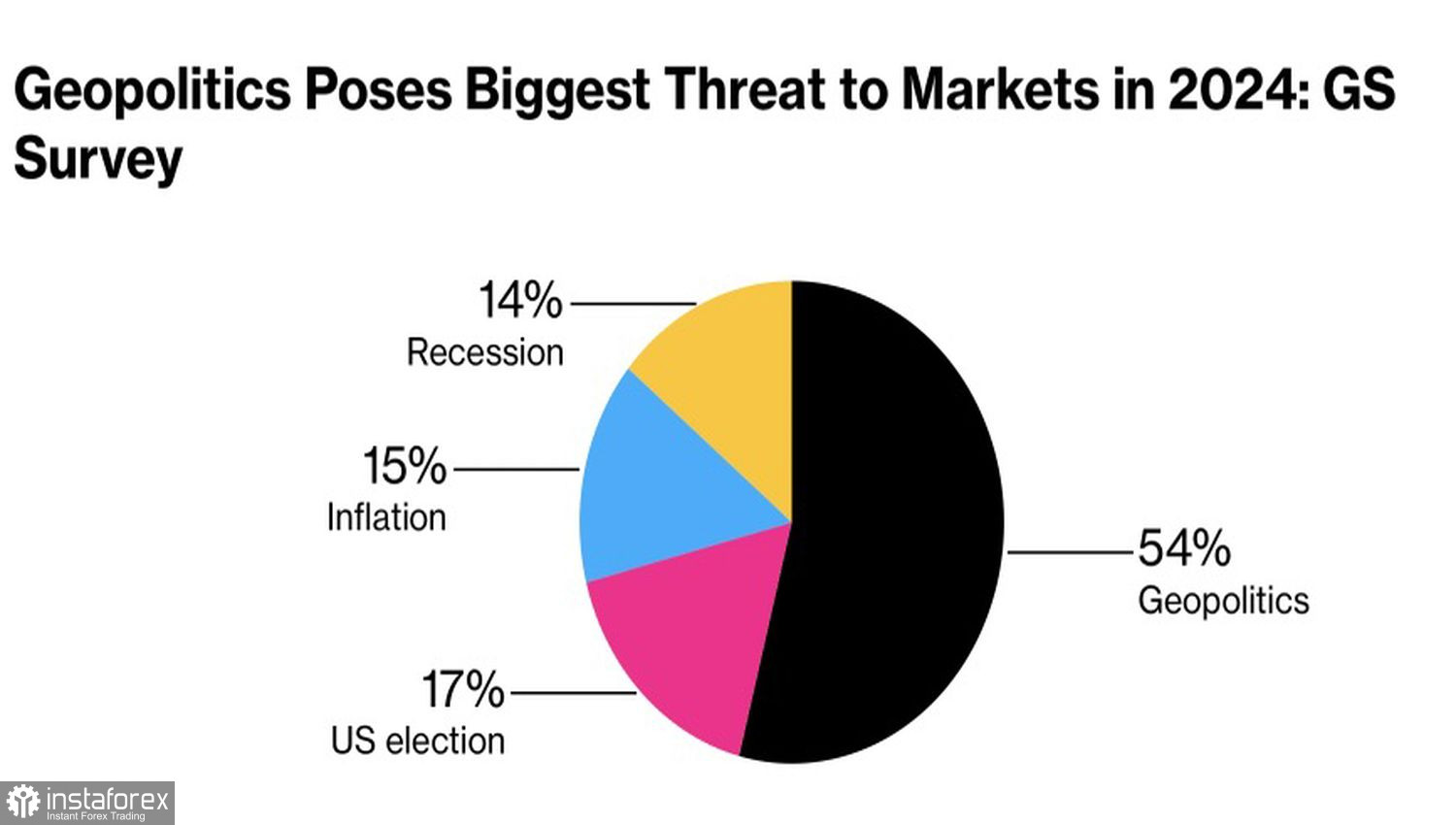

Gold started 2024 not in the best of spirits. Despite the rise in geopolitical tensions in the Middle East, the precious metal lost about 2% of its value since the beginning of January. Yet, Goldman Sachs clients cite geopolitics and the U.S. presidential election as the main risks for the markets in the new year, surpassing the inflation and recession that dominated in previous years.

Main risks for the markets in 2024

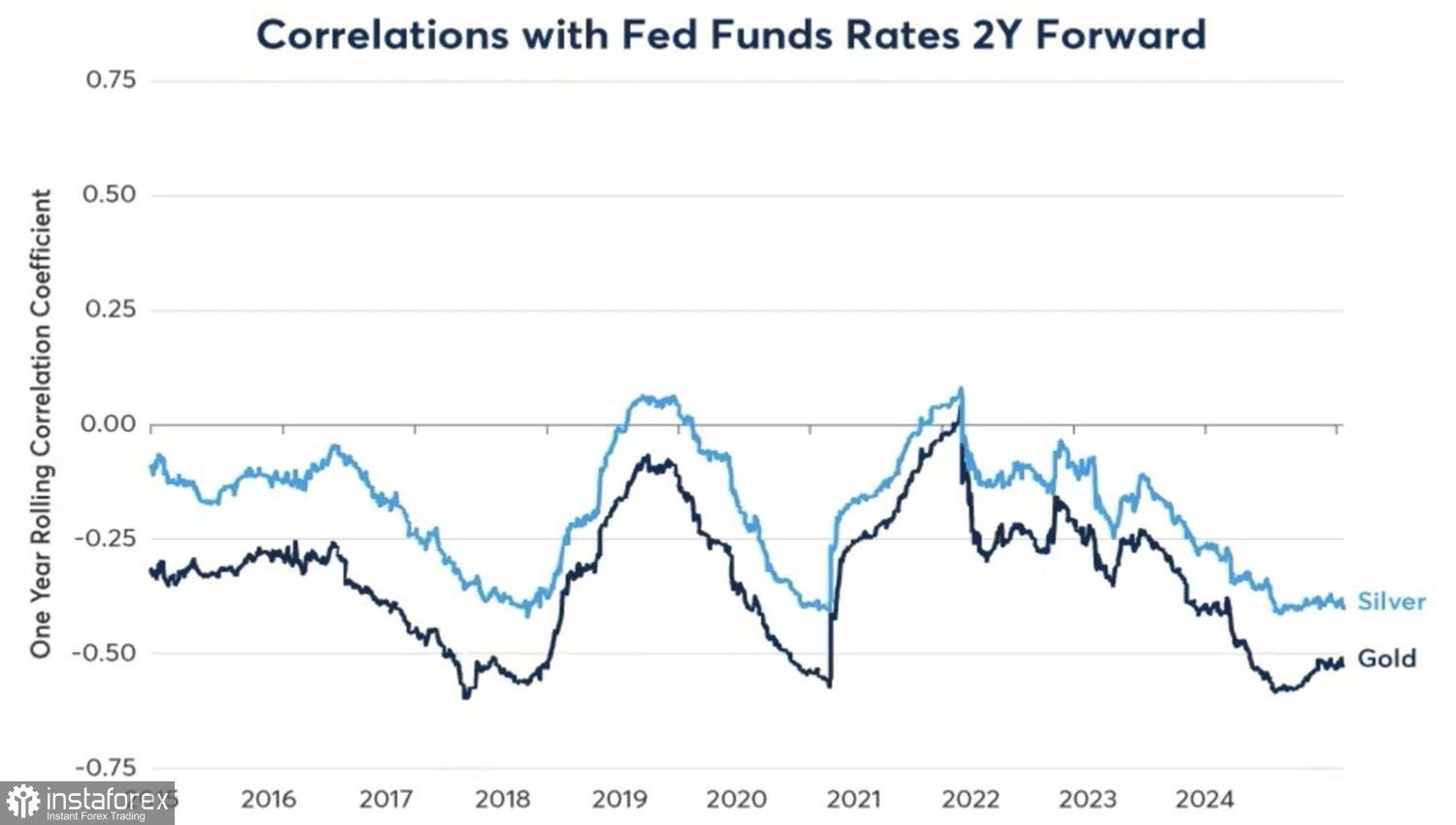

In fact, gold continues to show increased sensitivity to the Federal Reserve's monetary policy. The decrease in the likelihood of a 25 basis points cut in the federal funds rate at the March FOMC meeting from 80% to 52% was a catalyst not only for the strengthening of the U.S. dollar but also for the fall in XAU/USD quotes.

According to CME Group research, the precious metal reacts to the expected short-term market rate over two years. From October 2018 to June 2020, futures transitioned from pricing it at 3% to almost zero, allowing gold to rise from $1,200 to $2,080 per ounce, i.e., by 73%. However, in 2021–2022, the rate increased from zero to 4.5%, which was bad news for the precious metal. Currently, it is falling again, allowing us to talk about bullish prospects for XAU/USD.

Dynamics of gold's correlation with the expected Fed rate

On the other hand, CME Group notes that the quotes already incorporate a 200 basis points reduction in the federal funds rate in 2024–2025. Therefore, to continue the rally, gold will likely need a borrowing cost drop to 3% by the middle of next year. Judging by JP Morgan's optimistic forecasts of the precious metal soaring to $2,175 per ounce in the fourth quarter and up to $2,300 per ounce in the third quarter of 2025, the bank believes in this. But it may be in vain.

The Fed may not weaken monetary policy so aggressively. Strong labor markets and the U.S. economy, on one hand, and the resumption of supply disruptions due to geopolitical conflicts, on the other, risk reversing deflationary processes. High inflation may return, and the Fed's work to reduce it will be in vain. The best option is to sit on the sidelines and observe, at least until June. In such a scenario, gold will continue to be under pressure.

What could help it is only a deterioration in the macro statistics for the States. Not wanting to allow a recession, the Fed may start reducing rates in advance. For example, former St. Louis Fed President James Bullard believes the Fed will loosen monetary policy even before the PCE drops to the 2% target. He argues that delaying the pause might necessitate a sudden 50 basis points rate hike, signaling serious problems in the U.S. economy.

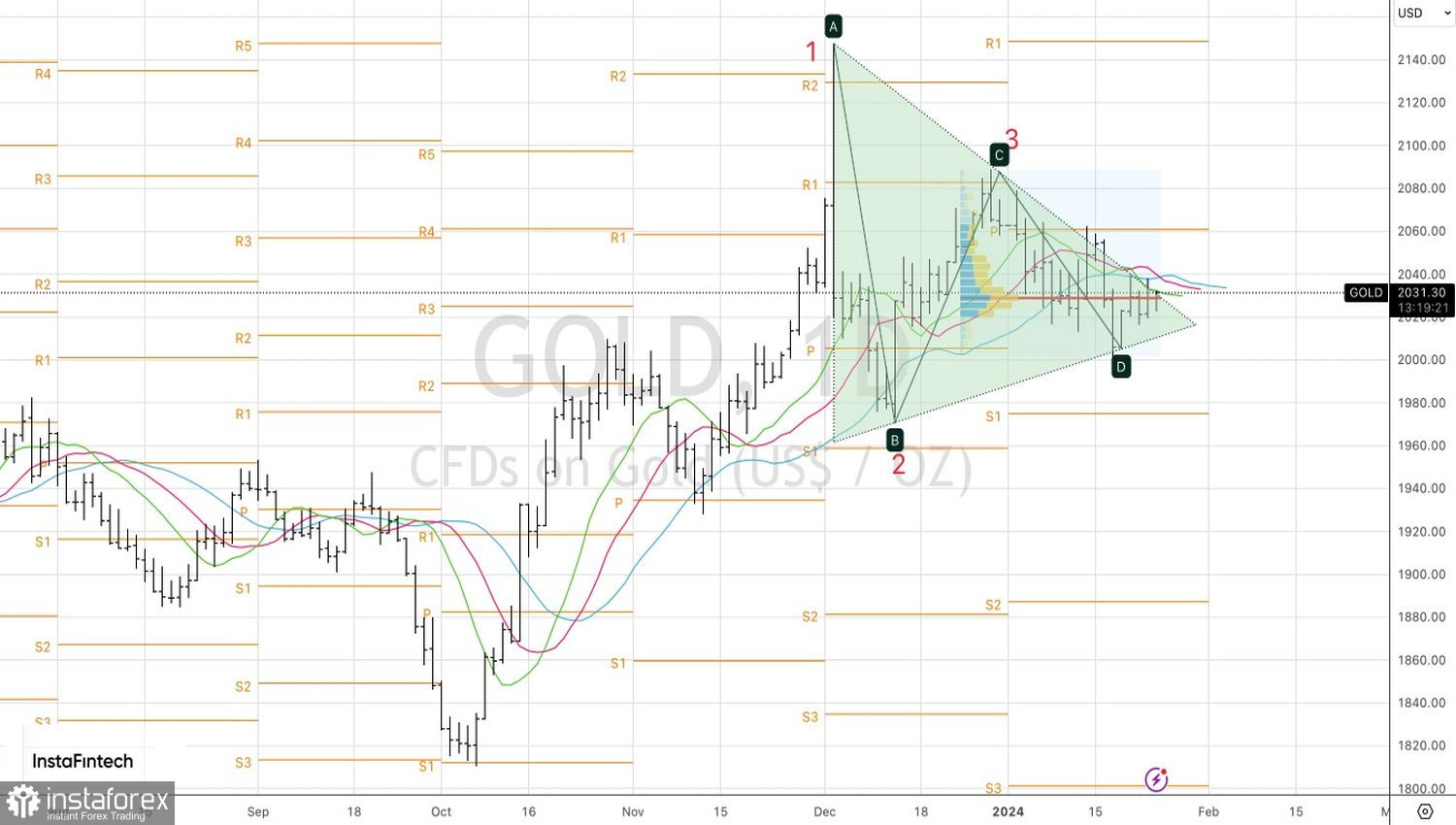

Technically, a triangle formed on the daily chart of the precious metal following the 1-2-3 post pattern. The spring is compressed, and the shot is about to happen. Therefore, it makes sense to place pending orders for buying at $2,040 per ounce and selling at $2,012 per ounce.