Going against the wind is not easy. The U.S. dollar tried to do just that after the ECB meeting and the publication of U.S. GDP data for the fourth quarter. At first, it seemed to succeed, but then the EUR/USD bears were forced to retreat. When stock indices rewrite historical highs, Treasury yields fall, and the chances of a federal funds rate cut in March increase from 41% to 51%, the USD index should decline, which is what eventually happened.

The main drivers of the S&P 500 rally from October to January were artificial intelligence, expectations of positive corporate earnings, forecasts of a Federal Reserve rate cut, and the Goldilocks scenario. This occurs when the economy cools but does not sink into recession, and the rate of inflation growth decreases. The latest macro statistics from the United States confirmed these conditions. The U.S. GDP in the fourth quarter slowed from 4.9% to 3.3%, but the latter figure was much better than the 2% forecasted by Bloomberg experts. Inflation also lost steam, decreasing from 2.6% to 1.7%. It's no surprise that the stock index rewrote its high again.

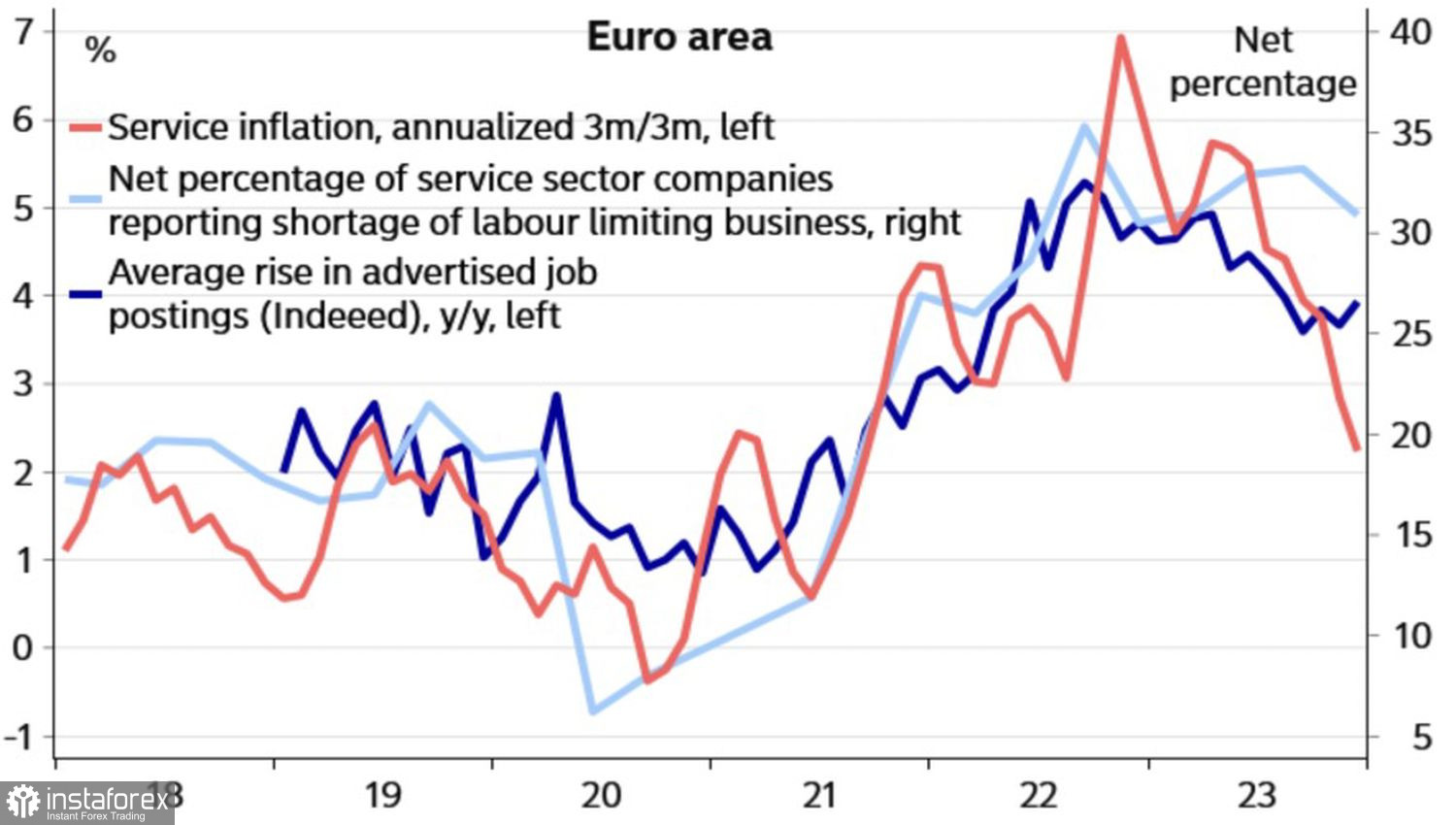

Investors focused on the decline in PCE growth rates, so the chances of a federal funds rate cut in March increased. This dropped bond yields and, in theory, should have negatively impacted the U.S. dollar. Instead, the EUR/USD bears went on the offensive. They were spurred on by Christine Lagarde, who refused to speak about the impossibility of easing the ECB's monetary policy in April when directly asked. At the same time, the Frenchwoman noted the slowdown in wages in the eurozone as an important disinflationary factor.

Eurozone inflation and wage dynamics

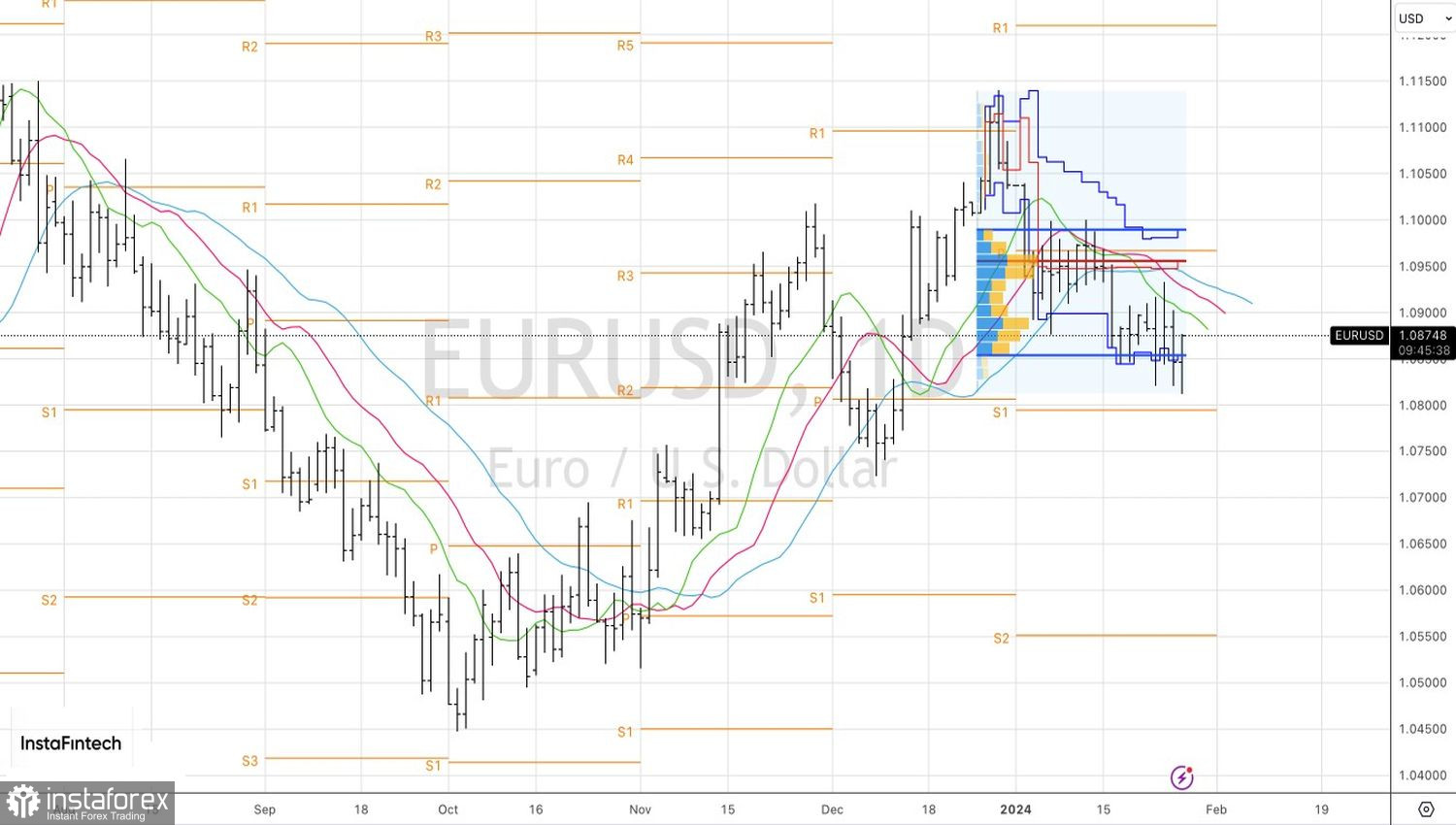

The futures market immediately raised the chances of the European Central Bank starting monetary expansion in April from 60% to 80% and increased the expected scale of deposit rate cuts in 2024 from 130 to 140 basis points. This sank EUR/USD. Though not as deeply as sellers would have liked. After all, the tailwind for the euro is too strong for the pair to leave the 1.085–1.100 consolidation range.

Bulls and bears called a truce in hopes that the packed economic calendar for the week leading up to February 2 would allow EUR/USD to decide on the direction of further movement. Will the Fed choose to remain silent on market pricing of the rate, as the ECB did? Will inflation in the eurozone continue to slow? And will the U.S. labor market finally lose ground? There are many key events, so potential market turbulence should not be surprising.

Technically, on the daily EUR/USD chart, little has changed. The Splash and Shelf pattern remains relevant. Three attempts by sellers to push the quotes beyond the lower boundary of the 1.085–1.100 consolidation range have failed. However, as long as the pair trades below the fair value at 1.0955, bears continue to control the situation. We sell the euro on the rise with a rebound from resistances at 1.09, 1.0925, and 1.0955.