The results of the first Federal Reserve meeting of the year will be announced on Wednesday. I can't say that there is much suspense surrounding this event, as the market does not expect a rate cut, not even by 5%. Therefore, everything will depend on the signals Fed Chair Jerome Powell sends to the market regarding upcoming meetings and the decisions that could be made during them. There is still a possibility that the rate may be lowered at the next meeting in March. However, if this had a 80% likelihood at the beginning of the year, now it is no more than 50%. There are also doubts about a rate cut following the May meeting. I believe that the first policy easing will take place between March and June.

This forecast is quite vague, but it best reflects the lack of unanimous opinion in the market about the US central bank's actions. As usual, there are three scenarios for Powell's speech. The first is neutral. Powell will announce that the rate remain at the current level, note the slowing pace of inflation decline, and say that rates need to be kept at their peak for some time.

The second scenario is that Powell will indicate that the Fed will move towards easing monetary policy in the near future but will refrain from specifying specific timelines. The third scenario is that Powell will suggest that it is not yet time to talk about lowering interest rates as inflation remains too high. In my opinion, each of these options has an equal probability. It is very difficult to say what stance the Fed is taking. Since the market does not understand what to expect from the US central bank, practically any statement made by Powell will come as a surprise to a certain extent. This gives us reason to assume that the market reaction will be strong on Wednesday.

Analysts do not believe that the dollar will receive strong market support in case Powell delivers hawkish rhetoric. I don't completely agree with them on this. The European Central Bank increasingly suggests that it will start lowering rates earlier than the market expected, while the Fed signals that it will start easing slightly later than the market anticipates. Based on this, the time lag between the first cuts by the ECB and the Fed is decreasing, and this works in favor of the US currency.

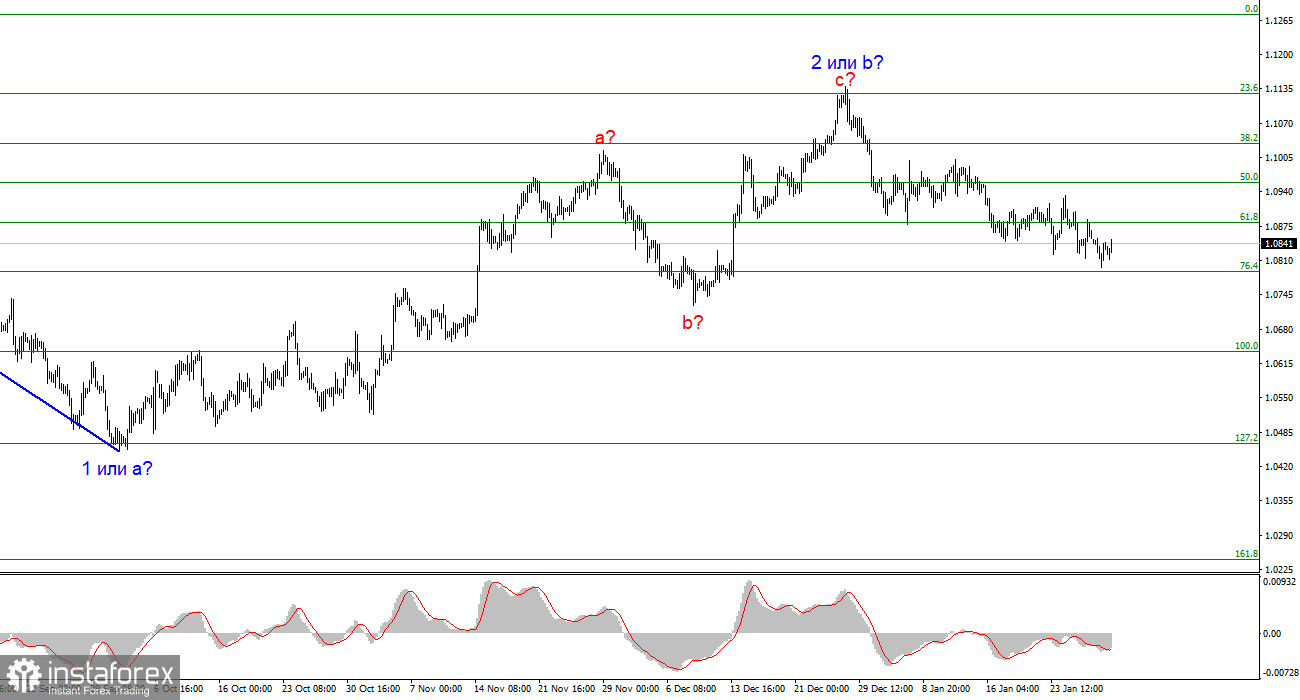

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

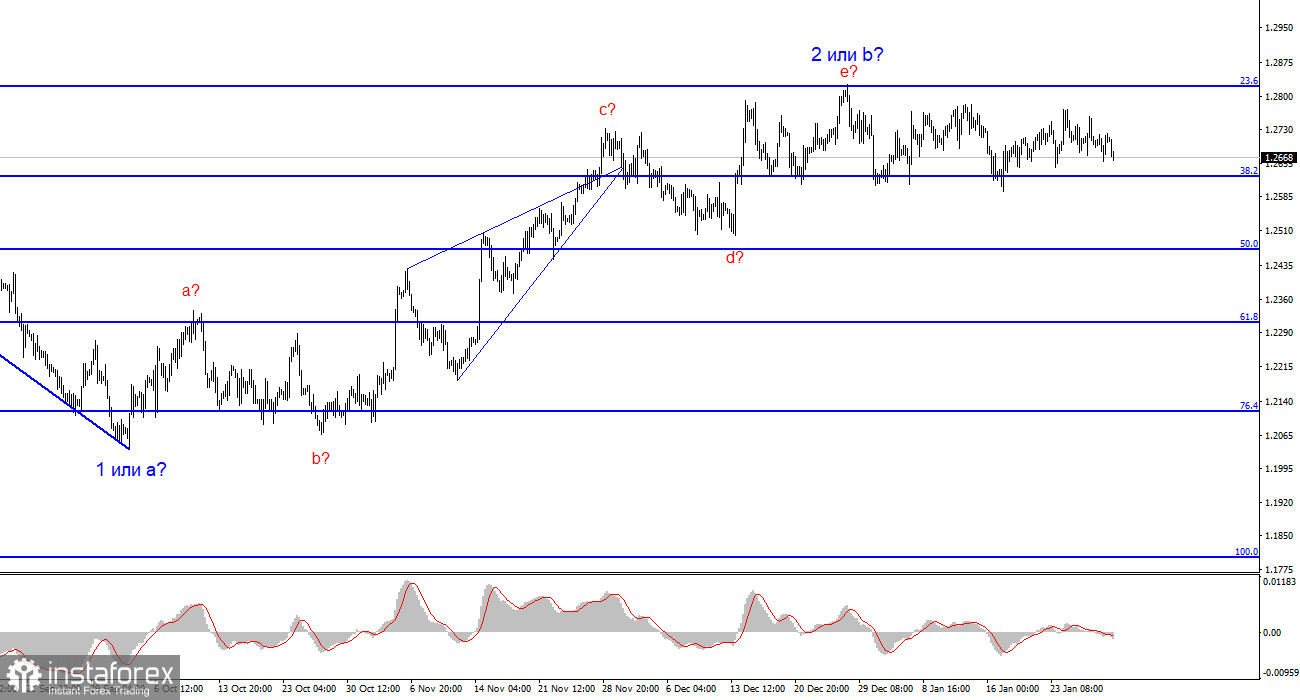

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush to short positions at this time. I would wait for a successful attempt to break through the 1.2627 level in order to grow more confident about the instrument's decline.