The results of the first Federal Reserve meeting is set to be announced on Wednesday, followed by the Bank of England on Thursday. It's hard to say which is more important. The market may see both in passing, while the horizontal movement will persist for the British pound. I certainly wouldn't want this scenario, but the facts have been stubbornly clear: both central banks are not ready to make significant decisions at the juncture of January and February 2024. The focus will be on the statements of BoE Governor Andrew Bailey and Fed Chair Jerome Powell.

So what can we expect from the British central bank on Thursday? Analysts believe that Bailey may drop some hints about a faster rate cut than the market expects. At present, the market anticipates the first rate cut not in the fall or in August, as I reported earlier, but in May. The probability of this is just over 50%. If this is indeed the case, then the BoE has another reason to start lowering rates as early as Thursday. Recall that for a long time, the market considered the BoE as the most hawkish central bank of 2024. If it turns out that the Fed and the BoE will start trimming rates almost at the same meeting, this will mean that the market has been wrong all this time by maintaining high demand for the pound in recent months.

In my opinion, it seems obvious and natural for the pound to fall, but many analysts still fear that the market maintains a bullish bias and is not ready to consider bearish reasons. The British economy remains stable against the backdrop of high BoE rates, but there is a significant gap between its resilience and that of the U.S. economy. In my opinion, economic reports, the market's significantly delayed expectation of rate cuts in the UK, and the state of the economy all suggest that the demand for the pound will fall.

However, this week will not only depend on the two central bank meetings. On Friday, we will receive data on the U.S. labor market, and on Thursday, the important ISM index for the manufacturing sector. If the dollar manages to strengthen, then it may weaken on Thursday evening or Friday.

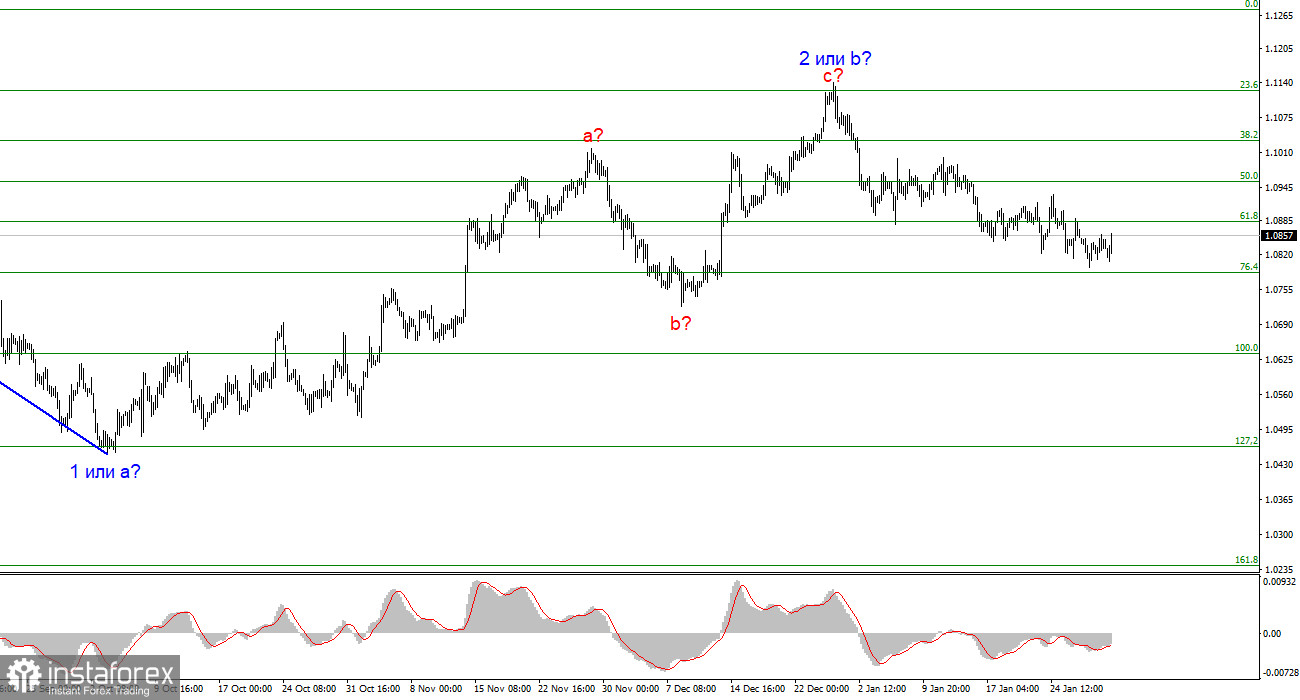

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush to short positions at this time. I would wait for a successful attempt to break through the 1.2627 level in order to grow more confident about the instrument's decline.