The market's situation remained the same. Although dollar fell in price ahead of the announcement of the outcome of the Fed meeting, which reflected traders' confidence in the inevitability of a monetary policy easing, it returned to its previous positions during Fed Chairman Jerome Powell's press conference due to the statement that even though rate hikes will not continue, a cut in rates will still not happen soon. Powell also mentioned that interest rates reached a peak, but inflation remained at an extremely high level.

In the eurozone, inflation indicators will come out today, and forecasts say that it will show a slowdown in the growth rate of consumer prices from 2.9% to 2.8%. If this happens, the European Central Bank will be the first to lower interest rates, leading to euro's decline.

As for the UK, the Bank of England will likely keep its interest rates unchanged. However, it may give a clearer signal about the imminent easing of its monetary policy, which will be a reason for pound to weaken.

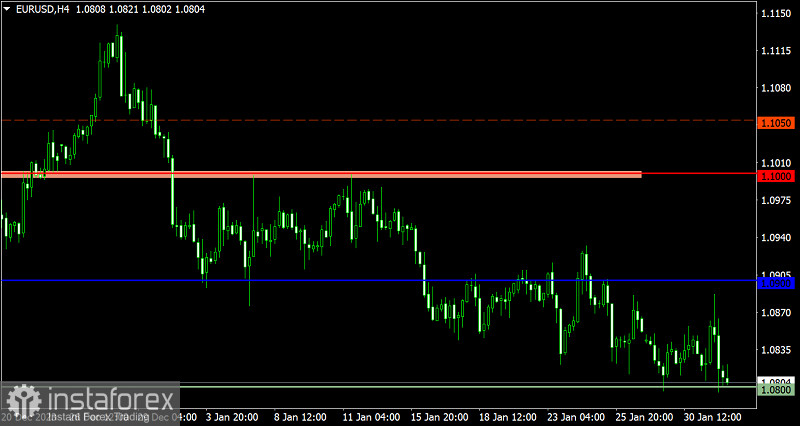

EUR/USD continued to trade downwards. The level of 1.0800 will act as a variable support, in which a stabilization of the price below this level will provoke an increase in the volume of short positions. Otherwise, the pair will fluctuate above the level.

GBP/USD continues to move within the range of 1.2600/1.2800. At the moment, it lies around 1.2600/1.2700, indicating the possibility of another flat market.