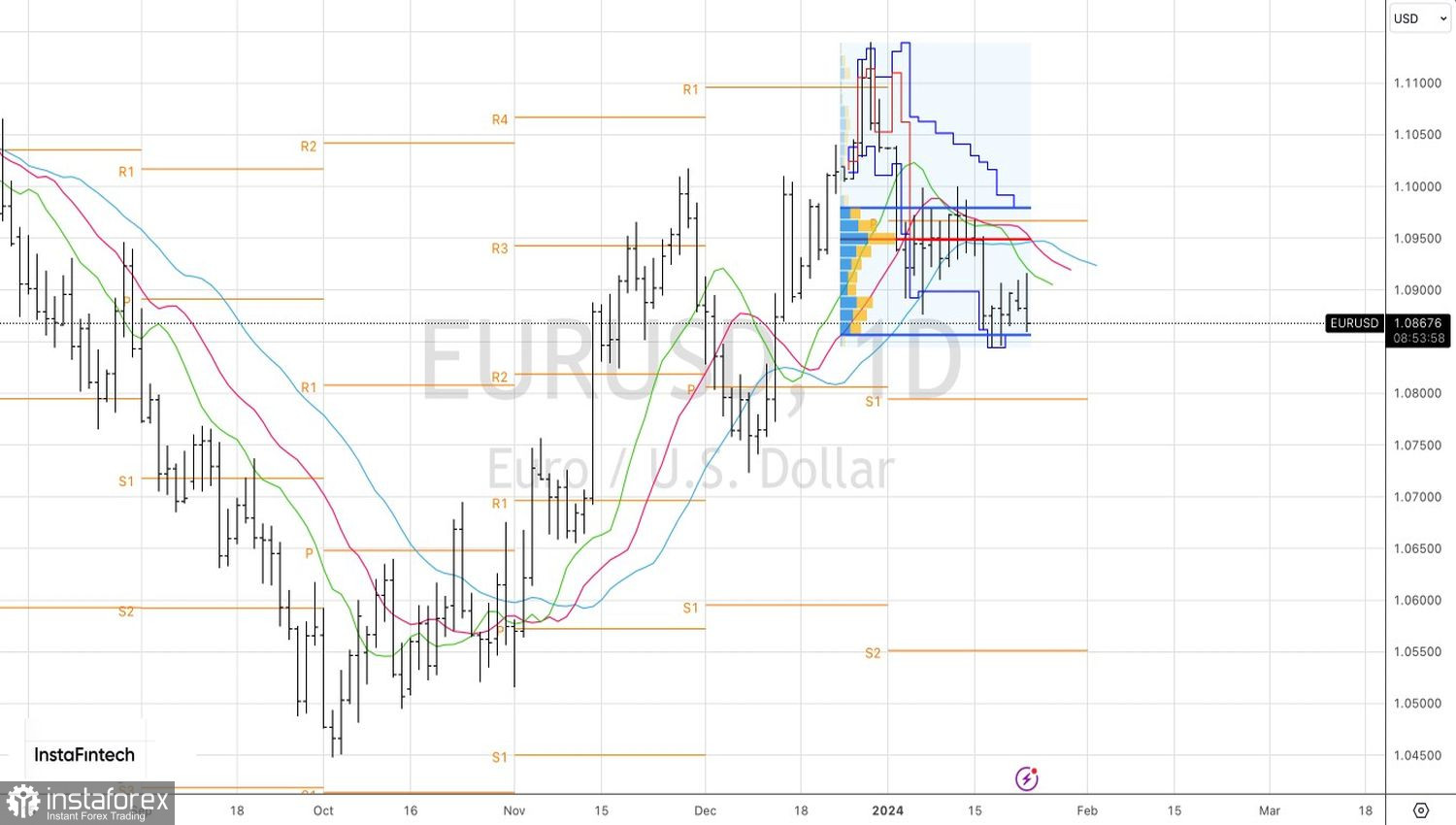

Technically, the inability of EUR/USD bulls to cling to the lower boundary of the consolidation range 1.09–1.099, formed within the Splash and Shelf pattern, is evidence of their weakness. Meanwhile, a drop in quotes below the fair value range of $1.086–1.098 will be a reason to increase previously opened short positions on the euro from the $1.09 level.