Analysis of EUR/USD 5M

EUR/USD extended its losses on Thursday, and there are many questions about it. The euro fell on the back of the European Central Bank's rate decision and the press conference from ECB President Christine Lagarde. However, there were no significant decisions made, and Lagarde's remarks only managed to elicit a mention of the possible rate cut in the summer. Lagarde did not promise that rates would start falling in the summer. She only reaffirmed her remarks that borrowing costs could be lowered from the summer while maintaining a hawkish tone, stating that the ECB is fully committed to its goal of reducing inflation to 2%.

Therefore, from our perspective, there was absolutely nothing in Lagarde's speech that could have triggered the euro's decline. However, the decline is the most logical scenario at this time, even in the absence of a fundamental or macroeconomic background, as we have been mentioned in recent weeks. Nevertheless, after yesterday's drop, the pair remained within an expanded sideways channel. If it used to trade between the levels of 1.0850 and 1.0910, it now trades between the levels of 1.0825 and 1.0910.

In any case, this is a sideways channel, and the price is clearly moving sideways. The fact that the price is currently below the Ichimoku indicator lines provides support to the bears, and we still expect the euro to fall. But for now, everything looks like a regular flat. Moreover, volatility is not very high, so we don't expect the pair to bring back trend movements.

Speaking of trading signals, EUR/USD only generated two. Initially, the pair broke through the range of 1.0878-1.0889, but failed to rise by 15 pips. It was advisable to close all positions before the ECB meeting, as the market reaction was unpredictable. When it became clear that there were no significant results, a sell signal formed in the same range. Traders could have executed this signal with a short position, and it brought about 30 pips of profit.

COT report:

The latest COT report is dated January 16th. As seen in the charts above, it is clear that the net position of non-commercial traders has been bullish for quite some time. To put it simply, the number of long positions is much higher than the number of short positions. This should support the euro, but we still do not see fundamental factors for the euro to strengthen further. In recent months, both the euro and the net position have been rising. However, over the past few weeks, big players have started to reduce their long positions, and we believe that this process will continue.

We have previously pointed out that the red and green lines have moved apart from each other, which often precedes the end of a trend. At the moment, these lines are still far apart. Therefore, we support the scenario in which the euro should fall and the uptrend must end. During the last reporting week, the number of long positions for the non-commercial group decreased by 4,200, while the number of short positions increased by 10,600. Consequently, the net position fell by 14,800. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 104,000. The gap is quite large, and even without COT reports, it is clear that the euro should continue to fall.

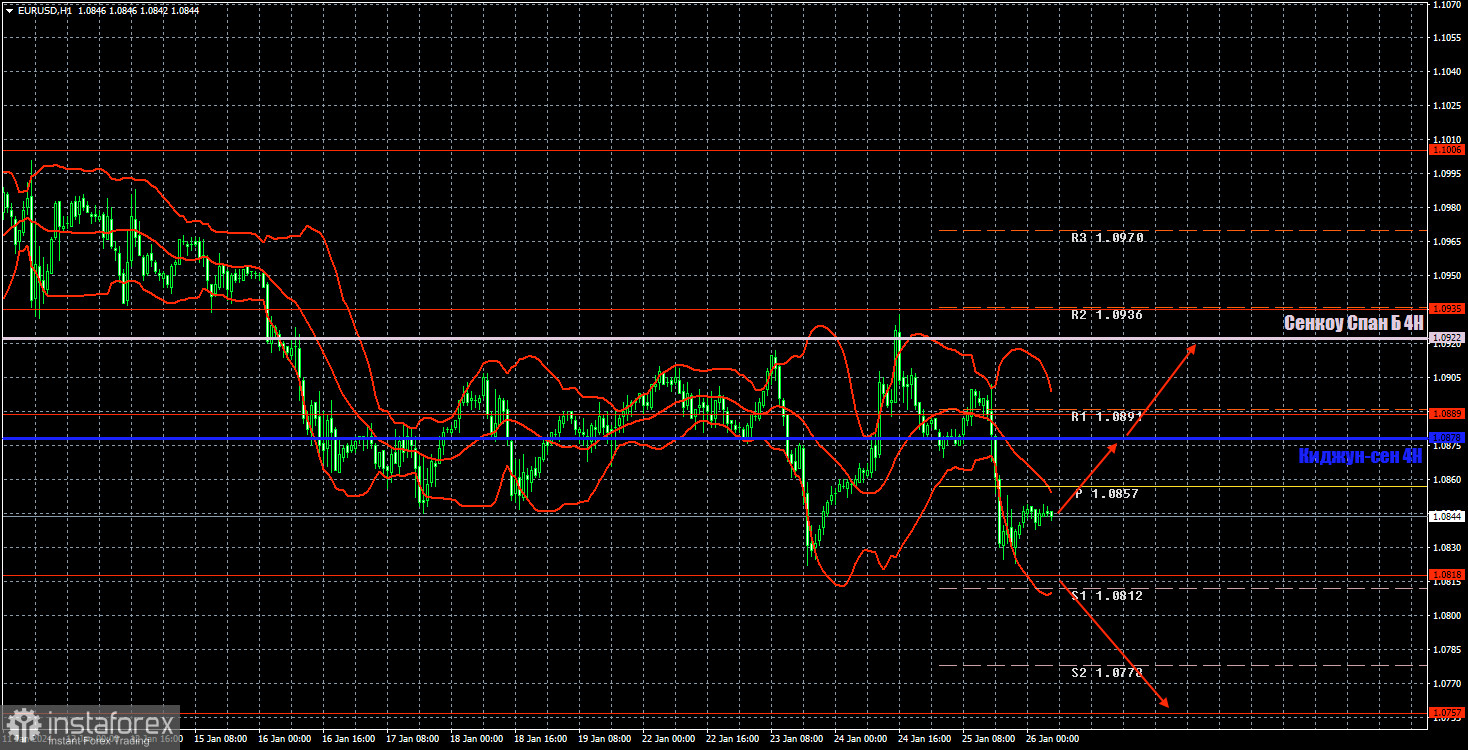

Analysis of EUR/USD 1H

On the 1-hour chart, EUR/USD tested the Senkou Span B line but couldn't settle above it. Everything indicates that the euro has corrected higher and is now ready for a new downward movement. We fully support such a scenario, but there is also the possibility of a flat between the levels of 1.0825 and 1.0910.

Today, we believe that the price may simply return to the critical line. If the price bounces from it, we will consider new short positions with 1.0823 as the target. You may consider long positions if the price consolidates above the Kijun-sen with Senkou Span B as the target. However, in case the pair rises, the flat will persist.

On January 26, we highlight the following levels for trading: 1.0658-1.0669, 1.0757, 1.0823, 1.0889, 1.0935, 1.1006, 1.1092, 1.1137, 1.1185, 1.1234, 1.1274, as well as the Senkou Span B line (1.0922) and the Kijun-sen (1.0878). The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a breakeven Stop Loss if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Friday, there are no important or interesting events lined up in the European Union. From the US docket, only three secondary reports on personal income, consumer spending, and producer prices will be released. We do not believe that these reports are capable of significantly affecting the pair's movement today.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.