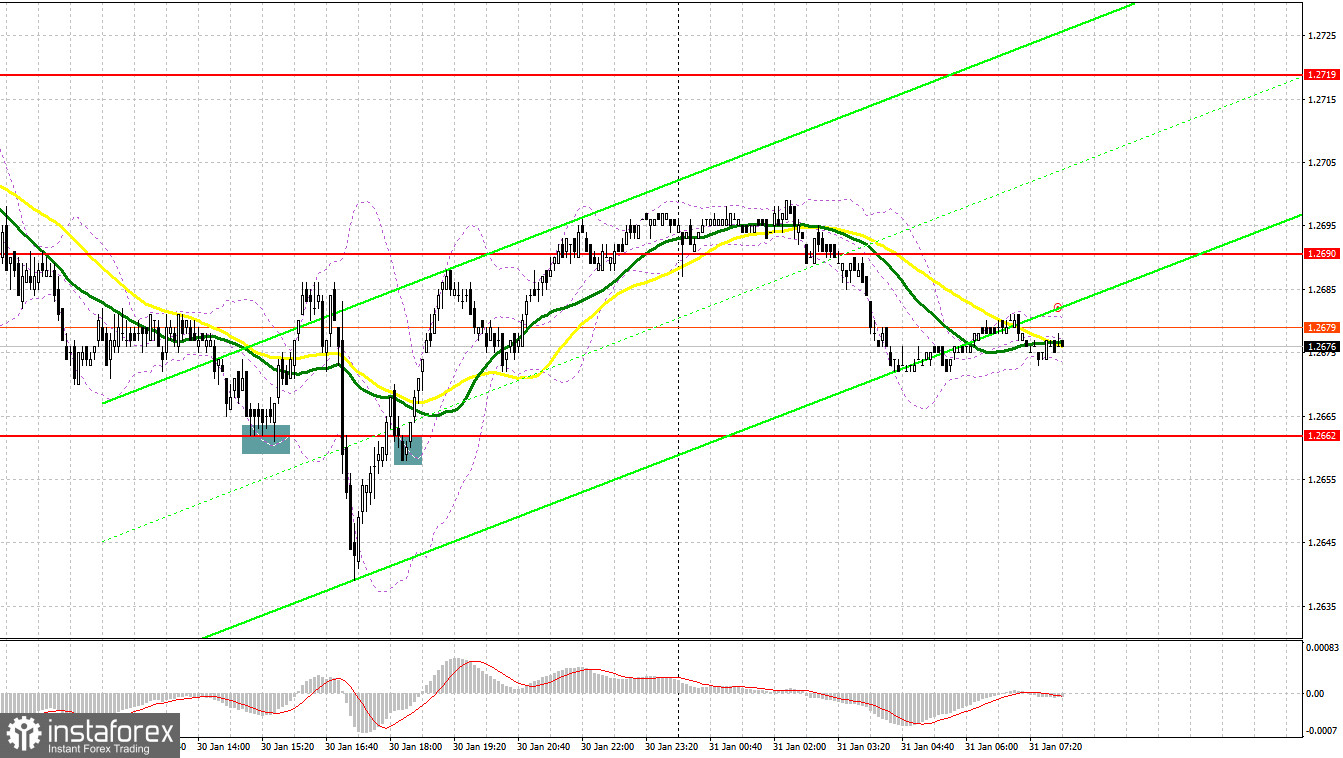

Yesterday, GBP/USD generated several signals to enter the market. Now let's look at the 5-minute chart and try to figure out what actually happened. In my previous forecast, I indicated the level of 1.2684 and planned to make decisions on entering the market from there. A decline and a false breakout at this level suggested an entry point for buy positions, but the pair only rose by about 15 pips, afterwards the pound was under pressure again. In the afternoon, safeguarding 1.2662 produced another buy signal. As a result, the pair was up by almost 30 pips.

For long positions on GBP/USD:

The UK has not released any important data this week, and at the upcoming Bank of England meeting, the central bank is expected to maintain its tough resolve against inflation. These factors will make it possible for us to buy the pound every time major players try to exert pressure on it. Today, there are no scheduled economic reports, so there's a good chance that the pair will continue to trade within a sideways channel with a subsequent bullish breakout.

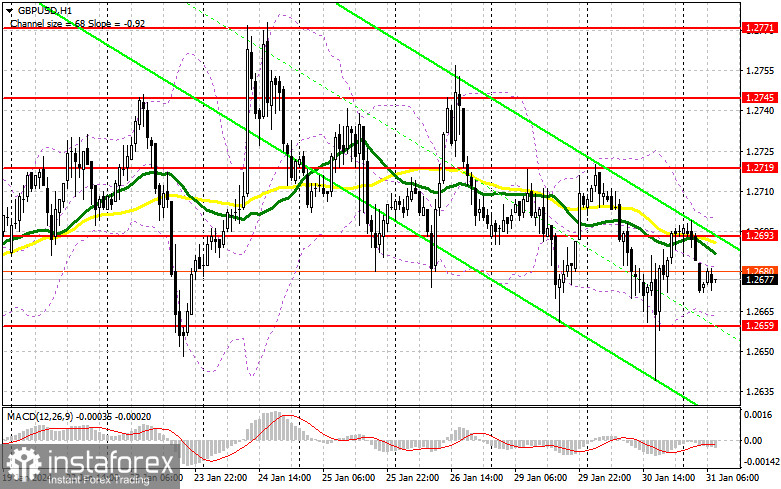

As the last two days have shown, an optimal buying opportunity might arise on dips. I will try to buy near the nearest support at 1.2659, established at the end of yesterday. Forming a false breakout on this mark will give an entry point in development of an uptrend and potentially testing 1.2693, which is in line with the bearish moving averages. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2719. The farthest target will be the 1.2745 high, where I will take profits. In a scenario where GBP/USD falls and there are no bulls at 1.2659, things will go rather badly for the buyers, and this may even push the pair out of the sideways channel. If this happens, I will postpone long positions until the test of 1.2627. Only a false breakout there will confirm the correct entry point. You can open long positions on GBP/USD immediately on a rebound from the low of 1.2598, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Yesterday, sellers were active but quickly lost all positions. However, the fact that bears have been pushing for a new local low for four trading days poses significant challenges for buyers. This, ultimately, may lead to a substantial pound sell-off, especially after today's Federal Reserve meeting. In case the pair recovers in the first half of the day, I plan to act only after a false breakout forms around 1.2693. This would confirm the presence of major players in the market, creating a sell signal with the downward target around 1.2659. A breakout and an upward retest of this range will deal a more serious blow to the bulls' positions, leading to the removal of stop orders and open the way to 1.2627. A lower target will be the area around 1.2598, where I will take profits. If GBP/USD grows and there are no bears at 1.2693, the bulls will regain the initiative and bring back the possibility of a bullish correction. In such a case, I would delay short positions until a false breakout at 1.2719. If there is no downward movement there, I will sell GBP/USD immediately on a bounce right from 1.2745, considering a downward correction of 30-35 pips within the day.

COT report:

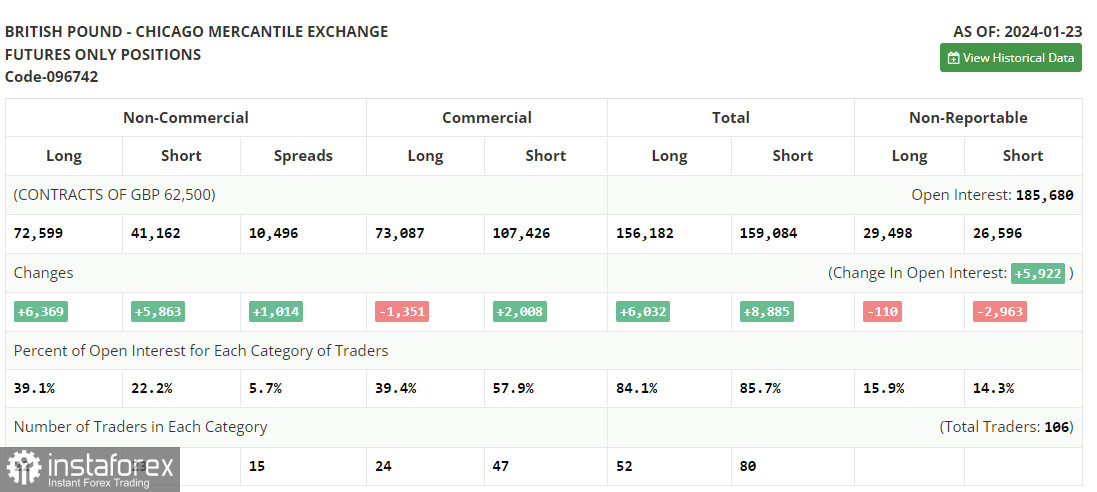

In the COT report (Commitment of Traders) for January 23, we find an increase in both long and short positions. Considering that traders are in a state of confusion, much like the Bank of England, the pound continues to receive support from buyers of risk assets. It is clear that the central bank is unlikely to opt for an imminent interest rate cut, especially after recent news about the resurgence of inflation pressures. This week, the two key central bank meetings will help determine the pound's direction – the Federal Reserve meeting and the Bank of England meeting. A firm stance may negatively impact the demand for risk assets, including the British pound; however, we shouldn't expect a significant decline from the pound. The latest COT report said that long non-commercial positions rose by 6,369 to 72,599, while short non-commercial positions increased by 5,863 to 41,162. As a result, the spread between long and short positions increased by 1,014.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower boundary near 1.2659 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.