The GBP/USD currency pair stays within the sideways channel of 1.2611-1.2787, but this week, there are finally real chances to exit it after a 1.5-month hiatus. First, we want to remind you that events with significant headlines only sometimes provoke corresponding movements. Thus, it is important to remember that everything will depend on whether or not the market's expectations are being met. Let's analyze macroeconomic and fundamental events in the UK and the US this week.

Monday, Tuesday, and Wednesday in the UK will be "empty." Only on Thursday will the market start receiving important information. It will all begin with publishing a relatively minor business activity report in the second estimate for January. However, a few hours later, the Bank of England meeting will conclude, and Andrew Bailey will deliver a speech. Why is this important and interesting?

Key rates will remain unchanged with a 100% probability. However, the market will find out how many members of the monetary committee voted for a rate hike, how many for unchanged rates, and how many for a rate cut. Recall that several Bank of England directors still vote for monetary policy tightening at each meeting. At the previous meeting, three out of nine did so. According to forecasts, their number may decrease to two at the January meeting, which can be considered a "dovish" signal.

The Bank of England, like other central banks, is expected to start reducing the key rate this year. The question is when it will happen. Andrew Bailey may provide an answer to this question after the meeting. Therefore, Thursday is a super important day for the British pound. On Friday, the UK calendar is empty.

In the US, the fundamental picture will be even more interesting. On Monday – nothing. On Tuesday – the not-so-important JOLTs report on the number of job openings for December. On Wednesday – the not-so-important ADP report on changes in nonfarm employment (analogous to NonFarm Payrolls). Then, the most interesting part begins – the Fed meeting.

Recall that the Fed is closer to the first key rate cut than other central banks. Therefore, any hint, phrase, or lack thereof can lead the market to an important conclusion about future changes in monetary policy. At the end of the January meeting, the rate is unlikely to change, but during Jerome Powell's press conference, he may share important information. Let's hope it won't be too "dovish," as we expect a further strengthening of the US dollar.

This hit parade of important events in the US will continue. On Thursday, a secondary report will be on initial jobless claims and the important ISM Manufacturing Index for January. On Friday – Nonfarm Payrolls, the unemployment rate, average hourly earnings, and the University of Michigan Consumer Sentiment Index. Of course, even important reports will be in the shadow of the Bank of England and Fed meetings and the Nonfarm Payrolls report. However, they can still influence market sentiment, the direction of the pair, and volatility.

Very interesting trading days await us at the beginning of the new week. Due to abundant events and reports, the pound may finally complete the flat pattern. However, conclusions can only be drawn on Saturday and Sunday because, on such strong news, the market will trade impulsively. Therefore, even breaking the boundaries of the sideways channel will not guarantee a specific direction for the pair in the future.

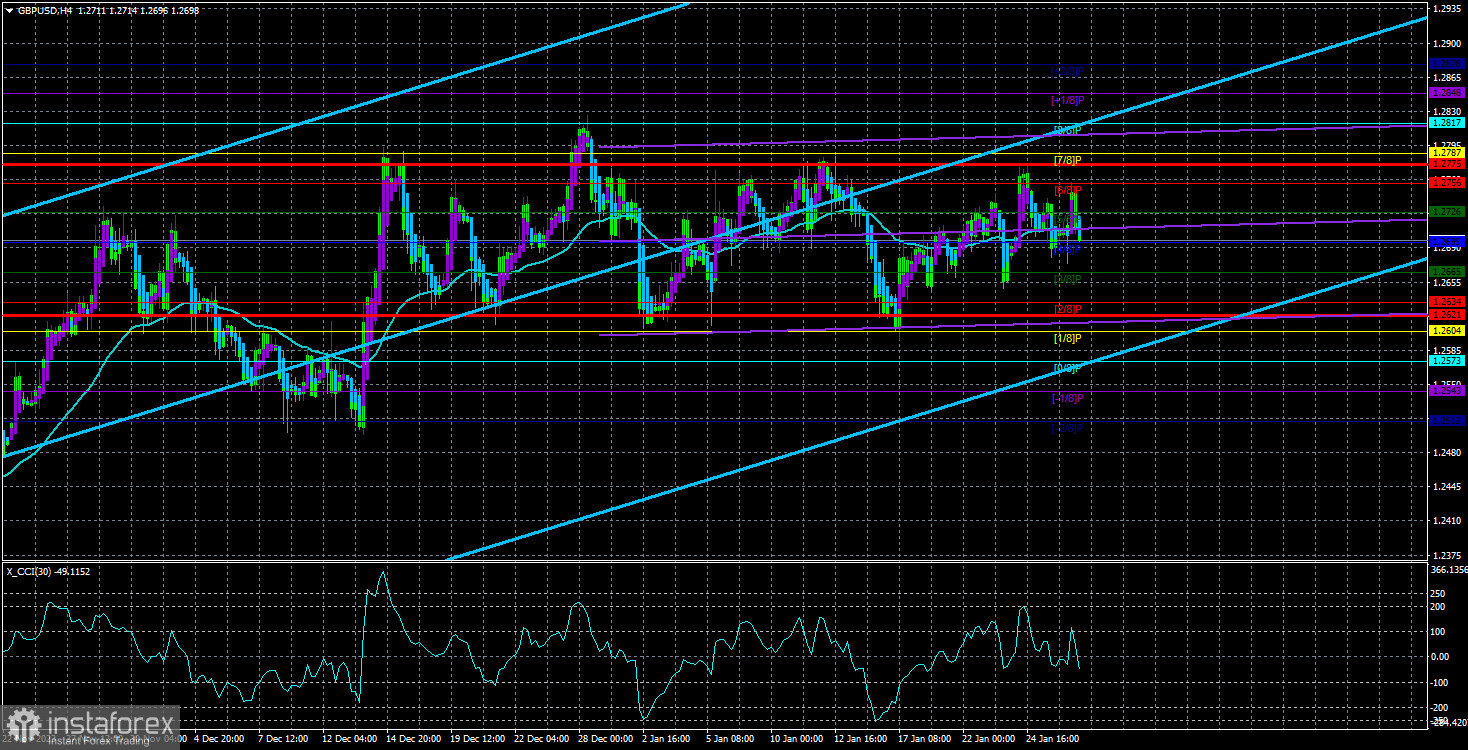

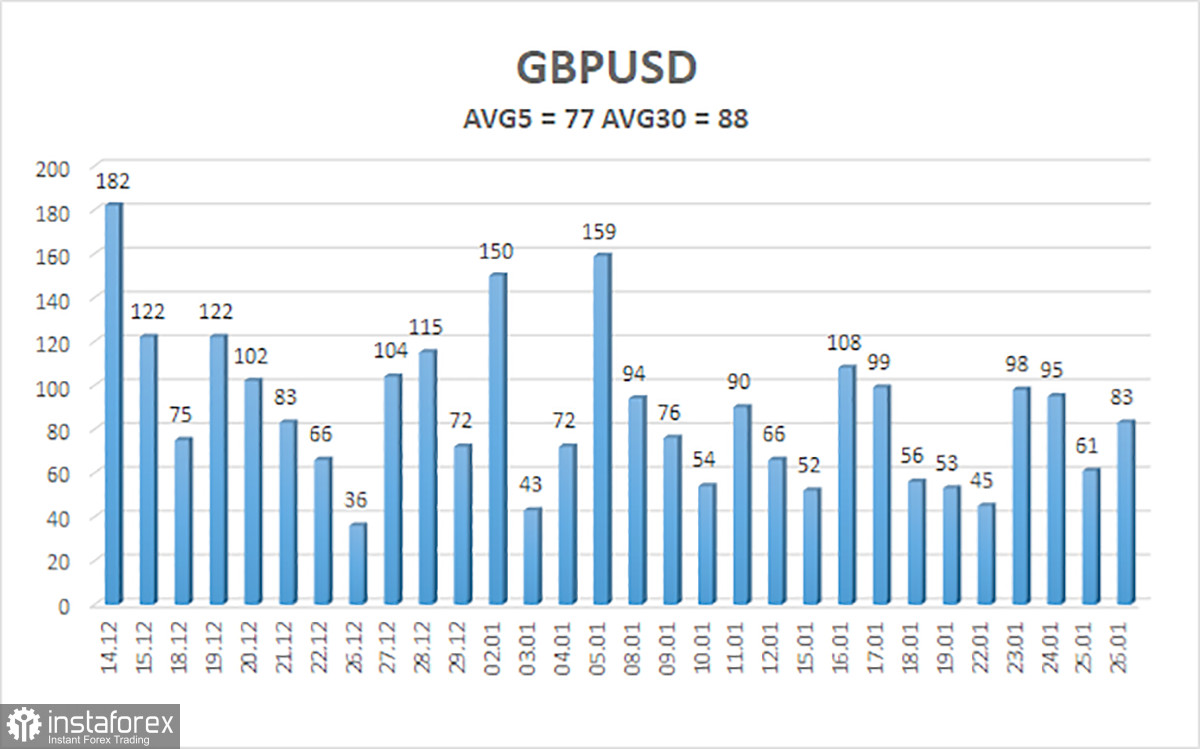

The average GBP/USD pair volatility for the last five trading days is 77 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, January 29, we expect movements within the range limited by the levels of 1.2621 and 1.2775. A reversal of the Heiken Ashi indicator upwards will indicate a resumption of the upward movement within the sideways channel.

Nearest support levels:

S1 – 1.2695

S2 – 1.2665

S3 – 1.2634

Nearest resistance levels:

R1 – 1.2726

R2 – 1.2756

R3 – 1.2787

Trading recommendations:

The GBP/USD currency pair will likely resume its movement toward the level of 1.2787, which serves as the upper boundary of the sideways channel. However, we remind you again that the market has a flat pattern, and movements can be highly random. The price often exceeds the moving average, so it has a formal character. We consider it reasonable to consider short positions with targets at 1.2634 and 1.2604 near the level of 1.2787, but clear sell signals are needed, which are currently absent.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for current trading.

Murray Levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal is approaching.