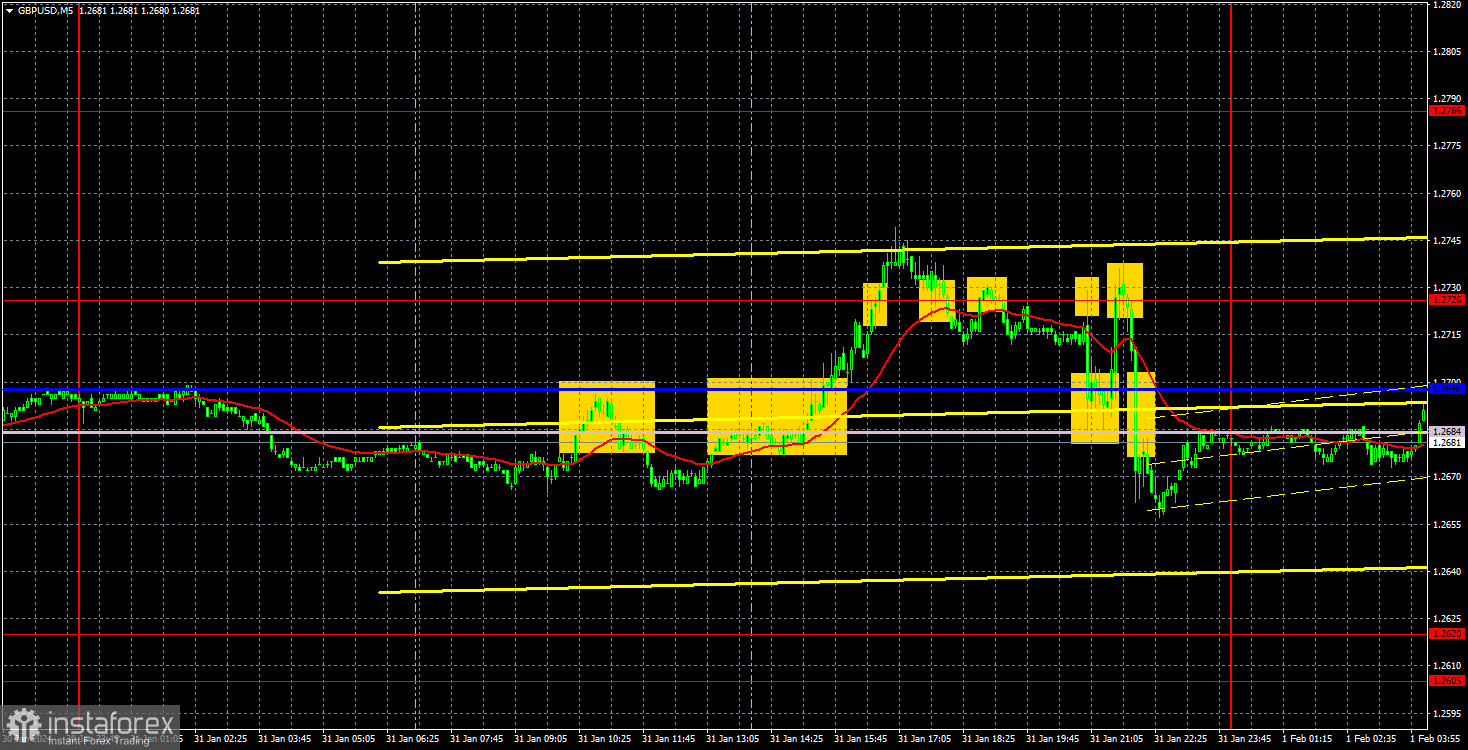

Analysis of GBP/USD 5M

GBP/USD managed to both rise and fall on Wednesday. As mentioned earlier, the pound traded higher due to the market's dovish expectations regarding Federal Reserve Chair Jerome Powell's speech and the weak US ADP report. The number of jobs created in the private sector was below forecasts, but we have to remember that the US NonFarm Payrolls report is more influential for traders.

When Powell's speech took place, it became clear that the Fed is not planning to lower the key interest rate in March and, furthermore, has no intention of doing so until it receives more evidence of inflation heading towards its 2% target. Powell emphasized the high pace of economic growth in the United States and the strength of the labor market, stating that monetary policy easing is not currently required. If his colleague Bank of England Governor Andrew Bailey hints today that the central bank may begin to lower the rate in the near future, the British pound may finally break out of the range and head lower.

However, at the moment, the pair continues to stay in the middle of the sideways channel and does not have a real chance of leaving it in the near future. Even if the results of the BoE meeting turn out to be significant, the pair requires a very strong impetus in order to fall below the level of 1.2605 or above 1.2786. Moreover, it's not just about piercing these levels, but also about a clear consolidation above or below them.

There were many trading signals on Wednesday. The first two were near the Senkou Span B and Kijun-sen lines. The first one was a false signal, and the second one was profitable. However, the most interesting part began when sell signals started forming around the level of 1.2726, and there were as many as four of them. The price's movements in the evening were chaotic, as it often changed direction. However, Powell's rhetoric was hawkish, so it was normal to anticipate the dollar's growth.

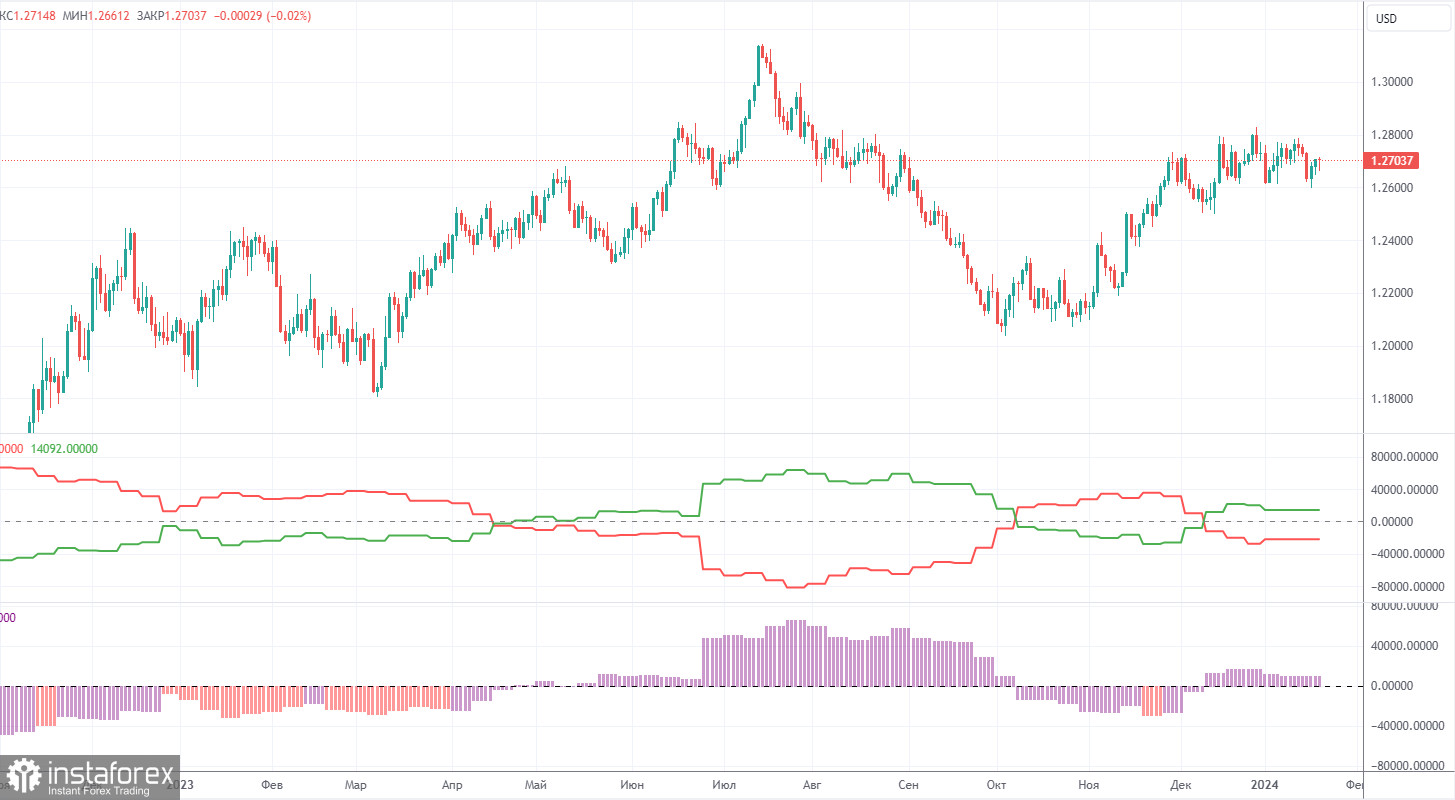

COT report:

COT reports on the British pound show that the sentiment of commercial traders has been changing quite frequently in recent months. The red and green lines, representing the net positions of commercial and non-commercial traders, often intersect and, in most cases, are close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 6,300 buy contracts and 5,800 short ones. As a result, the net position of non-commercial traders increased by 500 contracts in a week. The fundamental backdrop still does not provide a basis for long-term purchases on the pound.

The non-commercial group currently has a total of 72,600 buy contracts and 41,100 sell contracts. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we need to pay close attention to the technical picture and economic reports. However, even these types of analysis are currently secondary because, despite everything, the market still maintains a bullish bias towards the pound, and the price has been in a flat range for the second month. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement (but there are no clear sell signals yet), and for a long time now, the economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD continues to trade within the sideways channel of 1.2611-1.2787. The price has been unable to leave this channel for a month and even the FOMC meeting couldn't pull it out. Therefore, it would not be surprising if the British pound continues to stay within the range even against the backdrop of the Bank of England meeting today.

On Thursday, the pair has a higher chance of rising than falling, but it would be impractical to open positions at the moment. The price continues to be located in the middle of the sideways channel, and there is no point in expecting strong signals near the Senkou Span B and Kijun-sen lines.

As of February 1, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2513, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2684) and Kijun-sen (1.2698) lines can also serve as sources of signals. Don't forget to set a breakeven Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

Today, the Bank of England will announce the results of its meeting, and we believe they could be more dovish than the market expects. Therefore, it is likely for the pound to fall and the dollar to rise. The question is whether these events will be enough for the pair to break the lower boundary of the sideways channel.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.