Against the backdrop of a sparse economic calendar on Monday, the DXY index is rising, and the dollar is strengthening, but not against major commodity currencies. The EUR/USD pair is particularly notable, with the euro declining against the dollar and major cross pairs.

Market participants continue to analyze the results of last week's ECB meeting. As known, the bank leaders left interest rates unchanged: the key rate at 4.50%, the deposit rate at 4.00%, and the marginal rate at 4.75%. They also stated that it is too early to discuss a correction of monetary policy towards easing, as inflation remains high.

Speaking at the press conference, European Central Bank President Christine Lagarde stated that it is necessary to ensure a sustainable movement of the Consumer Price Index toward the target level of 2.0%. In her opinion, despite the persistence of risks of an economic downturn in the Eurozone, including conflicts in Ukraine and the Middle East, discussing a move to soften monetary policy parameters prematurely is not warranted at the moment.

However, there are still some factors that could increase pressure on the ECB when deciding on interest rates at upcoming meetings towards a reduction.

Firstly, the increased comments from ECB representatives that there is no need to wait for wage data, which is expected in May, before making any rate decisions. This was recently stated by ECB Governing Council member Mario Centeno. In early January, he claimed that the key interest rate of the European Central Bank would soon approach its peak. In his view, it is necessary to start lowering rates sooner rather than later, while avoiding sharp movements, as "inflation is steadily declining" and "almost all factors contributing to price growth have weakened."

Indeed, if the expected January data on consumer inflation in the Eurozone, to be released on Thursday, confirm a slowdown in the year-on-year Consumer Price Index (CPI) from 2.9% to 2.8% (and the core indicator from 3.4% to 3.2%), they will strengthen market expectations of the first interest rate cut in the Eurozone as early as April.

It is not ruled out that Centeno expressed the opinion of many ECB leadership members in his comments.

However, sharp movements in the EUR/USD pair may already begin on Tuesday and Wednesday when the Federal Reserve announces its interest rate decision at 19:00 (GMT).

It is widely expected that the interest rate will be maintained at the 5.50% level. Market participants will be interested in updated forecasts and comments from Federal Reserve representatives, especially regarding near-term plans and the March meeting of the U.S. central bank.

At 19:30, the press conference of the Federal Reserve Open Market Committee will begin. Any unexpected statements from Powell on the credit and monetary policy of the Federal Reserve will trigger an increase in volatility in the U.S. stock market and the dollar quotes, including the EUR/USD pair.

On Tuesday, at 09:00 and 10:00 (GMT), preliminary estimates of German and overall European GDP will be published. A continuation of the slowdown in the GDP of Germany and the Eurozone in the fourth quarter is expected, which should have a negative impact on the euro.

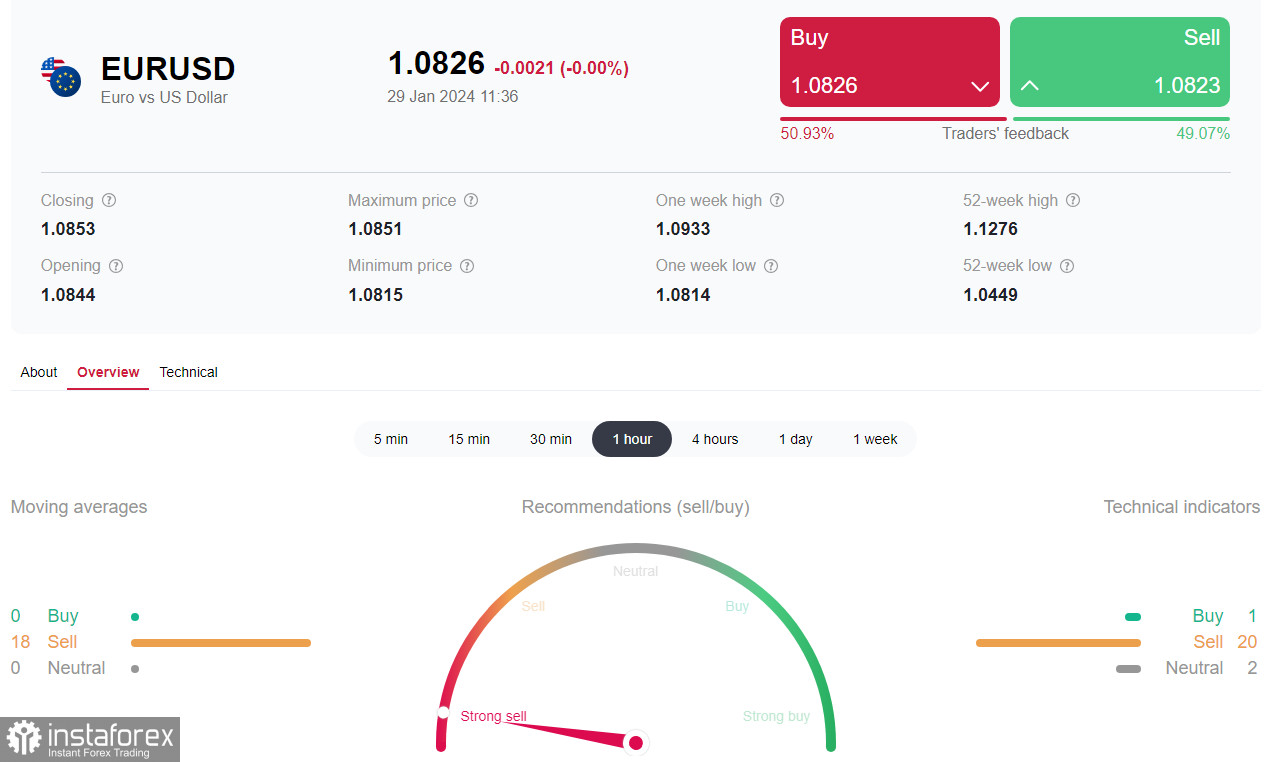

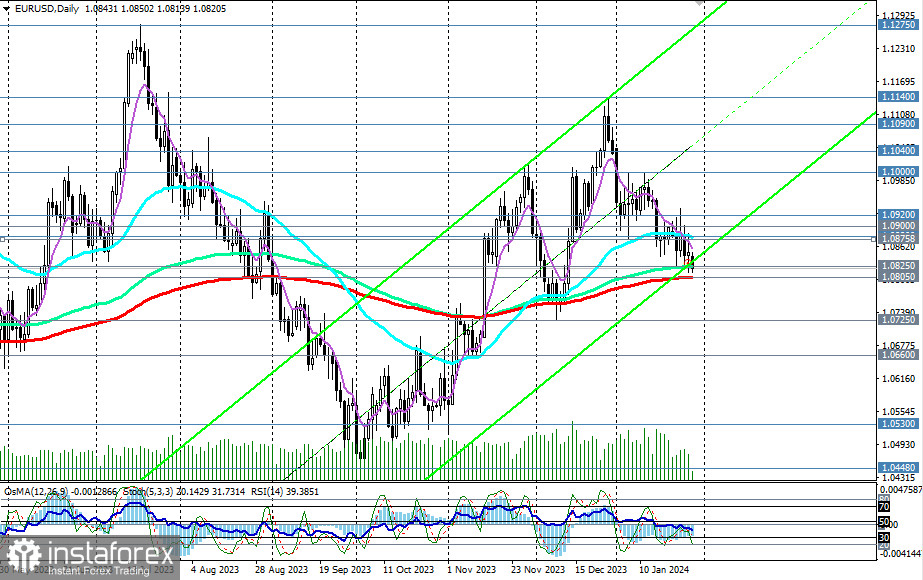

Opening today's trading day with a downward gap, at the beginning of the European trading session, the EUR/USD reached the zone of key support levels, separating the medium-term bullish market from the bearish one. Thus, as of writing, the pair was trading near the level of 1.0825, through which an important medium-term support level passes (144 EMA on the daily chart). A breakdown of the key support level of 1.0805 (200 EMA on the daily chart) will bring the EUR/USD into the zone of the medium-term bearish market, reinforcing the downward dynamics of the pair, which remains trading in the area of the long-term bearish market, below the key resistance level of 1.1000.