Wall Street Closes in the Red as Investors Brace for New Challenges

US stock markets closed Monday with the major indexes down about 1% as Treasury yields rose, driven by traders' revised forecasts for the Federal Reserve's future policy and concerns about the impact of instability in the Middle East on global oil prices. Escalation and anticipation of new data

Market participants continue to analyze economic indicators and prepare for the start of the earnings season for major companies. Additional concerns are caused by the approaching Hurricane Milton, which is expected to reach the United States in the coming days. Recall that Hurricane Helene, which recently swept across the country, claimed more than 200 lives and affected six states, leaving significant damage and requiring large-scale restoration work.

Corporate news: a blow to the giants

Investor sentiment worsened after a US court decision against Alphabet, which will have to reconsider its approach to mobile applications. This is due to the need to expand the capabilities for Android users, which may affect the company's profitability. In turn, analysts' forecasts caused a decline in the shares of such tech giants as Amazon and Apple.

Rising bond yields: Fed rate revision

Friday's employment report turned out to be more optimistic than expected, which prompted market participants to revise their expectations regarding future Fed decisions. Traders have now virtually ruled out the possibility of a 50 basis point rate cut in November, with an 86% chance of a 25 basis point rate cut. Moreover, there is a 14% chance that the Federal Reserve will leave rates unchanged, according to the CME FedWatch tool.

Record 10-Year Note Yield

The adjustment in interest rate expectations has led to a sharp rise in US Treasury yields. For the first time in two months, the yield on 10-year US government securities has exceeded 4%, which has become an additional factor of pressure on the stock market.

Experts continue to monitor the situation and predict possible fluctuations depending on new macroeconomic data and corporate reports, which can determine the further direction of the markets.

Investors await key economic signals

The financial world is eagerly preparing for the publication of the consumer price index for September and the start of the third quarter earnings season, which can set the direction for the markets in the coming months. Attention is also focused on the upcoming Federal Reserve meeting next month. With the first quarterly earnings results from major banks already underway, market participants will be closely monitoring the sector to assess the economic situation and possible regulatory measures.

Geopolitics heighten risks in the Middle East

In parallel with economic expectations, tensions in the Middle East are increasing, causing concern among investors. The Lebanese group Hezbollah has launched rocket attacks on northern Israel, including the major port city of Haifa. In response, the Israeli military is demonstrating its readiness to expand ground operations in southern Lebanon. Concerns about a possible escalation of the conflict are adding to the turbulence in stock and commodity markets.

Leading indices decline

The main US indices closed trading with significant losses on Monday. The Dow Jones Industrial Average fell by 398.51 points (0.94%) and closed at 41,954.24. The broad S&P 500 fell 55.13 points, or 0.96%, to 5,695.94, while the tech-heavy Nasdaq Composite lost 213.94 points, or 1.18%, to end the day at 17,923.90.

Fear Index Soars

The CBOE Volatility Index (VIX), often seen as a gauge of market uncertainty and panic, jumped 3.4 points to 22.64, its biggest one-day gain in a month and a half and its highest close since early August, signaling heightened nervousness among market participants.

Energy Gains on Oil Price Jump

Of the 11 key S&P 500 sectors, only energy ended the day in the green, up 0.4%. Oil prices continued to rise amid concerns about potential supply disruptions due to the escalation in the Middle East, leading to a fifth straight day of gains for U.S. crude futures, which rose 3.7%.

Worst Losers: Utilities and Communications

Utilities were the worst performers among all sectors, falling 2.3%. The communications sector was also hurt by a significant decline in Alphabet shares, with the tech giant's stock falling 2.5%, continuing a string of negative news for the company.

Stock analysts continue to closely monitor macroeconomic and geopolitical factors that could impact further market dynamics in the coming days.

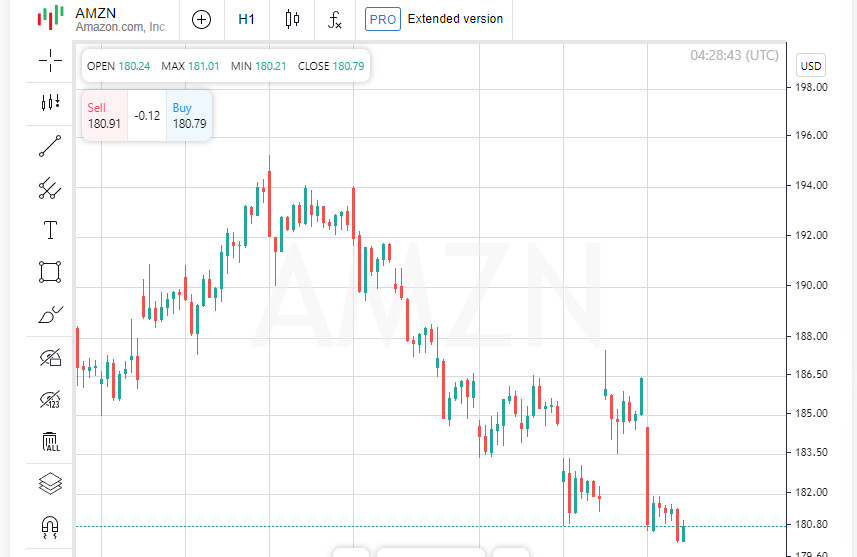

Giants Fall: Apple and Amazon Under Pressure

One of the most notable moves in the market was a sharp decline in Apple shares after Jefferies analysts changed their outlook on the stock from a "buy" to a "hold." As a result, the company's shares fell by 2.3%, which was the largest decline among the components of the S&P 500 index on the day. Following it, Amazon shares also came under pressure, ending the trading session with a decline of 3%. This happened against the backdrop of a rating downgrade by Wells Fargo, which increased investor pessimism towards the e-commerce giant.

Generac in the Spotlight Amid Hurricane

At the opposite extreme of the index, Generac Holdings was the company whose shares soared by 8.52%. The growth was caused by increased demand for generators and backup power systems, which is associated with expectations of another hurricane approaching the United States. Investors are betting that demand for the company's products will increase significantly in the event of major disruptions and power outages.

Pfizer on the Rise with Activist Investor

Shares in pharmaceutical giant Pfizer rose 2% after news that hedge fund Starboard Value had acquired a stake in the company worth about $1 billion. The entry of a major shareholder known for his active influence on the management of companies has fueled optimism among investors who expect the new strategic stake could spur growth.

Air Products and Chemicals Succeeds: Mantle Ridge's Bet

Shares in Air Products and Chemicals also saw a strong move, closing with an impressive 9.5% gain after news that hedge fund Mantle Ridge had increased its stake in the company, raising expectations for a positive change in the company's strategy.

Overall Market Sentiment: Bearish sentiment prevails

Despite positive results from some companies, the overall market sentiment remained negative. On the New York Stock Exchange, decliners outnumbered advancers by a ratio of 2.73 to 1. There were 222 new highs and 55 new lows on the day, highlighting the significant volatility in the market.

On the tech-heavy Nasdaq, the picture was even grimmer, with 2,988 stocks ending the day in the red against 1,292 gainers, reflecting a ratio of 2.31 to 1. The S&P 500 posted 34 new yearly highs and just two new lows, while the Nasdaq reported 83 highs and 118 new lows, highlighting the bearish sentiment prevailing among market participants.

Trading Volumes Decline

Trading volume on U.S. stock exchanges totaled 11.39 billion shares, below the 20-session average of 12.06 billion shares. The decline in activity points to uncertainty among market participants, who are likely to take a wait-and-see approach ahead of upcoming economic and corporate events.

Global Markets Under Pressure: U.S. Bond Yields Rise

Global stock indices began the new week in negative territory, while U.S. Treasury yields continued to rise steadily. Benchmark 10-year bonds rose above 4%, signaling to investors that the Federal Reserve may be changing its monetary policy. The gain was the highest since early August and confirmed that market participants are preparing for a less aggressive rate cut by the Fed.

Yields hit record high after strong employment data

The 10-year Treasury yield hit 4.033%, the highest since August 1 and the first time it has been above 4% since August 8. The reason was last Friday's employment report, which was much better than expected and significantly changed expectations for the central bank's next steps. Investors believe that the Fed may take a more cautious stance and avoid sharp rate cuts, which has led to a revision of market forecasts.

Rate change probability: the market has adjusted expectations

The probability of the Fed cutting rates by 25 basis points in November is now estimated at 84.6%, and the chances that the regulator will leave rates unchanged have increased to 15.4%, according to the CME FedWatch Tool. Just a week ago, the market was confident that a 25 basis point cut was imminent and even priced another, larger 50 basis point cut at 34.7%.

Strategists Warn of a Possible Reversal

"The market has changed its outlook dramatically, from expecting a significant rate cut in November to expecting rates to remain unchanged," said Gennady Goldberg, chief rates strategist at TD Securities in New York. He said the shift in expectations occurred in just a few days, amid positive macro data that has forced investors to rethink their positions.

"It would be surprising for the Fed to back off from further cuts so quickly after the recent 50 basis point cut," Goldberg added. He stressed that the market is still in flux and much will depend on data in the coming weeks.

Outlook for the Future: Cautious Optimism or Pause?

Financial analysts agree that the Federal Reserve is unlikely to take any drastic steps, given that the recent rate cuts have already caused significant volatility in the markets.

Instead, the regulator may prefer to wait and see how previous decisions affect the economy and inflation. At the same time, some market participants warn that current expectations may change again if future economic data is not as optimistic as the latest employment figures.

The market situation remains tense, and any change in expectations could affect Treasury yields, which in turn will affect stock performance and overall volatility.

US markets close in the red: only the energy sector showed growth

Trading on Wall Street on Monday ended with quotes falling, and only the energy sector was able to stay in positive territory. Shares of energy companies included in the S&P 500 index showed growth amid continuing rise in oil prices. This is due to concerns that the deepening crisis in the Middle East could lead to disruptions in the supply of raw materials and restrictions on exports.

Global indices under pressure: MSCI goes into the red

The MSCI world share index lost 3.66 points (0.43%), falling to 843.74. This was the fifth decline in the last six trading sessions. The tense situation in global markets reflects increasing caution among investors ahead of important economic data. At the same time, the European STOXX 600 index managed to break into positive territory, closing with a gain of 0.18%. Despite this, the rise was limited due to pressure on sectors sensitive to interest rate changes, such as real estate and utilities.

Treasury yields again went up

The yield on 10-year US Treasury bonds jumped by 4.3 basis points, reaching 4.024%. This follows a recent revision to expectations for the Federal Reserve's rate path. Short-term 2-year notes, whose yields are closely linked to interest rate expectations, also rose 5.7 basis points to 3.989%. Earlier in the session, their yield rose to 4.027%, the highest since August 20.

Yield Curve Signals Sentiment Shift

Investors are closely watching the behavior of the Treasury yield curve, which is considered an important indicator of economic expectations. The gap between the 2-year and 10-year yields, which has been inverted for some time, is now positive at 3.3 basis points.

This is the first time the curve has shown a sustained increase since briefly falling into negative territory on September 18. An inversion of the yield curve is traditionally seen as a harbinger of a recession, and its return to positive territory may signal an easing of concerns about an economic downturn.

Awaiting Key Data: All Eyes on CPI

Economic uncertainty remains as key U.S. macroeconomic data is not due until Thursday. Investors are awaiting the release of the Consumer Price Index (CPI), which could provide further clues about the Federal Reserve's next steps.

Earlier, Fed Chairman Jerome Powell and his colleagues said the central bank was now shifting its focus from fighting inflation to maintaining labor market stability. The announcement triggered a revision in market expectations, adding uncertainty to the near-term rate outlook.

Market participants are now taking a wait-and-see approach, hoping for more data to help clarify the path the Fed will take in managing monetary policy.

Top Fed Officials Set to Speak: Markets Await Signals

Market participants are eagerly awaiting speeches from several key Federal Reserve officials this week. Fed Governor Michelle Bowman and Atlanta Fed President Raphael Bostic are scheduled to speak on Monday, which could shed light on the current sentiment of the Fed and provide additional clues about future rate management.

Kashkari: US economy showing resilience

Minneapolis Fed President Neel Kashkari noted that despite signs of a slowdown, the labor market remains strong, supporting overall economic stability. He said the Fed's goal is to maintain current labor market conditions even as rates are lowered, which should support sustainable growth. The statements confirm that the Fed is prepared to tread carefully to avoid abrupt changes in the economy.

Oil Market Shows Solid Gains

Oil prices continue to rise amid geopolitical tensions and expectations of further supply disruptions. U.S. crude oil rose 3.71% to $77.14 a barrel. Meanwhile, Brent crude also rose 3.69% to close the day at $80.93 a barrel. Energy demand is picking up, with traders keeping a close eye on the situation in the Middle East for fear of further disruptions to supply chains.

Dollar at a crossroads: currency gyrations continue

The dollar index, which measures its strength against a basket of six major currencies, was down 0.05% to 102.48. The euro, meanwhile, was also down slightly to $1.0973. Meanwhile, the Japanese yen strengthened, rising 0.42% against the dollar to close the day at 148.09 yen after recently hitting a seven-week high of 149.13. The British pound also slipped, losing 0.22% to end the day at $1.3083. This points to continued volatility in currency markets, where investors are assessing the risks and prospects for monetary policy in the world's largest economies.

BoJ prepares for rate hike: wage growth will be key factor

The Bank of Japan said wage growth is becoming more sustainable, which is helping to boost consumer activity. As companies across the country pass on higher costs to consumers, the Japanese economy is moving closer to meeting the conditions for raising interest rates. This could be a significant step forward for the Bank of Japan, which has long maintained an ultra-loose monetary policy.

Analysts say that any changes in central bank policy could significantly affect sentiment in global markets. Investors will be watching the Fed's speeches and news from Japan to understand how events will develop and what actions the world's largest central banks may take in the coming months.