The time for summarizing the meetings of the Federal Reserve (FOMC) and the Bank of England is approaching. The FOMC meeting will start on Tuesday and conclude on Wednesday. The BoE meeting will start on Wednesday and end on Thursday. The euro and the pound are under moderate market pressure, but their recent movements have been different. The euro has shifted to building a bearish wave, according to the current wave analysis, while the pound continues to trade horizontally.

The market consensus on the Fed's rate has shifted from March to May, but some market participants still insist on a rate cut in March. One of the world's largest banks, Goldman Sachs, said that it expects the Fed to cut interest rates 5 times this year, starting in March. Since the March meeting will be the second meeting this year, the bank's analysts assume at least two pauses during the year. Five 25 basis point cuts would bring the benchmark down to 4.25% by the end of the year.

Goldman Sachs analysts believe that the Fed has achieved a sufficient level of progress in inflation and will not wait for inflation to drop to 2% before starting the rate cut cycle. The bank also believes that current labor market indicators are a reason to start easing sooner rather than later. Take note that new labor market data will be published on Friday, and there are other important reports throughout the week. The latest GDP report for the fourth quarter exceeded market expectations by 1.3% (+3.3%), so personally, I believe that the FOMC will not lower the rate in March.

However, if the market believes in a rate cut in March or if Fed Chair Jerome Powell hints at a faster easing of monetary policy on Wednesday, the US dollar may lose demand again, significantly damaging the current wave analysis. I assume that the market has already priced in the factor of a rapid transition to FOMC rate cuts in 2024, so I still expect the US dollar to strengthen. However, the market has often twisted facts to its advantage.

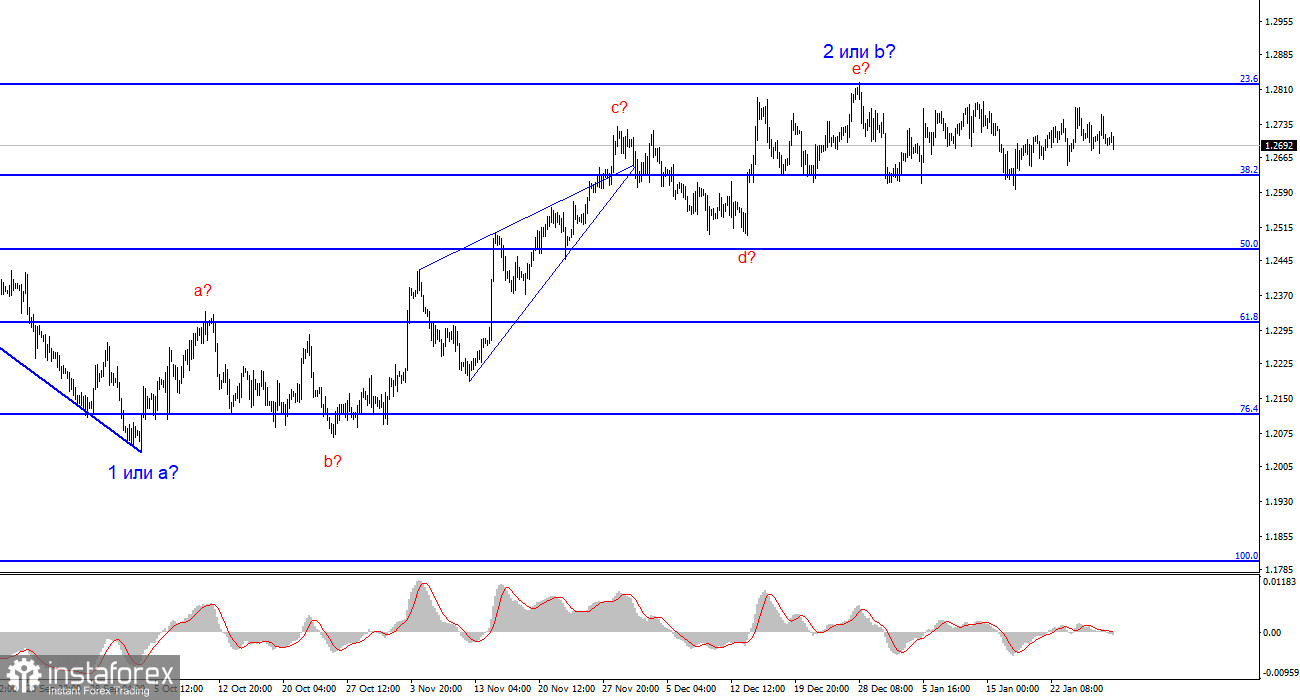

In any case, the pound remains between the 23.6% and 38.2% Fibonacci levels. As long as it does not leave this range, neither Powell nor BoE Governor Andrew Bailey will help us see the formation of a descending wave.

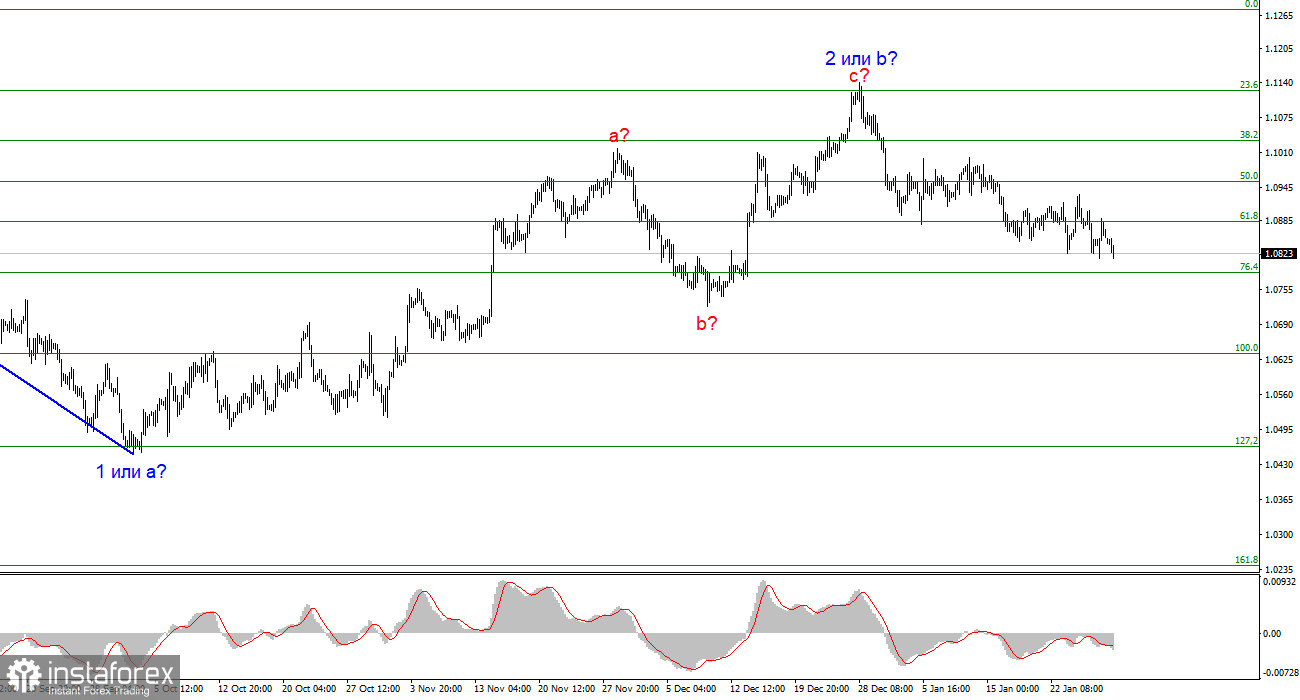

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci scale, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush to short positions at this time. I would wait for a successful attempt to break through the 1.2627 level in order to grow more confident about the instrument's decline.