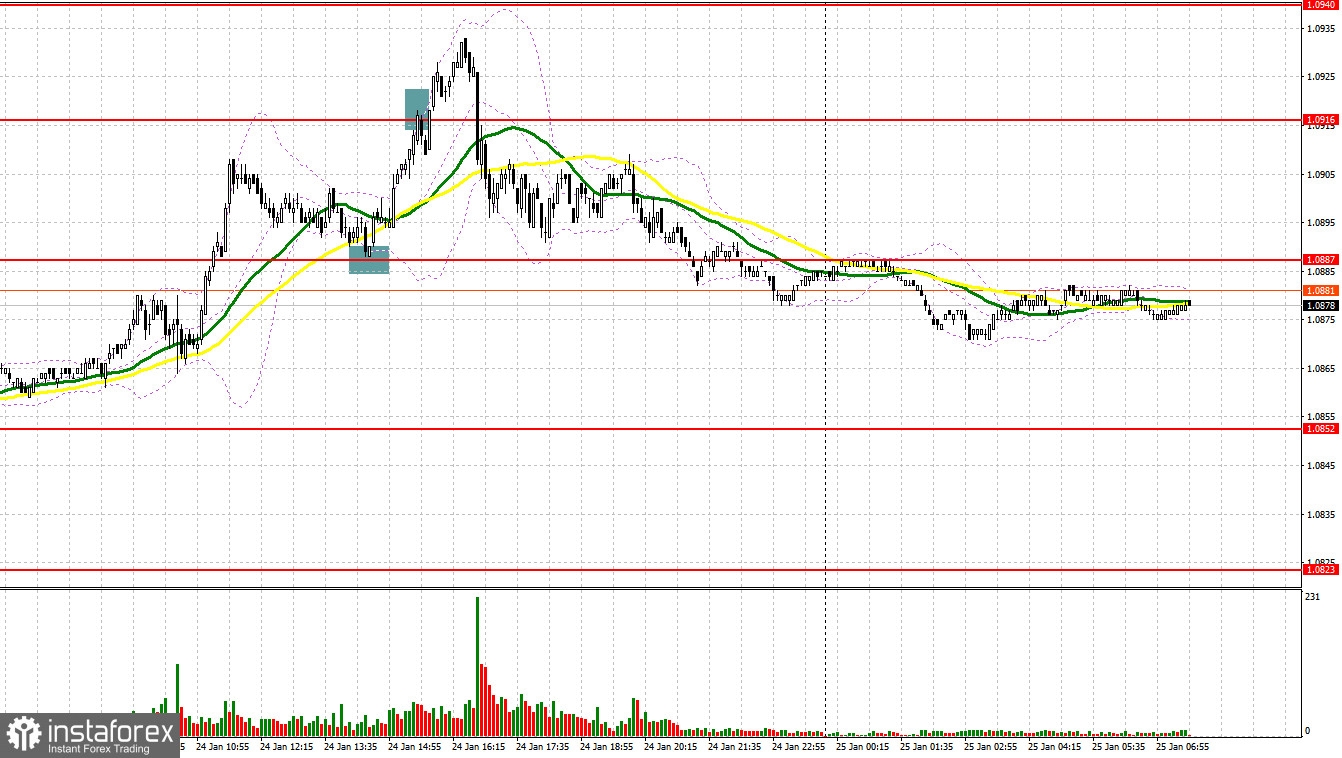

Yesterday, the pair formed several entry signals. Let's take a look at the 5-minute chart and discuss what happened. In my previous forecast, I focused on the level of 1.0887 and recommended making market entry decisions based on it. A rise and false breakout of this level without a retest did not generate a buy signal, so I was forced to skip the whole movement in the morning. In the afternoon, a false breakout at 1.0887 produced a buy signal in continuation of the trend, which pushed the price to rise to the area of 1.0916. Sales occurred after an unsuccessful attempt to settle above this level, which triggered stop-loss orders, as an immediate reversal did not materialize.

For long positions on EUR/USD

Yesterday, strong US PMI data exerted pressure on the euro and strengthened the dollar in the second half of the day, bringing the market back into balance in preparation for today's European Central Bank meeting. Although the ECB is expected to leave interest rates unchanged, hints that it may trim rates earlier than the Federal Reserve could disrupt the plans of risk asset buyers. If the central bank continues to adhere to its policy of tight rates, expressing concerns about inflation while relying on a stable economy, the euro could break out of its sideways channel and perform well against the US dollar. In addition, the pair could be influenced by data on the business climate indicator, the assessment of the current situation, and the IFO economic expectations indicator for Germany. If the indicators turn out to be better than expected, that would be another reason to buy the euro.

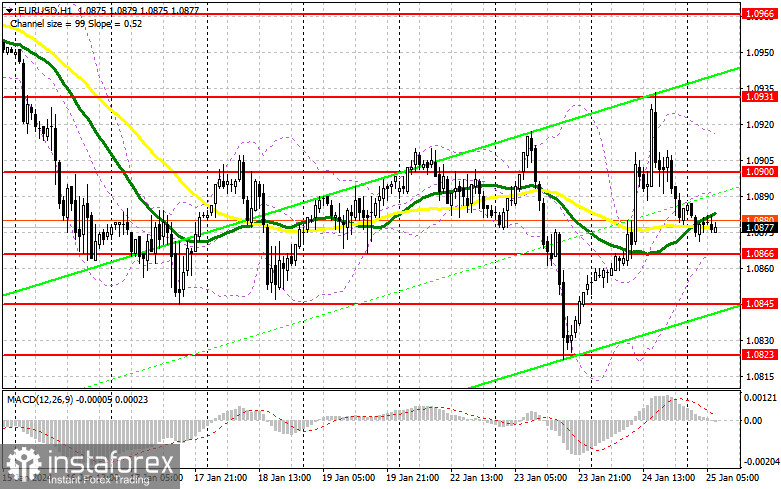

In case the pair falls in the first half of the day, I will act near the nearest support at 1.0866, established yesterday. Forming a false breakout there along with strong German data will be a suitable option for me to enter the market with the goal of correcting higher. This may push the pair to 1.0900. Only a breakout and a downward test of this range will create a good entry point for long positions, aiming for an upward correction and potentially testing 1.0931. The ultimate target is found at the 1.0966 high where I plan to take profits. Testing this level will indicate that a new uptrend will be formed. Should EUR/USD decline and traders show no activity at 1.0866 in the first half of the day, which is likely to be the case, the pressure on the pair will return. In this case, I will try to enter the market after a false breakout forms near 1.0845. I would consider opening long positions immediately on a rebound from 1.0823, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

Bears retain the chances for a bigger sell-off. Very weak German data may exert pressure on the pair, but a lot will depend on Lagarde's statements. In case the pair edges up, sellers will have to defend the nearest resistance at 1.0900. Forming a false breakout on this mark would confirm the presence of major players in the market, which may push the pair down to the area of 1.0866 - an intermediate support, which is in line with the bullish moving averages. It is important to return to this level. Only after a breakout and consolidation below this range, as well as an upward retest, do I expect another sell signal at 1.0845, a break below will be quite difficult. The ultimate target here is the 1.0823 low, where I plan to take profits. In case EUR/USD moves upwards during the European session without bearish activity at 1.0900 along with very good German data, the demand for EUR/USD will return, but this will not lead to a bull market yet. In that case, I will delay going short until the price tests the next resistance at 1.0931. I may consider selling there but only after a failed consolidation. I plan to initiate short positions on a rebound from the 1.0966, aiming for a downward correction of 30-35 pips.

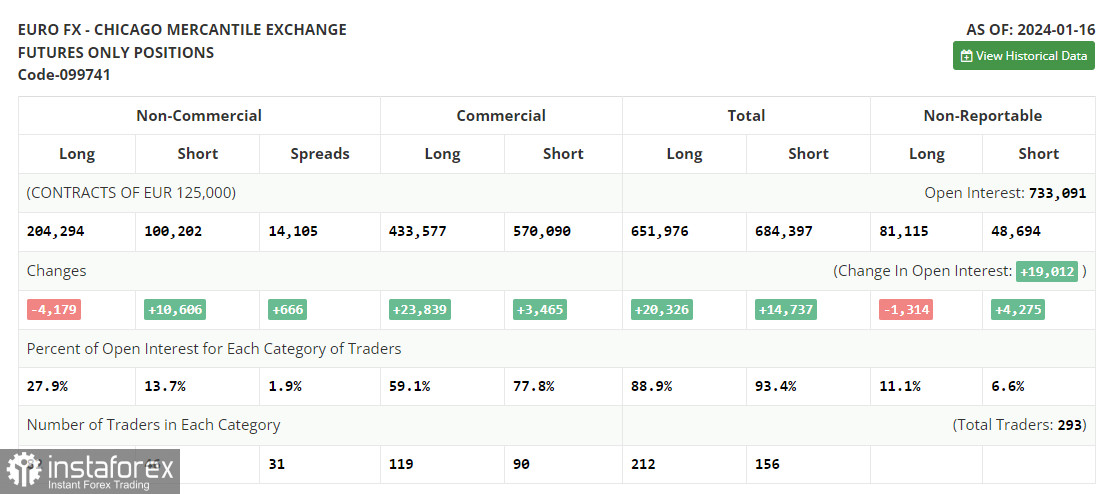

COT report:

In the COT report (Commitment of Traders) for January 16, there was a decrease in long positions and an increase in short positions, which indicates a change in the balance of power in favor of the U.S. dollar. Obviously, a strong labor market and a high probability of a new spike in U.S. inflation early this year helps maintain the chances of a tight policy from the Federal Reserve. If the timing of the first Federal Reserve rate cut is pushed to a later period, this will help the dollar strengthen against the euro. The European Central Bank meeting will be held this week, and the Bank may also leave rates unchanged in its fight against inflation, which should level the euro's position in the EUR/USD pair, and help keep the price within the channel. The COT report indicated that long non-commercial positions fell by 4,179 to 204,294, while short non-commercial positions increased by 10,606 to 100,202. As a result, the spread between long and short positions increased by 666.

Indicator signals:

Moving averages:

Trading just around the 30- and 50-day moving averages indicates sideways movement

Please note that the time period and levels of the moving averages are analyzed only for the 1H chart, which differs from the general definition of the classic daily moving averages on the 1D chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border around 1.0866 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.