The U.S. economy is not in danger of slipping into a recession despite the Federal Reserve's high level of interest rate (the highest in decades). Some indicators have decreased, such as business activity indices, job creation, and the number of open vacancies. However, the most important indicators that reflect economic growth remain at high levels. GDP grew by 4.9% in the third quarter and is expected to add another 2.1-2.2% in the fourth quarter.

Many economists, upon seeing the GDP forecast for the fourth quarter, immediately considered the dollar as an underperformer. Let's think about this. The economy is growing at a rate of 2% during a period of high interest rates, and yet people expect the dollar to fall! How much should the economy grow for the U.S. dollar demand to rise, if even a +5% growth doesn't inspire the market to buy?

The Fed is on track to achieve a soft landing in the US economy, Goldman Sachs Group Inc.'s Chief Economist Jan Hatzius said. A soft landing means lowering interest rates before a recession occurs. Hatzius does not expect a severe impact on the U.S. economy in the near future. He also added that a March interest rate cut "would make sense."

In my opinion, there is indeed no need to expect a recession, and a soft landing is highly probable. However, I strongly disagree with a rate cut in March. Furthermore, the market no longer agrees with this outlook either. Just a month ago, the market was confident in the first rate cut in March. Then, some FOMC members expressed doubts about this scenario, and the probability of a rate cut at the second meeting of the year began to decline. Currently, it stands at only 42.5% (according to the CME FedWatch tool).

Therefore, the market has finally recognized its own mistake in expecting the U.S. central bank to transition to monetary easing so quickly. If this is the case, then demand for the U.S. dollar should increase in the near future. In contrast to the euro, it is rising, completely in line with the current wave pattern. The only problem is with the pound, which is still trading in a horizontal channel.

The Bank of England, the Fed, and the European Central Bank meetings are ahead of us, and we might hear important information from the heads of the central banks. This could change market sentiment. However, in my opinion, over the past few weeks, we have already heard enough speeches to form a clear view of what is happening: the Fed's policy will remain tight slightly longer than the market expected, while the policies of the BoE and the ECB will remain tight for less time than the market anticipated.

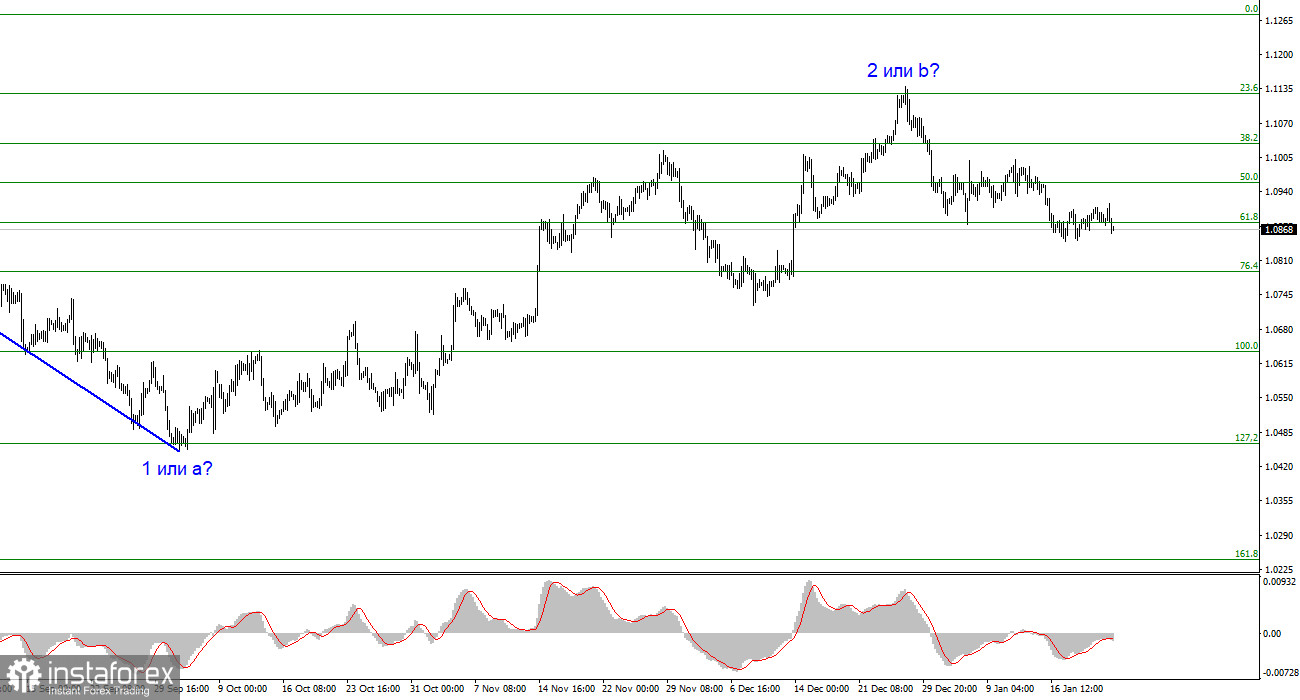

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

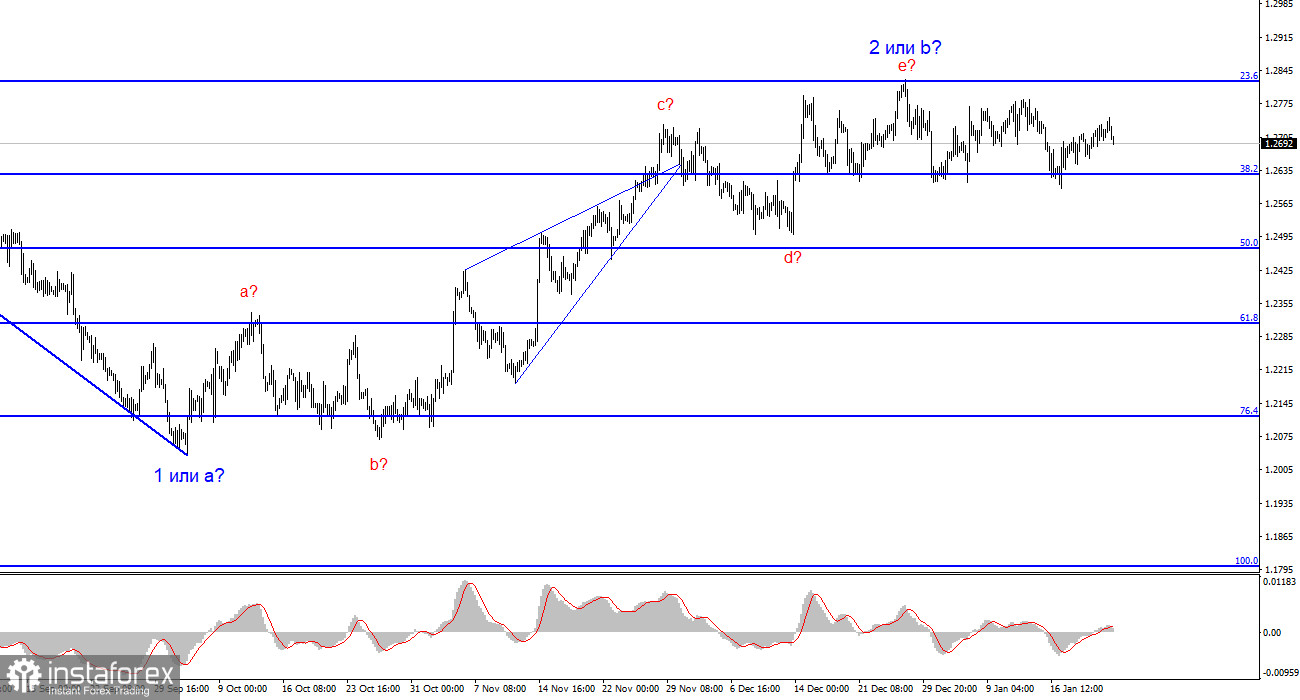

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. In fact, we are already seeing some signs of its end. However, I wouldn't rush to short positions at this time. Since the movement has been horizontal for a month, I would wait for a successful attempt to break the level of 1.2627, afterwards it will be much easier to expect the pair to fall further.