EUR/USD

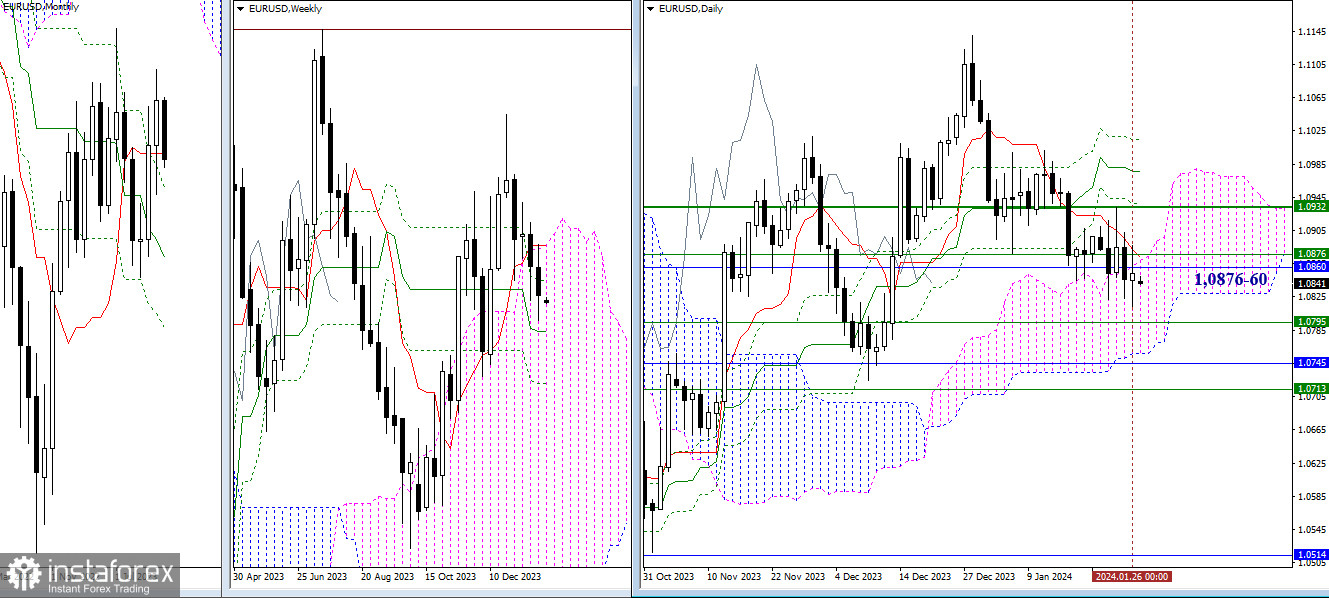

Higher Timeframes

Despite some decrease, the pair couldn't part with the attraction levels around 1.0876 – 1.0860 (monthly short-term trend + weekly Fibonacci Kijun). Therefore, the main conclusions and expectations on this chart section, voiced earlier, remain relevant. If the bears fail to handle the situation, the return of bullish activity will lead to testing the nearest resistances – levels of the daily cross (1.0938 – 1.0977 – 1.1015), with reinforcement from the weekly short-term trend around 1.0932 and the upper boundary of the weekly cloud. If the bears manage to break free from the influence of 1.0876-60, their task will be to navigate through a fairly wide zone of supports, uniting levels of different timeframes (1.0795 – 1.0757 – 1.0745 – 1.0713).

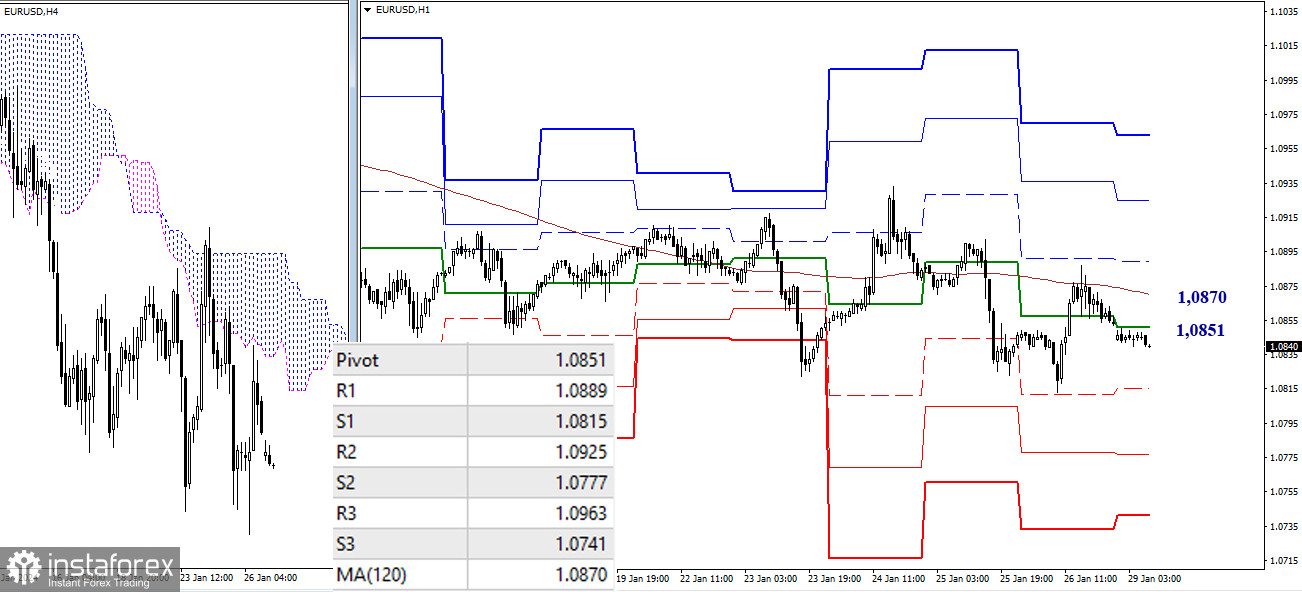

H4 – H1

On lower timeframes, the advantage remains on the side of bearish players. Yesterday, they tested the resistance of the weekly long-term trend but couldn't seize the key level and change the situation. Nevertheless, the pair is currently in a correction zone, and to continue the trend, it is necessary to update the low (1.0813). Other intraday targets will be the supports of classic pivot points (1.0815 – 1.0777 – 1.0741). A shift in sentiment and balance of power is possible only after overcoming the key levels of 1.0851 – 1.0870 (central pivot point + weekly long-term trend). Further targets for an upward movement in this case will be the resistances of classic pivot points (1.0889 – 1.0925 – 1.0963).

***

GBP/USD

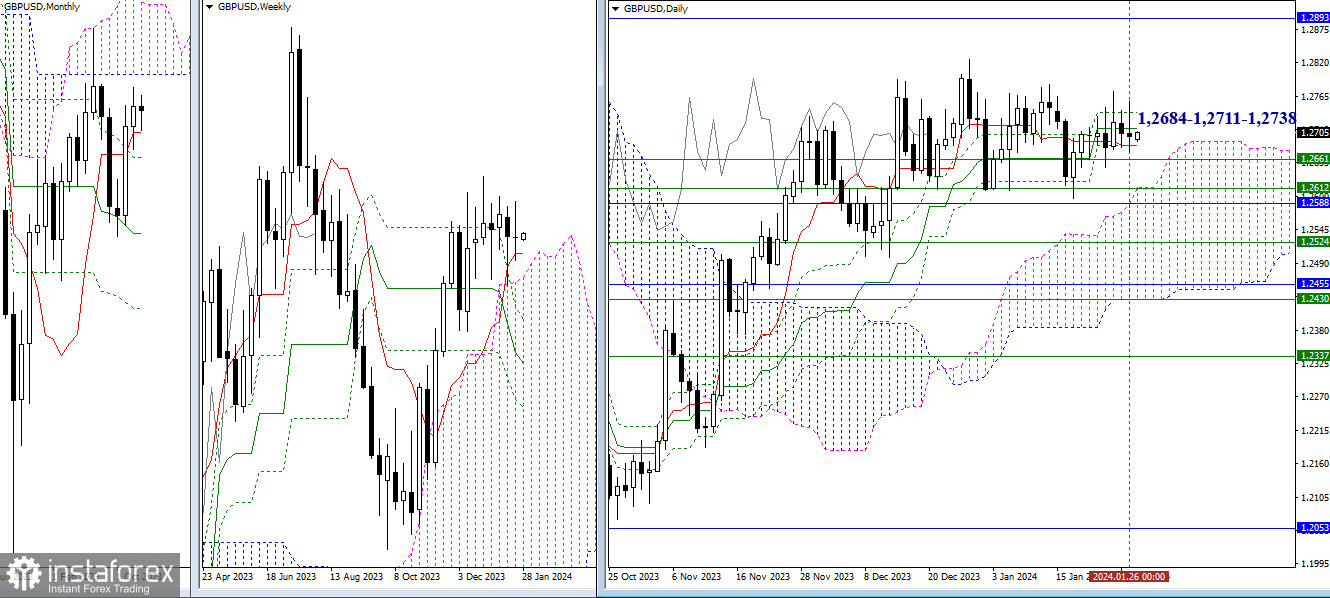

Higher Timeframes

The past week retained uncertainty. The pair continues consolidation around the levels of the daily Ichimoku cloud (1.2684 – 1.2711 – 1.2738). In the current situation, breaking out of the consolidation zone, overcoming the highs (1.2784 – 1.2826), and moving towards the lower boundary of the monthly cloud (1.2829) remain crucial for bullish players. For bears, supports of various timeframes continue to obstruct their path, located at the boundaries of 1.2661 – 1.2612 – 1.2588.

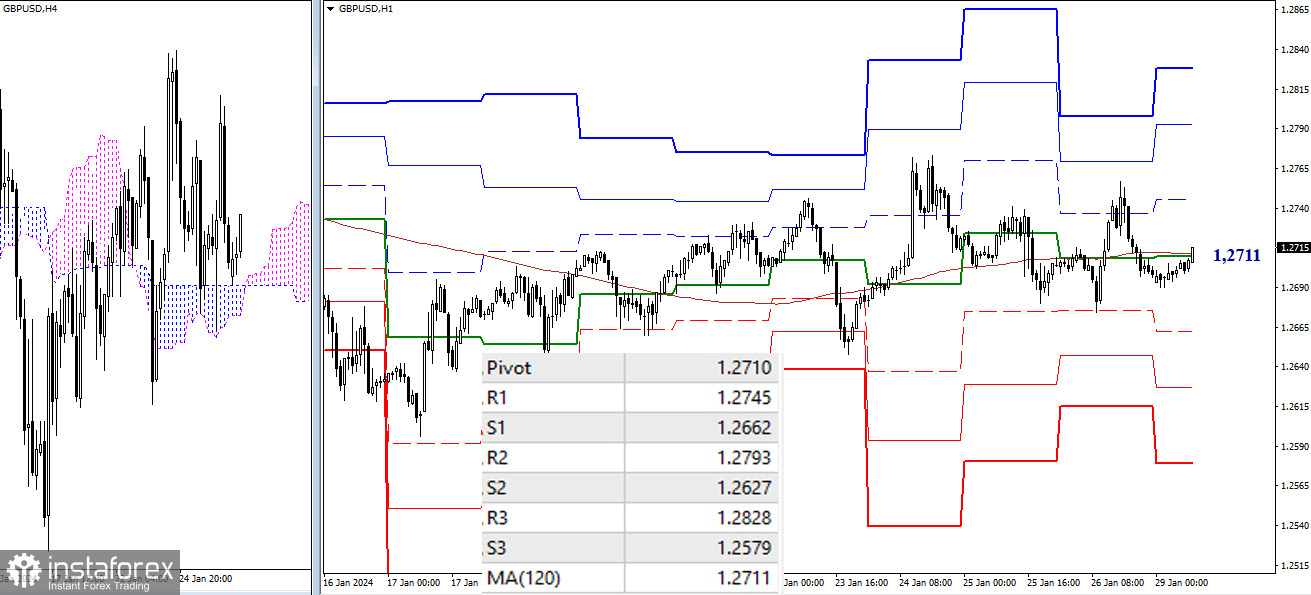

H4 – H1

Key levels 1.2711 and 1.2710 (weekly long-term trend + central pivot point of the day) have combined their efforts today, and the pair is currently engaged in testing them. As a result, the situation can be characterized as uncertain. Trading above these levels favors bullish players. Intraday bullish targets include the resistances of classic pivot points (1.2745 – 1.2793 – 1.2828). However, if events unfold below key levels, bearish players will have the advantage. Strengthening bearish sentiments is possible through the breakdown of supports of classic pivot points (1.2662 – 1.2627 – 1.2579).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)