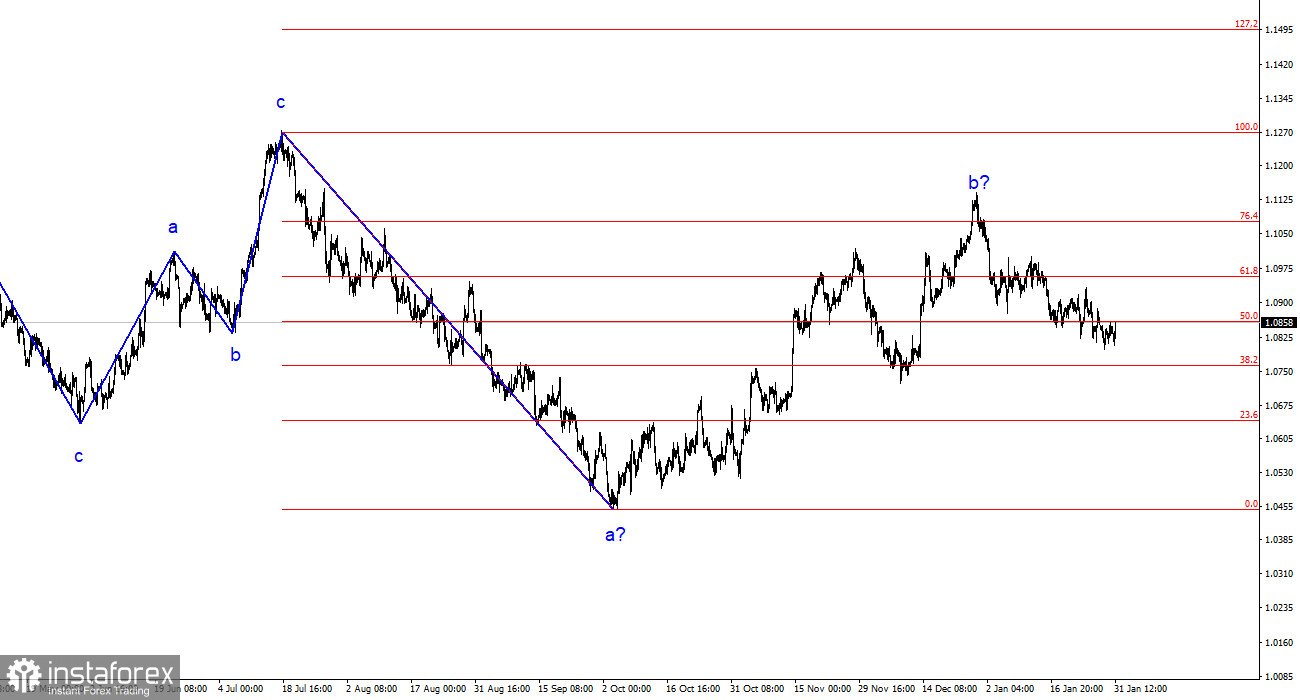

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have seen only three-wave structures that constantly alternate with each other. The construction of another three-wave pattern, a descending one, continues. The presumed wave 1 is completed, but wave 2 or b has become more complicated three or four times, and there are no guarantees that it will not be complicated again.

Although the news background cannot be considered "supporting the European currency," the market regularly finds reasons to increase demand for the euro. This situation does not reflect the real picture in the currency market. The upward trend segment may resume, but its internal structure will become unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave 3 or c is currently being formed, and the entire wave 2 or b is completed. The current pullback from the reached highs looks convincing.

German inflation collapsed to 2.9%

The euro/dollar pair rose by 15 basis points on Tuesday. The amplitude remained relatively low throughout the day, and the market awaited more important reports and events this week. The first is scheduled for tonight, and Thursday and Friday are expected to be quite eventful. Tonight is the FOMC meeting, tomorrow is the inflation report in the European Union, the Bank of England meeting, and the ISM index in the United States. On Friday, there will be Nonfarm Payrolls and the unemployment rate in the United States. However, let's return to today's reports.

In Germany, a whole package of economic statistics was released, which left an unpleasant aftertaste. Reports cannot be called unsuccessful but could have been much better. The retail trade report was the most disappointing, with volumes decreasing by 1.6% month-on-month and 1.7% year-on-year in December. Markets expected much higher values. The unemployment rate can even be pleasing, as the value for January remained unchanged, while the December value was revised from 5.9% to 5.8%. The consumer price index slowed down from 3.7% to 2.9%, although the market expected a decrease of 3%.

However, the latter report can play a nasty trick on the euro. As a benchmark, German inflation can be used to predict European inflation. If the indicator is decreasing in Germany, it means that tomorrow, we may see a sharp drop in European inflation. Although market expectations are currently reduced from 2.9% to 2.8% year-on-year, even a drop to 2.7% can lead to decreased demand for the euro. However, I need this.

General conclusions

Based on the conducted analysis, I conclude that the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect to continue building an impulsive downward wave 3 or c with a significant decline in the pair. The unsuccessful attempt to break through the level of 1.1125, corresponding to 23.6% according to Fibonacci, indicated the market's readiness for sales a month ago. I am currently only considering selling with targets around the calculated level of 1.0462, corresponding to the Fibonacci level of 127.2%.

On a larger wave scale, it can be seen that the presumed wave 2 or b, which is already more than 61.8% according to Fibonacci from the first wave in length, may be completed. If this is the case, the scenario with the construction of wave 3 or c and a decline in the pair below the 4-figure mark has begun to unfold.